Jerome Powell Speech: Fed Chair Says Rate Cuts Will Depend on Labor Market Conditions

Highlights

- Powell stated during his press conference that a weak labor market will warrant more rate cuts.

- He also confirmed that a rate hike isn't the base case for anyone at the moment.

- The Fed is unlikely to cut anytime soon as they see an improvement in the labor market.

Federal Reserve Chair Jerome Powell has signaled that the central bank is unlikely to make further rate cuts unless the labor market weakens again. This comes as crypto traders continue to price in the possibility of interest rates remaining unchanged until the June FOMC meeting, when Powell will no longer be the chair.

Jerome Powell Says Weak Labor Market Will Warrant Rate Cuts

During his FOMC press conference, the Fed chair stated that a weak labor market would warrant further rate cuts. However, they will continue to hold interest rates steady if the labor market holds strong, even as inflation remains elevated.

His remarks followed the Fed meeting, in which the FOMC decided to leave interest rates unchanged at the target range between 3.50% and 3.75%. The committee noted that the unemployment rate has shown some signs of stabilization while inflation remains somewhat elevated.

In his opening statement, Jerome Powell reiterated that indicators suggest that labor market conditions may be stabilizing after a period of gradual softening. He noted that the unemployment rate was 4.4% in December and has changed little in recent months. However, the Fed chair added that job gains have remained low and that the total nonfarm payrolls declined at an average pace of 22,000 per month over the last three months.

In his statement, Jerome Powell also noted that the three rate cuts they made last year have brought them within a plausible neutral range and should help stabilize the labor market as inflation resumes its downward trend. As such, the FOMC is likely to keep holding interest rates steady as it adopts a wait-and-see approach.

CoinGape already reported that the Federal Reserve is likely to hold interest rates steady until the June FOMC meeting, according to Polymarket data. The June meeting will be the first after Powell’s term as Fed chair ends in May. Notably, he declined to comment on whether he would remain on the board after his term ends.

Other Takeaways And Highlights From The Fed Chair’s Presser

Jerome Powell reiterated that the Trump tariffs’ impact is likely to be a one-time increase, noting that most of the inflation overrun is due to tariffs, not demand. He stated that they expect the tariff impact on goods to peak by mid-2026.

The Fed chair briefly touched on the Fed’s independence as he addressed U.S. President Donald Trump’s case against Fed Governor Lisa Cook, describing it as the most important legal case in the Fed’s history. This came as he explained why he attended the hearing, which took place last week. He also reaffirmed the Fed’s independence while warning that it will be hard to restore faith in the institution if there are signs that they are setting monetary policy to benefit a particular group.

Meanwhile, Jerome Powell refused to comment on the remarks he made on January 11 after the Department of Justice (DOJ) launched a criminal investigation into the Fed chair. Back then, he stated that the investigation was because the Fed refused to lower rates in line with Trump’s preference. Interestingly, when asked what advice he would give to his successor, he urged them to stay out of politics.

The Fed chair also commented on the rise in the gold price, urging market participants not to take too much message from the precious metal’s rise. He added that they do not take a strong signal from the rising gold and silver prices.

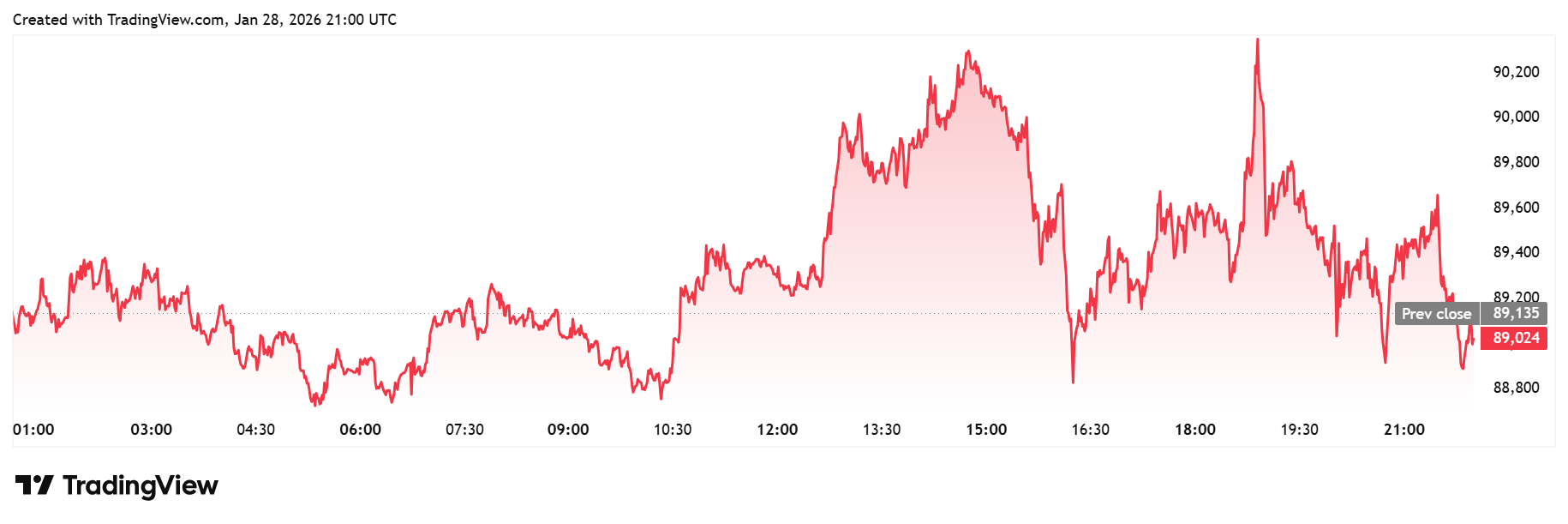

Bitcoin remained muted amid Jerome Powell’s press conference. TradingView data show the flagship crypto trading just above the psychological $89,000 level, down on the day despite earlier highs of $90,000.

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k