Just-In: Jump Trading Starts Selling More Ethereum, Will ETH Price Crash Again?

Highlights

- Jump Trading has started selling more Ethereum holdings.

- The crypto trading firm claimed 17,049 ETH worth $46.44 million from Lido to sell.

- Traders didn't responded immediately as ETH price continues to trade above $2,700.

Crypto market maker Jump Trading has started selling more Ethereum holdings, as per on-chain data platforms. This move may bring a correction in ETH price, similar to a more than 20% crash last week.

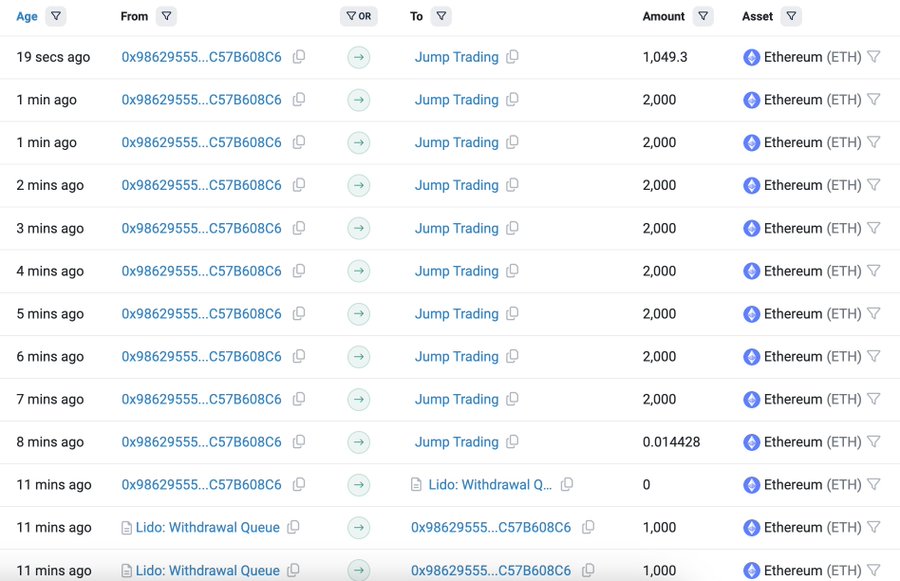

Lookonchain in a post on August 14 reported that prominent crypto trading firm Jump Trading has started selling ETH once again. The firm claimed 17,049 ETH worth $46.44 million from liquid staking protocol Lido. It then transferred the coins to the wallet address “0xf58“. Notably, the firm uses the wallet for selling to crypto exchanges.

The crypto market maker currently holds 21,394 wstETH, which is valued at $68.58 million.

Spot On Chain revealed that the crypto firm continued to redeem the last 21,394 wstETH for 25,156 stETH recently. However, Spot On Chain claims the crypto firm did not request to withdraw instantly from Lido like before.

Jump Trading still holds nearly $148M worth of Ethereum. This includes 24,993 ETH in wallet 0xf58 and 29,093 stETH staked with Lido Finance.

The selloffs picked pace after Kanav Kariya announced his departure from Jump Crypto after serving as the firm’s president for nearly three years. It happened after the CFTC launched an investigation into Jump Crypto in June.

Jump Trading Can Trigger Another ETH Price Crash

Last week, ETH price dropped more than 20% after Jump Trading liquidated $300 million to crypto exchanges. It started with 17,576 ETH worth $46 million dumped centralized exchanges, but the trading firm is moving a larger amount of ETH as compared to the past week.

ETH price currently trading more than 3% in the past 24 hours, with the price currently trading at $2,725. The 24-hour low and high are $2,613 and $2,750, respectively. Furthermore, the trading volume has decreased by 28% in the last 24 hours, indicating a decline in interest among traders.

Ethereum witnessing a sudden selling activity in the derivatives market. Total ETH futures open interest fell more than 1% on some exchanges in the last 4 hours, as per Coinglass data. The futures open interest is at $29.92 billion, up 5% in the last 24 hours.

Meanwhile, CoinGape reports a potential liquidation of Threshold (T) by Jump Trading after the recent $300 million Ethereum dump.

- Will Crypto Market Crash as U.S.–Iran War Reportedly Imminent?

- Bitcoin Quantum Threat: CryptoQuant’s CEO Flags Risk of Losing Satoshi’s 1M BTC Stash to Hackers

- Crypto Regulation: Hyperliquid Launches Policy Group to Push DeFi Integration in U.S. Markets

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026