Bitcoin [BTC] Numbers Could Go Big, but its Still Very Small: Analyst

The Open-interest of Bitcoin and Ethereum futures is nearing its’ ATH levels. Crypto trust funds are selling at a premium and options market premiums are also high. Moreover, there is a huge stablecoin supply sitting on the side-lines. While the market looks primed for a bullish break-out, here are some hard truths on the scale of the markets.

According to leading on-chain analyst, Willy Woo, the value combined in stablecoins could be effectively more than Bitcoin. The basis of this argument lies in the argument that every dollar invested on-chain expands up to 25 times on the market. Hence, the total stablecoin supply with is above $11 billion dollars could be more than BTC’s $175 billion.

Moreover, the transaction velocity of stablecoins has taken over Bitcoin. This is indicative of increasing usage of stablecoins for transfer of value other than trading. He says,

Stablecoins are increasingly used for transmission of funds and securitising trade settlement. It’s not just used for hedging from bearish crypto price action like the old days

Hence, with the small market and considerable risk involved, Bitcoin could still couple with stocks in case of a downtrend.

Where are We Now?

With the advent and development of the Bitcoin derivatives market, they have dominated the price action on BTC. The traders’ sentiments on CME are giving hints of a large break-out.

According to a leading trader, Filbfilb (alias), the discrepancy between the shorts and long has reached a ‘level previously unseen in the last 2 years.’ Moreover, the funding rates also represent a long-lasting funding accumulation that has been on since May. He mentions,

This was similar back in Jan->April 2019 as Bitcoin broke out of the 3/4k range (or the 2018 accumulation levels)… Agree with me or not.. whatever happens, when this thing goes, it’s going to go big.

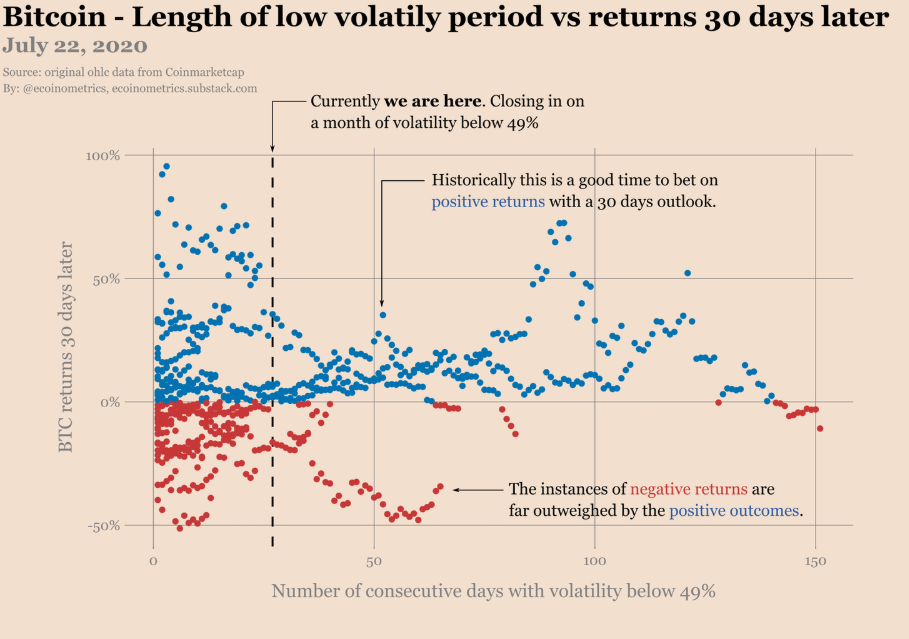

Furthermore, according to another statistical analysis of Bitcoin volatility, the resemblance with 2019 is strong but not a generalized view. The 30 days realized volatility of Bitcoin has arrived a critical junction with values lower than 49%. This has happened rarely in Bitcoin’s history.

However, the red dots tend to be pretty big drops, typically -40% or more at 30 days.

This analysis implies that as long as Bitcoin is avoiding a huge drop from current levels, a continued period of accumulation will become more and more favourable towards the bulls. The favourable treatment by regulators and credit card companies in recent times calls for greater turnovers. Nevertheless, there are still significant markers which point southwards.

Do you think Bitcoin [BTC] is ready for a big bull run? Please share your views with us.

- Polymarket Sues Massachusetts Amid Prediction Market Crackdown

- CLARITY Act: Bessent Slams Coinbase CEO, Calls for Compromise in White House Meeting Today

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- Crypto, Banks Clash Over Fed’s Proposed ‘Skinny’ Accounts Ahead of White House Crypto Meeting

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%