Crypto Gem: This Proof Of Meme (POM) Crypto Coin Is Up Almost 3000% Over Last year

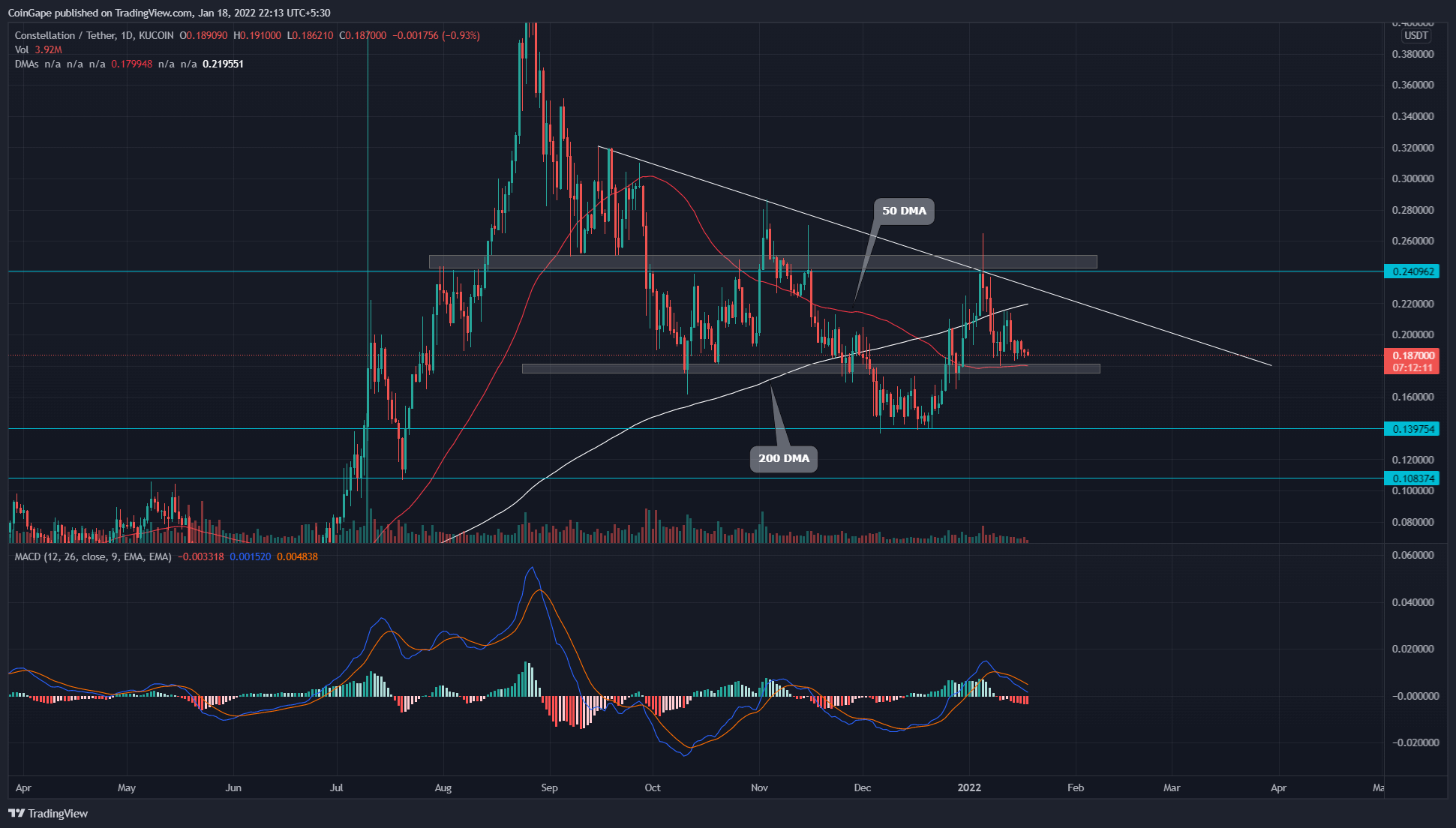

The Constellation (DAG) price is still trapped in a moderate correction phase. The DAG/USD price started a recovery rally as the coin was entering the year 2022. However, a descending trendline is interrupting any bullish rally trying to reclaim the higher level.

Historical Performance

During the third quarter of 2021, the DAG coin parabolic rally entered a correction phase. This moderate pullback plunged the price to the $0.14 mark, indicating around 70% loss from the All-Time High($0.462).

The DAG price obtained sufficient demand from this bottom support($0.14) and initiated a new recovery rally. However, the price rallied to the $0.24 mark, faced strong resistance from an upcoming resistance trendline, pushing the coin price back to the lower levels.

Descending trend brings 23% discount on Constellation (DAG) Price

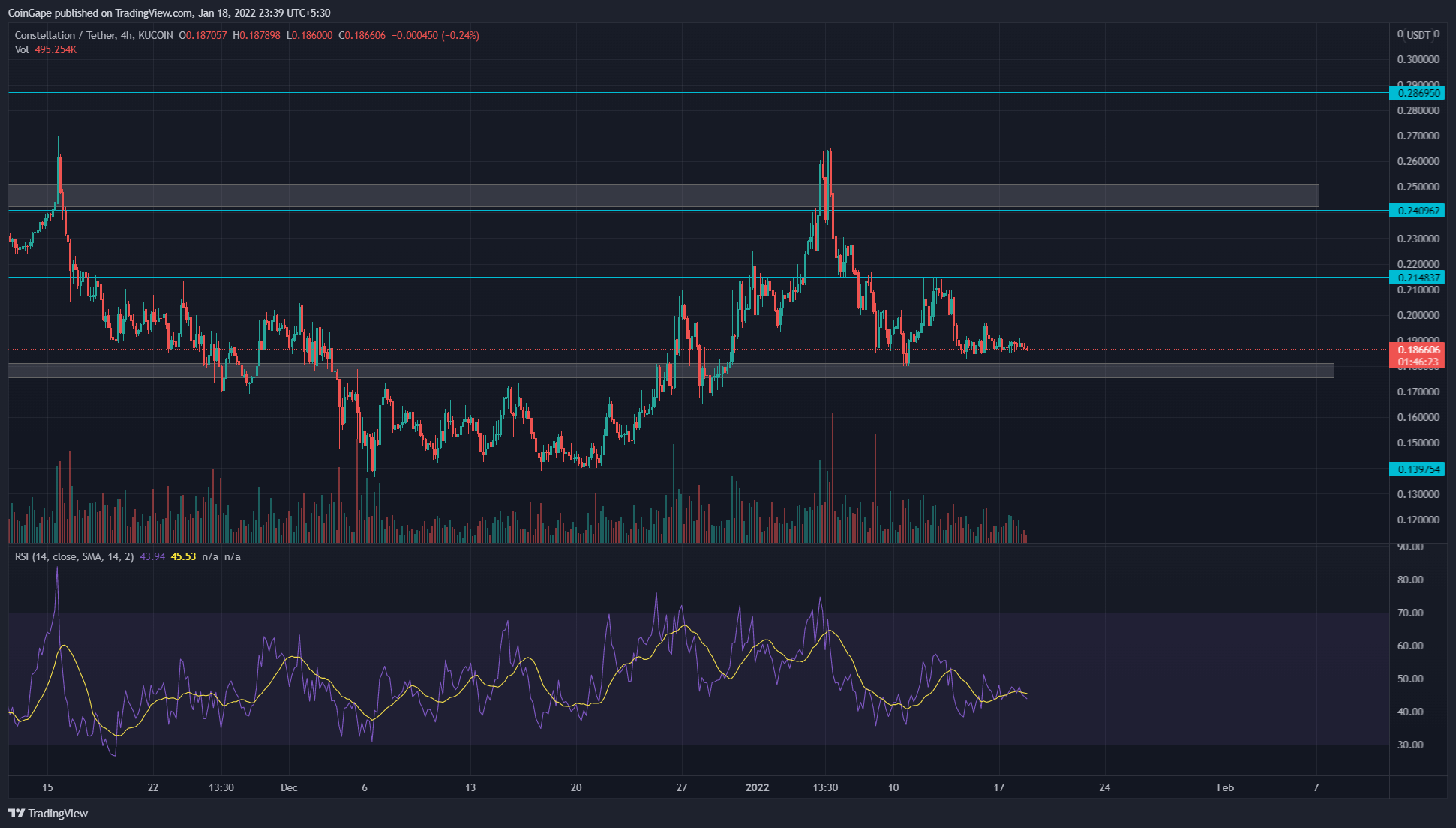

Rejecting from $0.24 resistance, the DAG price plummeted to the $0.18 support, losing around 23% in value. For almost two weeks, the coin price has been hovering above this support level, trying to acquire sufficient demand.

If DAG price manages to bounce back from this $0.18, the coin buyers have to overcome the descending trendline too, in order to continue its rally.

By the press time, the currently DAG price is trading at $0.186, with an intraday loss of 1.27%. Moreover, the 24hr volume change is $1.4 Million, indicating an 11.52% loss. According to coinmarketcap, the token stands at #180 rank with its current market cap of $243.5 Billion(+1.26%).

Technical Analysis

The DAG price has again slipped below the 200 DMA line, indicating a bearish trend. Combining with the $0.18 horizontal level, the 50 DMA line is trying to maintain a recovery rally.

The Moving average convergence divergence shows the MACD and signal line is constantly approaching the neutral zone(0.00)from above. If the DAG price breaks down from the $0.18 support, these lines will cross below the midline, providing an extra confirmation for the selling opportunity.

The 4-hour RSI chart displays bullish divergence, indicating a better possibility of bullish reversal.

- Resistance levels- $0.24 and $0.287

- Support levels- $0.18 and $0.14

- New $2M Funding Reveals Ethereum Foundation’s New Threat

- U.S. Shutdown Odds Hit 78% as CLARITY Act Faces Fresh Uncertainty

- Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent?

- Trump Backed Rick Rieder Now Leads the Odds for New Fed Chair

- Trump Threatens 100% Canada Tariffs as Bitcoin Holds $89K

- PEPE vs PENGUIN: Can Pengu Price Outperform Pepe Coin in 2026?

- Binance Coin Price Outlook As Grayscale Files S-1 for BNB

- Solana Price Prediction as SOL ETF Inflows Outpace BTC and ETH Together

- Bitcoin and Gold Outlook 2026: Warsh, Rieder Gain Traction in Trump’s Fed Pick

- PEPE Coin Price Eyes 45% Rebound as Buyers Regain Control on Spot Markets

- Pi Network Price Prediction: Will PI Coin Hold Steady at $0.18 Retrace Lower?