Crypto Market Insights For February 20th: BTC, HBAR, FIL

Highlights

- The Bitcoin Greed and Fear Index at 72% the market sentiment is bullish.

- The Hedera (HBAR) coin has broken through the $0.1 resistance level, signaling a potential trend reversal after a 21-month sideways movement.

- The rising Filecoin price may face intense supply pressure at $0.81 resistance.

Crypto Market Insights: The Bitcoin price wavering below $52000 reflects a consolidation period to bolster the next rally. The cryptocurrency market has been quite volatile for the past few days as Bitcoin price witnesses a post-rally consolidation below the $52000 resistance, while Ethereum and some major altcoins continue to progress forward at a slower pace.

However, the sideways trend in BTC will likely assist this asset in recuperating the exhausted bullish momentum and further uplift the recovery trend in the digital market.

The latest data from analytics firm Santiment reveals a notable surge in capital flow into cryptocurrencies, with a marked uptick in derivatives trading signaling a bullish yet risk-tolerant sentiment among investors. Over four months, market caps have escalated, reflecting this risk appetite.

Bitcoin leads the charge with an open interest of $9.85 billion, while Ethereum’s open interest stands at $5.59 billion. Other cryptocurrencies like Solana and Chainlink show significant open interests of $1.62 billion and $549 million, respectively. This trend points to investors’ growing confidence and their readiness to engage with more complex financial instruments within the crypto ecosystem.

📈😮 A major increase in money has been entering into #cryptocurrency, which should be a surprise to no one. Notably, there has been a dramatic increase in the speculation of derivatives in #crypto as market caps have risen significantly the past 4 months. With pic.twitter.com/arM5nxCMlY

— Santiment (@santimentfeed) February 19, 2024

Also Read: New Bitcoin Addresses Holding $25 Bln BTC Incur Losses, Major Selloff Ahead?

Here’s Why Bitcoin Price Is At Critical Juncture

The recovery trend in the leading cryptocurrency Bitcoin hit a major roadblock at $52000 resistance. The overhead supply has turned the recovery trend sideways, creating short body candles to indicate increasing uncertainty in the market.

However, the consolidation came after an aggressive 3-week rally, indicating the buyers are taking a breather to restore their strength.

However, On-chain data provided by Lookonchain reveals a substantial purchase volume in the Bitcoin market, with approximately 848.39K addresses acquiring around 481.71K BTC, valued at approximately $25 billion, at an average acquisition cost of $52,125 per BTC.

Data from @intotheblock shows that 848.39K addresses bought ~481.71K $BTC($25B) at an average price of $52,125.

These addresses are currently at a loss and may generate selling pressure when their positions reach breakeven.https://t.co/DsTpEwOO9b pic.twitter.com/87Rthk8wGC

— Lookonchain (@lookonchain) February 20, 2024

The current market conditions have these addresses experiencing losses, suggesting a potential increase in selling pressure as these investors seek to minimize losses or break even.

Thus, a positive reversal from this $52000 may trigger a notable correction, potentially retesting $49000.

Also Read: Robert Kiyosaki: Bitcoin Price Might Reach $100k In June 2024

Hedera Price Reflects Bullish Sentiment Amidst Surge in Open Interest

An analysis of the daily time frame chart shows the hedera coin witnessed a sideways trend over the past 21 months. The $0.1 level acted as a key resistance in the seller’s arsenal to prevent sustainable growth.

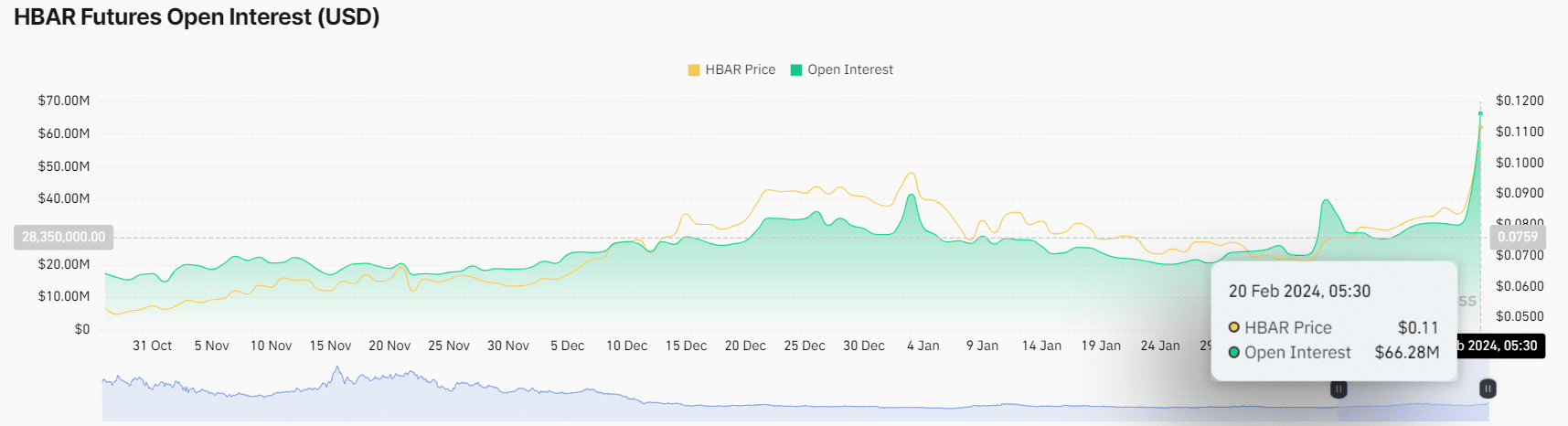

However, due to currency market uncertainty, the HBAR witnessed an aggressive inflow which led to a 28% surge within three days. In tandem with this rally, the HBAR’s Futures Open Interest doubled, projecting a jump from $32 Million to $66 Million. This surge reflects a heightened investor interest and implies robust confidence in HBAR’s market potential.

Moreover, the rising Hedera price recently breached the forbidden resistance of $0.1, indicating an early sign of trend reversal. Currently trading at $0.107, if the HBAR price shows sustainability above at $0.1, the buyers may propel a rally to $0.163.

Also Read: Bitwise Bitcoin ETF Enters $30B Investment Advisor Network

Is Filecoin Price Rally Heading to $.095?

FIL, the native cryptocurrency of a decentralized storage system Filecoin, witnessed a notable upswing in the last two weeks. This positive upturn surged the coin price from $4.976 to $7.76 registering 55% growth.

Despite the current market uncertainty, the high momentum rally in Filecoin can be attributed to the partnership announcement with highly scalable layer 1 Blockchain Solana. Filecoin’s integration with Solana, as announced on their official X platform(formerly Twitter) account, represents a significant evolution towards decentralized storage, potentially driving the recent uptick in Filecoin’s market value.

This partnership enhances Solana’s data accessibility and fortifies the blockchain’s infrastructure, signaling a robust step forward for decentralized networks and their users.

Solana's integration with #Filecoin is a significant move away from centralized storage solutions and a remarkable step towards enhancing the reliability and scalability of the Solana blockchain.@solana is utilizing Filecoin to make its block history more accessible and usable… pic.twitter.com/1NcuaLNYT5

— Filecoin (@Filecoin) February 16, 2024

With sustained buying the Filecoin price must breach the overhead resistance of $8.1. This breakout should buyers with suitable support to boast a 17.5% rally to hit a $9.5 high.

Related Articles: Crypto Prices Today: Bitcoin Drops Below 52K, XRP & ADA Gain As PEPE Dips

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Coinbase Adds XRP, ADA, LTC, DOGE as Collateral for Crypto-Backed Loans

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week