Cryptocurrency Price Today: MANA, SAND And AXS Price Shows Recovery Signs As Metaverse ETFs Gain Popularity

Despite a bearish sentiment spread across the whole crypto-verse. The Meta-industry has seen some great fundamental perks as more established companies are entering the metaverse. Moreover, due to the recent bloodbath, inventors can grab discounted offers in these metaverse tokens providing enormous growth potential.

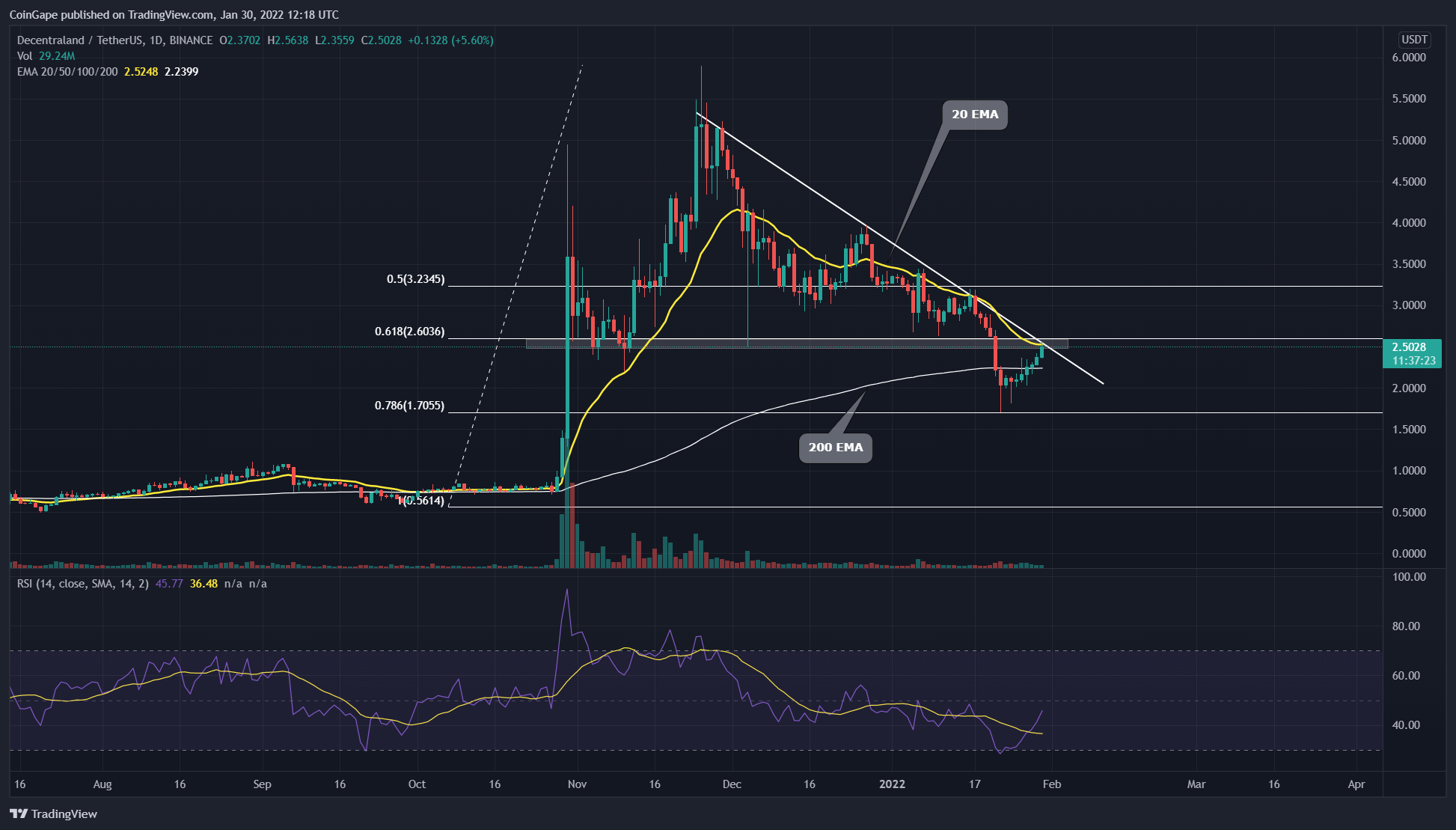

MANA Bulls Challenge Major Technical Resistances For Bullish Breakout

The correction phase initiated during late November 2021 had tumbled the MANA/USD pair by 70% while dropping it to 0.789 Fibonacci retracement level. The MANA price has rebounded from the bottom support($1.75) due to strong demand pressure.

- The V-shaped recovery in MANA registered a 40% gain, pumping the token price to $2.51. The price action will soon challenge a shared resistance of 20-day EMA, 0.5 FIB level, and the long coming resistance trendline, indicating an ultimate test for bulls.

- A breakout or rejection from the overhead resistance would confirm the upcoming rally in MANA.

- The Relative strength index(46) shows a parabolic rally approaching the neutral zone(0.00), which projects the growing bullish momentum.

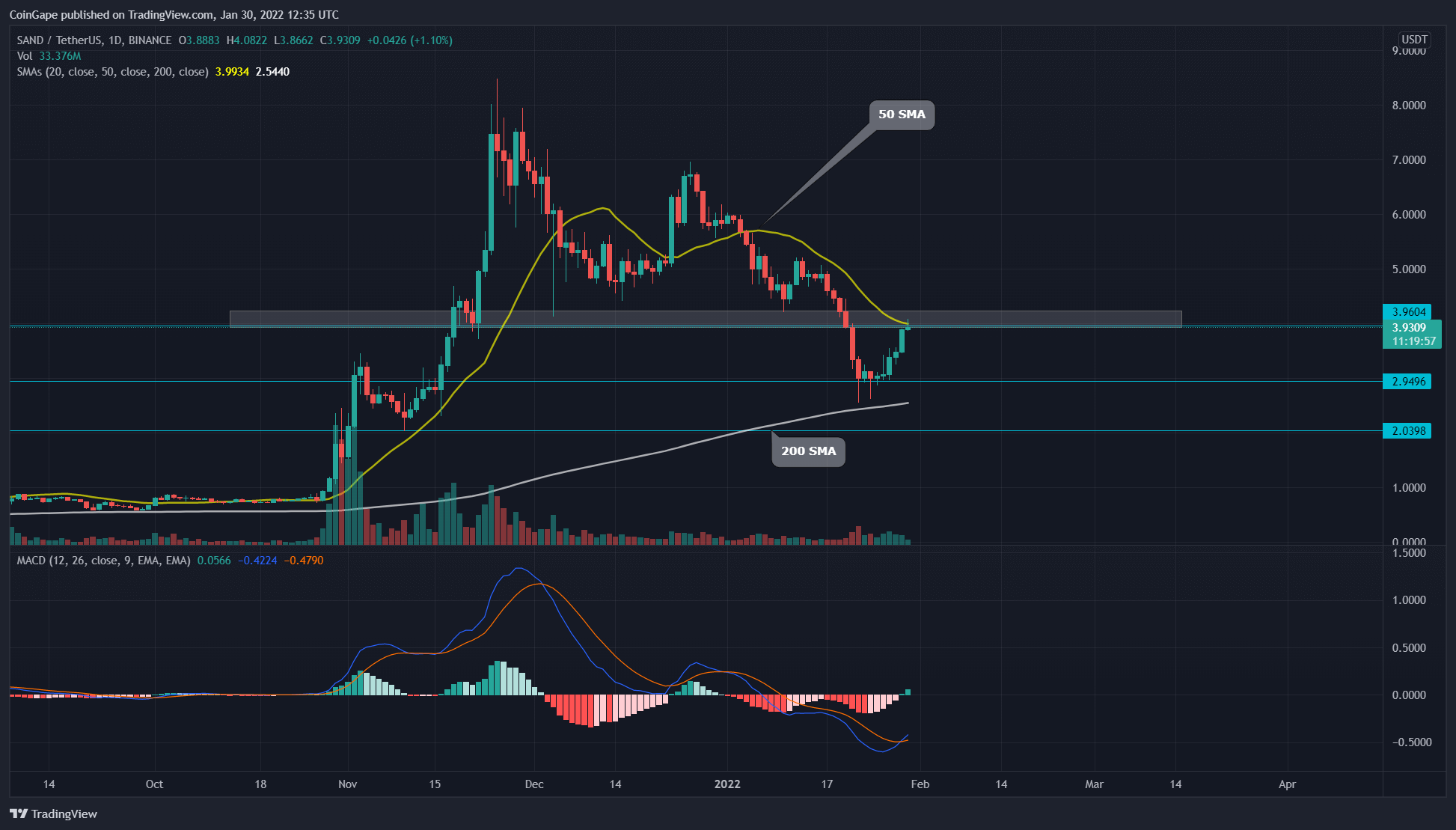

SAND/USD Chart Shows Rounding Bottom Pattern

The recent lower low($2.59) in SAND price shows a 65% fall from the All-Time High of $8.48. The bulls managed to defend the 200-day EMA support, indicating the overall trend is still bullish.

- A recovery rally initiated this week has gained 50% as the price currently trades at $3.93. The price action is at the doorstep of a combined resistance of $4 and 20 SMA, preparing for a bullish breakout.

- Moreover, the token chart shows a rounding bottom pattern in the 4-hour time frame, suggesting a better probability for a $4 breakout.

- The moving average convergence/divergence shows a bullish crossover of the MACD and signals line, providing additional confirmation for a recovery rally.

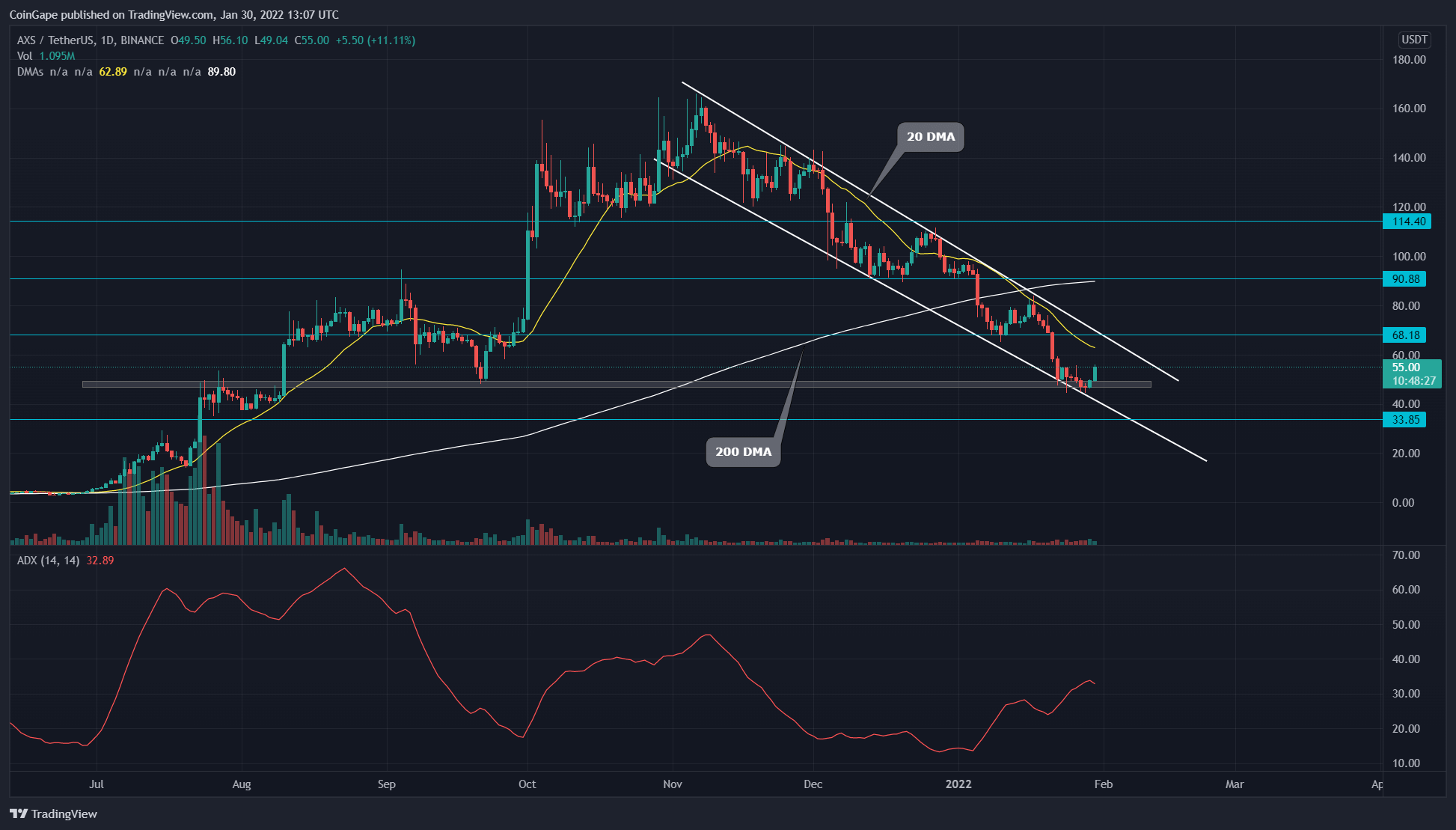

AXS Price Extends Correction Phase In Falling Channel Pattern

The AXS/USD technical chart shows a falling parallel channel pattern in the daily time frame chart. The price action respecting this pattern has lost 72% from the All-Time High of $165.6 by sliding to the $46.6 mark.

- The sellers marked a new lower low($46.6) at the support trendline, triggering a bullish pullback to the overhead resistance. Thus, until this pattern is intact the AXS price will remain in a bearish trend.

- On a contrary note, the bullish breakout from this falling channel could provide an excellent long opportunity to buyers.

- The ADX(32.8%) slope rallying higher indicates the increasing bearish momentum.

- ApeX Omni Review – Is It Actually Worth the Hype?

- NYSE’s Tokenized Securities Plan ‘Bullish’ for Crypto, Binance’s Founder CZ Says

- Grant Cardone’s Cardone Capital Adds More Bitcoin Amid Crypto Market Dip

- CLARITY Act’s ‘Drastically Higher’ Disclosure Thresholds Could Push Crypto Projects Abroad, Coinbase Warns

- Trump Tariffs: China Warns U.S. on Greenland as Supreme Court Ruling Nears

- Top 3 Price Prediction for Ethereum, XRP and Bitcoin If Crypto Structure Bill Passes This Month

- Dogecoin Price Eyes a 20% Rebound Ahead of SCOTUS Ruling on Trump’s Tariffs

- Bitcoin Price Prediction Amid US-EU Tariff Tension

- XRP Price Prediction 2026: Will Price Rebound After Today’s Crash?

- Will Bitcoin, Ethereum, and XRP Prices Hit New Highs If the Clarity Act Is Approved This Year?

- MSTR Stock Price Prediction Amid Vanguard’s First-Ever $505M Buy as VanEck Goes Bullish