Ethereum (ETH) Fell 25% From Swing High; Is Correction over?

Ethereum (ETH) price analysis shows an extended consolidation. ETH tested one month low below $1,500 on Saturday. The price is trading in red for the past few hours.

As of publication time, ETH/USD is trading at $1,503.67, down 0.31% for the day. The second largest cryptocurrency by the market cap holds the 24-hour trading volume with more than 40% gains at $25.21 billion.

- Ethereum price trades lower extending the previous session’s loss.

- A decisive break below $1,500 would bring more losses to the coin.

- This bearish formation on the weekly chart favors bears.

Ethereum price is in limbo

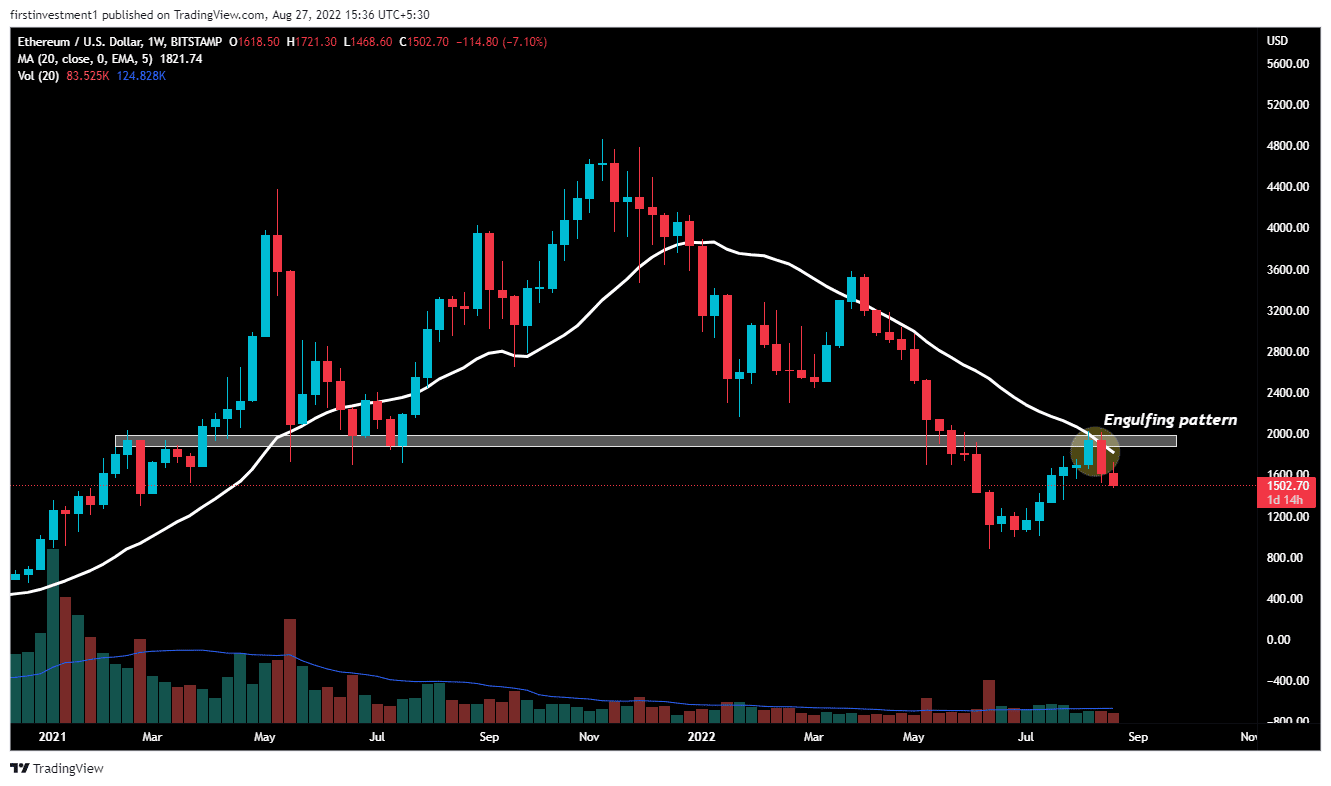

ETH price closed above $2000 for the first time since March 29, 2021, and since then the price had made a high of $4,867. However, the price broke the support of more than one year of $2000 on May 22, 2022, & tested the all-time low of $898.

Finally, the price tested the $2000 level again in the previous week, but couldn’t sustain above the level as it faces heavy resistance, which was once acting as a support.

Further, ETH faces pressure near the 20-day exponential moving average. Along with a 38.6% Fibonacci retracement, which will act as immediate resistance for this week.

A bearish engulfing pattern on the weekly chart favors the bearishness. A bearish engulfing pattern produces the strongest signal when it appears at the tip of an uptrend. During this pattern, the red candle engulfs the previous (smaller) green candle & appears at the highest of an uptrend.

Since bearish engulfing candles can indicate the start of a chronic downtrend, it’s helpful to contemplate an initial take profit level while remaining hospitable to further downward movement. Adjust stops accordingly or think about employing a trailing stop.

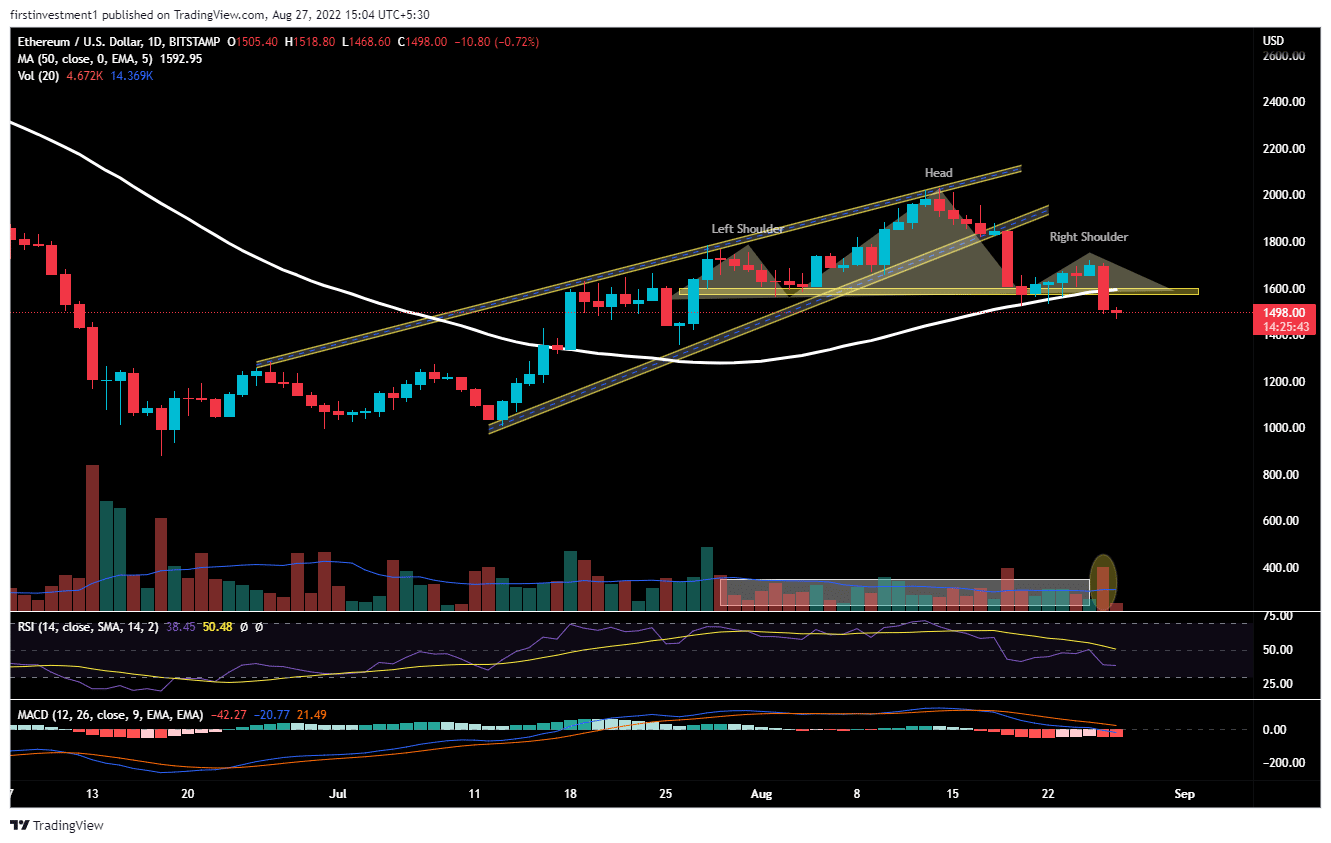

On the daily chart, the Ethereum price has given a breakdown of a “Rising Wedge” pattern on August 18, indicating weakness around the overall look. After making lower highs and lower lows, ETH even slipped below the 50-day exponential moving average in the previous session.

In addition, a breakdown of a “Head & Shoulder” pattern, with rising volumes compared to previous average volumes hints at more weakness in the coin. The neckline of support is at $1,565. If the price sustains below this given level, then there is a higher chance of ETH moving toward $1,400.

The RSI (14) is trading below 50. Another momentum oscillator, the MACD line crosses below the signal line below zero, indicating a bearish trend.

The nearest support is $1,477, whereas the nearest resistance is $1,575. There is a higher probability of the price to breaks its support level. “Sell on rising” opportunity is the best course of plan we can go with.

On the other hand, a weekly move above the $1,575 level could invalidate the bearish outlook. And the price can be higher than $1,700.

ETH is bearish on all time frames. Below $1,477 closing on the hourly time frame, we can put a trade on the sell side.

- Polymarket Sues Massachusetts Amid Prediction Market Crackdown

- CLARITY Act: Bessent Slams Coinbase CEO, Calls for Compromise in White House Meeting Today

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- Crypto, Banks Clash Over Fed’s Proposed ‘Skinny’ Accounts Ahead of White House Crypto Meeting

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%