Ethereum Price Analysis: Can $1000 Support Drive ETH Price Higher?

June’s second week-sell off plunged the ETH/USDT pair to a low of $896.1. However, the high demand pressure prevented a daily candle from closing below the $1000 support, resulting in long-tail rejection. Nevertheless, if buyers could sustain above the psychological support, the price may witness a minor relief rally.

Key points:

- The ETH price has been losing for straight eleven weeks

- The coin chart shows demand pressure near $1000

- The intraday trading volume in the Ethereum is $27.3 Billion, indicating a 3.2% gain

Source- Tradingview

Source- Tradingview

From Mid-April to June, the Ethereum(ETH) price slowed its downfall as the broader market witnessed uncertainty among the market participants. Furthermore, The buyers were trying to sustain the price above $1700, which resulted in a minor consolidation.

However, submitting to the last week’s crypto crash, the ETH breached $1700 support on June 10th. The post-retest fall tumbled the altcoin by 41% and sank it to $1000 psychological support. On June 18th, the sellers tried to break this crucial support, but despite being backed by high volume, the daily candlestick reverted with a long-lower price rejection.

Today with another failed attempt to sustain below the $1000, the ETH price is up 4.5%. Thus, this psychological support indicates high demand pressure and could trigger a minor relief rally.

The replenished bullish momentum may drive a bullish pullback to $1400 or $1700.

Alternatively, the daily candlestick closing below the $1000 support would invalidate the bullish theory.

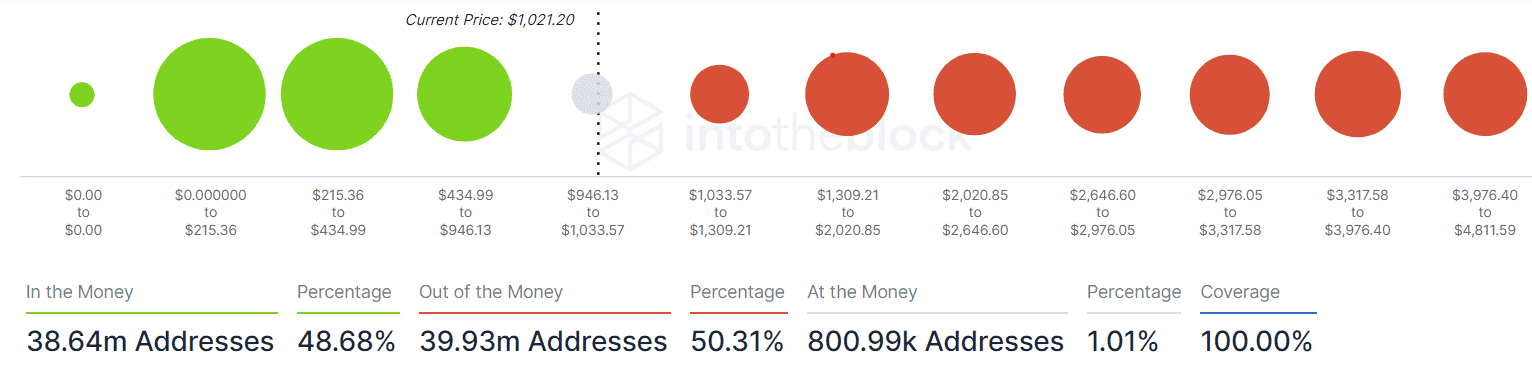

Ethereum(ETH) Global In/Out of the Money

Source- intotheblock

The Onchain GIOM metric indicates that 50.3% of Ethereum addresses are witnessing losses while 48.68% of addresses are in profit. This decreases the potential of investors holding their coins amid the bear market.

Moreover, the nearest green cluster suggests the $619 average as a potential demand zone. On the flip side, the two red cluster projects $1163 and $1750 as supply regions.

Technical indicator-

Relative Strength Index- The daily-RSI slope wavering in the oversold region encourages the recovery theory.

EMAs- The fast-moving 20-day EMA has provided constant resistance to ETH prices since April. A potential recovery needs to surpass this dynamic resistance to carry a genuine rally

- Resistance level- $1400, and $1700

- Support levels- $1000 and $800

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k