Litecoin Price Strikes Multi-Month Resistance, Is It Safe To Enter?

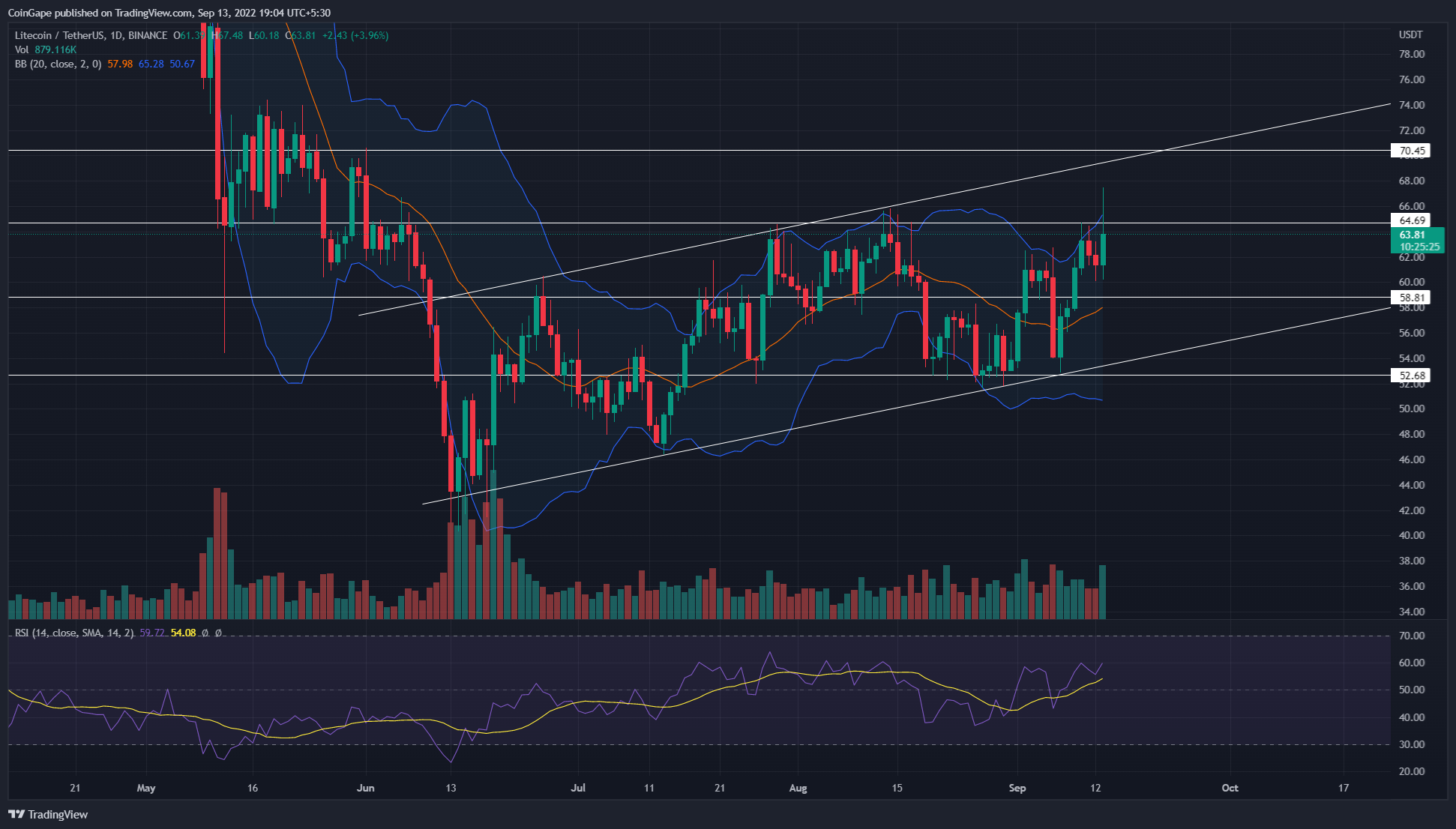

A rising parallel channel pattern governs the ongoing recovery in LTC/USDT pair. The recent bull cycle within this pattern was initiated when the coin price rebounded from the shared support of $52.7 and ascending trendline. However, the Litecoin price is struggling to surpass the $64.7 resistance . Click here to know how this chart pattern may influence litecoin’s future price.

Key points:

- The rising Litecoin price has halted at monthly resistance of $64.7 as the market condition witnesses a sudden selling pressure.

- The bullish recovery regains the 100-day EMA slope.

- The intraday trading volume in the Litecoin coin is $828.5 Million, indicating a 47.5% gain.

A bullish recovery from $52.7 support drove the prices 24.5% higher to hit a record high of $67.5. Thus, the technical chart shows the Litecoin price has breached the multiple-month resistance of $64.7. This resistance level reverted the price several times over the past three months.

Thus, a bullish breakout from this barrier with a suitable rise in volume activity will offer a long opportunity for interest traders. Anyhow, traders must wait for a daily candle closing above this resistance which may surge the Litecoin prices to the $70.5 mark.

However, by the press time, it seems the crypto market is facing sudden selling pressure due to the unexpected number in the consumer price index(CPI). As a result, Bitcoin has dropped 4.3% and Ethereum 5.4%.

Similarly, the Litecoin price has reverted below the mentioned resistance and lost most of its intraday gains. Thus, a long-wick rejection at the aforementioned important resistance($64.7) is unfavorable for buyers as it may further encourage a bearish reversal.

A potential reversal could pull the prices 7% lower to hit the local support of $58.8. Anyhow, the rising channel pattern is a bearish contention pattern, indicating the Litecoin price is eventually poised for a significant correction.

Thus, this pattern’s bullish breakout upper trendline will release the Bitcoin price from a bearish threat.

Technical indicator

Bollinger band indicator: similar to $64.7 resistance, the coin price shows rejections signs at the upper band of this pattern. Such signals usually result in price reversal to the midline support.

RSI: the indicator value at 60% suggests the overall market sentiment of Litecoin is bullish.

- Resistance Levels: $64.7 and $70.5

- Support Levels: $58.8 and $52.6

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs