Terra Price Prediction: LUNA Price Challenges 0.23% Fibonacci Retracement; Keep Eyes On $120

LUNA’s price continues to extend gains after slipping below a crucial support level on February 17. However, the price faces strong resistance near $97.90. Still, the underlying bullish sentiment could keep up the pace of gains intact in the asset.

- LUNA price edges higher challenging the upside resistance barrier near $99.0.

- Investors can expect LUNA to continue with the gains and retest the all-time highs near $120.

- However, a breakdown of the $90.0 support level will ignore the bullish theory.

As of writing, LUNA/USD is exchanging hands at $97.49, up 2.86% for the day. The 24-hour trading volume of the eight-largest cryptocurrency is holding at $2,177,736,684.

LUNA price set to move higher

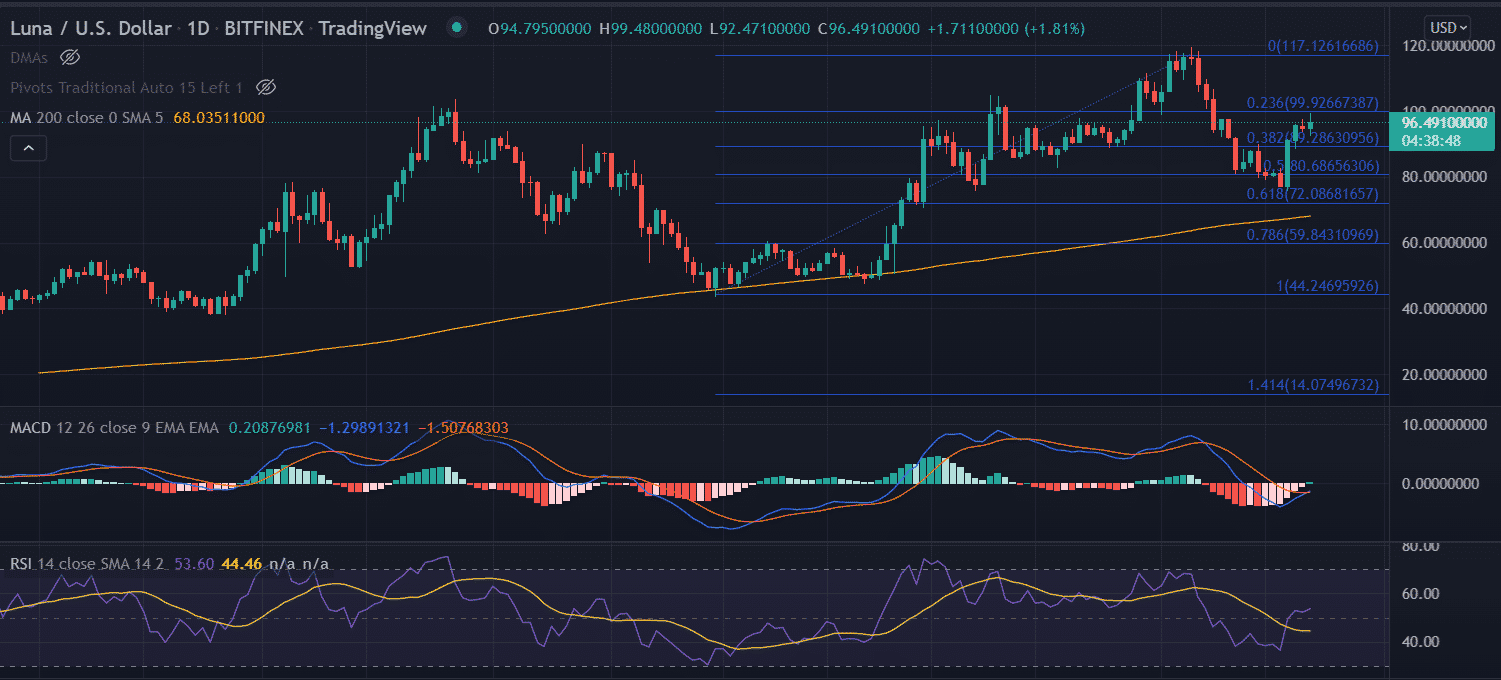

On the daily chart, the LUNA price retraced 45% after testing record highs at $119.44 on April 5. The price after briefly falling below the 0.5% Fibonacci retracement level, which is extending from the lows of $43.87 bounced back to revisit the highs of $99.48.

Now, a daily close above the 0.23% Fibonacci retracement level would push the price higher to recapture the all-time highs near $120.0.

On the flip side, a break below the session’s low would neglect the bullish arguments for the price. In this scenario, the sellers would drag LUNA to the lows of Tuesday at $88.56.

In addition to that, a sustained selling pressure would open the gates for the psychological $0.80 level.

LUNA faces rejection near the horizontal zone extending from $97.0 to $103. Thus, making it a crucial level to trade. The buyers must cross the range with above-average volumes to sustain further gains.

Technical indicators:

MACD: The moving average convergence divergence attempt to cross above the central line.

RSI: The relative strength index stays in the positive zone while reading at 54.

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs