Will Solana Price Crash to $150 or Soar to $350?

Highlights

- Solana Price hovers around $200, with bulls and bears struggling to gain control

- Solana’s price action hinges on critical support and resistance levels.

- The derivatives market signals mixed sentiment despite declining trading volume.

Solana price, a Layer 1 blockchain asset, remains around the $200 mark, struggling to recover from the recent market downturn. SOL continues to face selling pressure as broader crypto market corrections weigh on its momentum. The price trend leans bearish, raising concerns about a potential drop to $150. However, bullish sentiment could push it toward $350 if recovery gains strength.

The global crypto market cap surged 0.73% in 24 hours, reaching $3.23 trillion. Bitcoin (BTC) faced market volatility, holding at $98,000, while Ethereum (ETH) traded higher at $2,800. However, XRP and Solana continued struggling to recover. Investor uncertainty remains a key factor influencing market trends, with mixed performance across major cryptocurrencies.

Solana Price Teeters: Crash to $150 or Surge to $350?

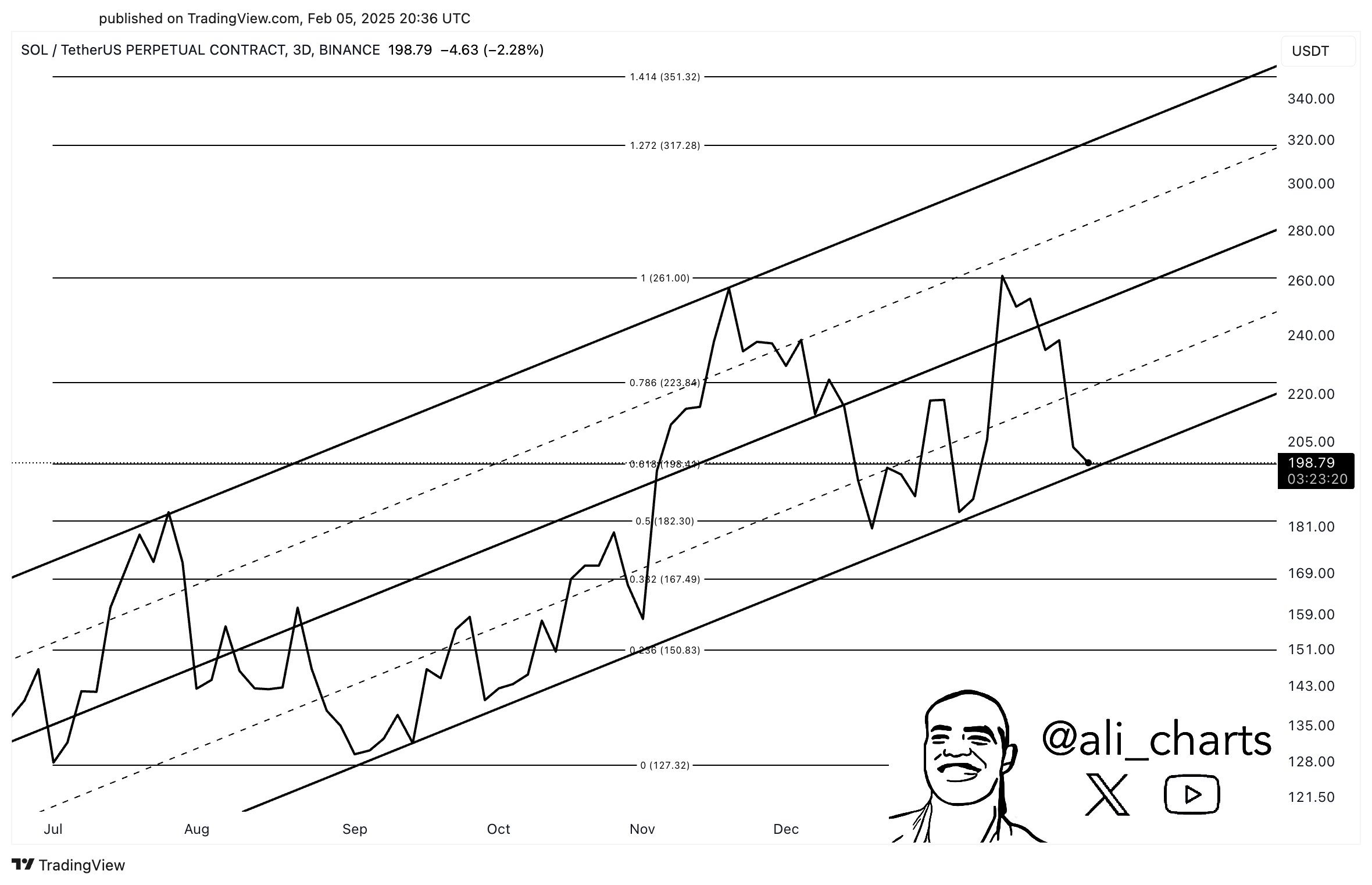

Crypto analyst Ali has raised a critical question regarding the SOL price trajectory for traders. In a recent market analysis, Ali highlighted a parallel channel pattern that could dictate SOL’s next significant move.

The cryptocurrency is at a pivotal moment, with two potential outcomes: a sharp decline to $150 or a bullish surge toward $350.

Solana has been trading within a well-defined parallel channel, suggesting that price action remains within structured boundaries.

Ali’s analysis indicates that bullish momentum could push SOL toward the upper resistance level, around $350, if the channel holds. However, a breakdown from this formation could trigger a steep correction, with a key support target at $150.

With Solana currently priced at nearly $198, its short-term direction depends on how it reacts to the support and resistance levels within the channel.

Solana Derivatives Market Sees Mixed Signals

According to Coinglass data, Solana’s derivatives market has witnessed a notable shift, with trading volume experiencing a sharp decline of 34%. Despite the drop, the total derivatives volume remains substantial at $8.06 billion.

Meanwhile, open interest in Solana futures and options has shown resilience, recording a slight increase of 0.86%. The total open interest now stands at $5.48 billion, reflecting continued trader engagement despite declining volume.

Solana Price Analysis

The SOL price hovered at $202, showing signs of a potential reversal after a prolonged consolidation phase. The asset traded near key support at $200, with resistance at $220 acting as the next hurdle.

The Relative Strength Index (RSI) rested at 42, suggesting neutral conditions with room for an upward move.

A decisive close above $220 could propel the Solana price prediction toward $250, with extended targets at $300 and $350; to reach this, SOL requires about 70%. On the downside, failure to hold $200 may trigger a drop toward the $160 support, followed by $150 as the next critical level.

Solana price remains at a crossroads, with key support and resistance levels determining its next move. A bullish breakout could send SOL soaring toward $350, while further downside pressure may drive a decline to $150.

Frequently Asked Questions (FAQs)

1. What are the key resistance and support levels for Solana?

2. Can Solana reach $350 in the near future?

3. Why is Solana’s price fluctuating?

- Bitcoin Quantum Threat: CryptoQuant’s CEO Flags Risk of Losing Satoshi’s 1M BTC Stash to Hackers

- Crypto Regulation: Hyperliquid Launches Policy Group to Push DeFi Integration in U.S. Markets

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026