Breaking: Michael Saylor’s Strategy Adds 850 BTC As Bitcoin and MSTR Fall

Highlights

- Strategy bought 850 Bitcoin between September 15 and 21.

- Michael Saylor had hinted about the purchase yesterday.

- Bitcoin and MSTR are down amid this development.

Strategy has continued to double down on its BTC accumulation spree as the company has announced another weekly Bitcoin purchase. This comes amid the significant declines in the flagship crypto and the MSTR stock, which has dropped to a five-month low.

Strategy Acquires 850 BTC for $99.7 Million

In a press release, the company announced that it had acquired 850 BTC for $99.7 million at an average price of $117,344 per Bitcoin. It has also achieved a BTC yield of 26% and now holds 639,835 BTC, which it acquired for $47.33 billion at an average price of $73,971 per Bitcoin.

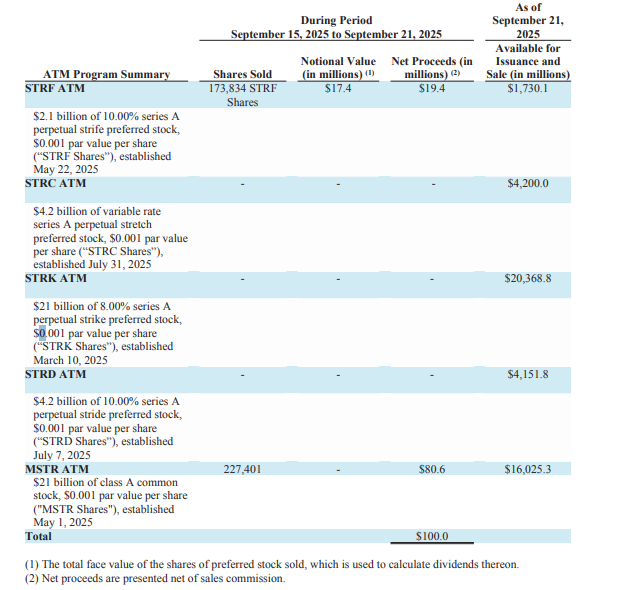

The SEC filing shows that Strategy sold MSTR and STRF shares to fund this purchase. It raised $80.6 million and $19.4 million from the MSTR and STRF sales, respectively.

Strategy’s co-founder, Michael Saylor, had hinted about the purchase in an X post yesterday, stating that “The Orange Dots go up and to the right.” This again indicated that Saylor and his company plan to continue accumulating more BTC and have no intention to sell.

The Orange Dots go up and to the right. pic.twitter.com/CrTo7DQ9qw

— Michael Saylor (@saylor) September 21, 2025

It is worth noting that this marks the company’s eighth consecutive weekly Bitcoin purchase in a period that spans back to the end of July. Last week, the company added 525 BTC for $60 million, which is one of its smallest weekly purchases this year.

MSTR Stock and Bitcoin On The Decline

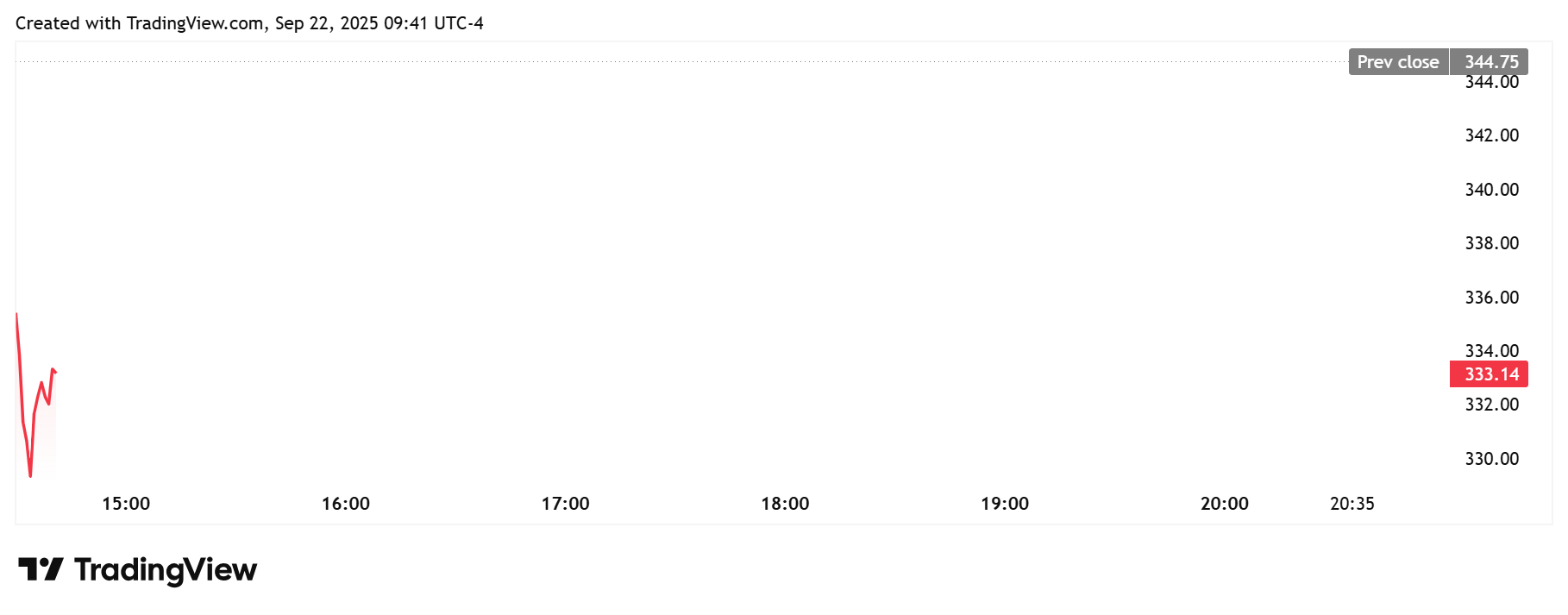

Strategy’s latest BTC purchase comes amid a decline in the MSTR stock and Bitcoin. TradingView data shows that the stock is currently trading at around $336, down over 2% from last week’s closing price of $344.

The MSTR stock has traded sideways over the last month, recording a gain below 2%. Meanwhile, as CoinGape reported, the Strategy stock hit a five-month low of $323 per share last week. A positive is that the stock is still up 14% year-to-date.

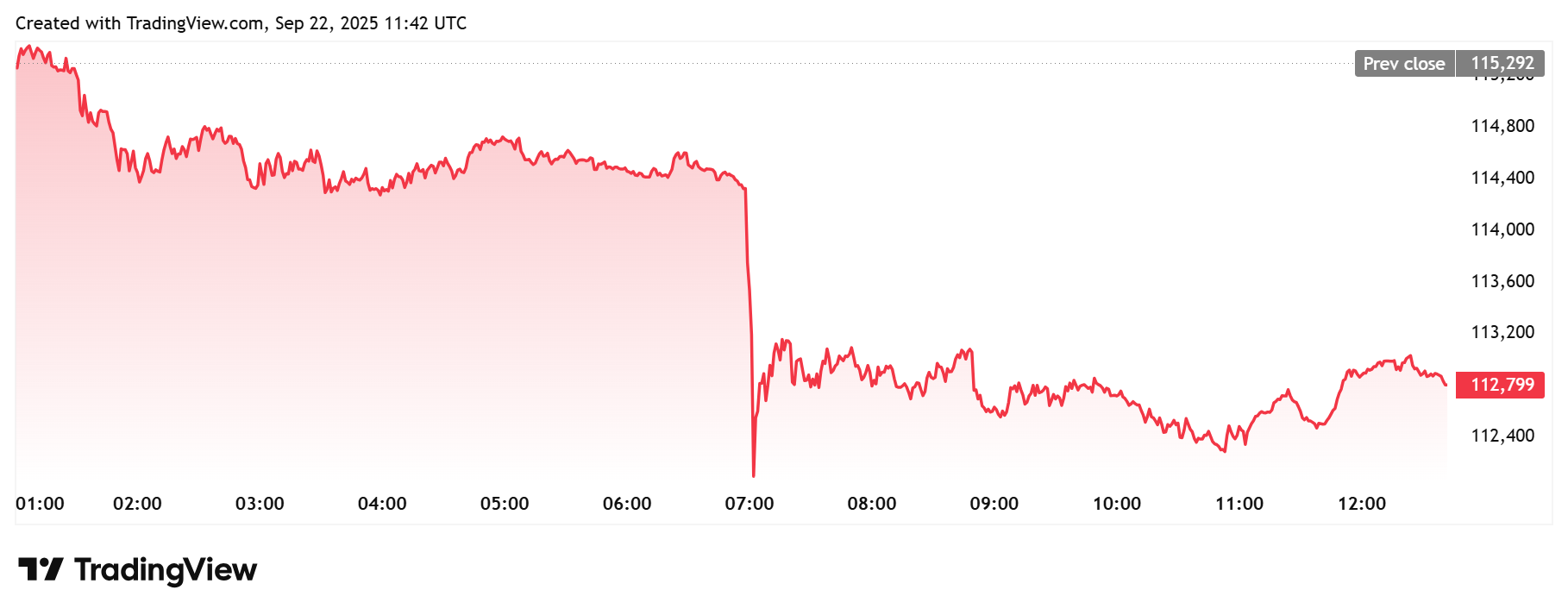

The Bitcoin price is also down at the moment. TradingView data shows that the flagship crypto is currently trading just below the psychological $113,000 level, down over 2% in the last 24 hours.

This comes amid a broader crypto market crash, which is believed to be due to several macroeconomic factors, including the rise in U.S. Treasury yields. Bitcoin and Strategic critic Peter Schiff has predicted that BTC could still drop below $100,000 as gold rallies to $4,000.

More like before Bitcoin breaks down. I think the breaking point will be when gold breaks above $4,000 and Bitcoin breaks below $100,000.

— Peter Schiff (@PeterSchiff) September 22, 2025

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k