Why Is The GameStop (GME) Stock Up Today?

Highlights

- Michael Burry confirms recent buying and a long-term value stance on GME Stock.

- Insider purchases and Bitcoin-related activity have also put the spotlight on GameStop.

- The GME stock surged as much as 8% today following Burry's disclosure.

GameStop shares moved higher on Monday after investor Michael Burry disclosed a position in the company, reviving market interest in GME Stock. The disclosure coincided with renewed insider activity and heightened trading interest tied to the stock’s historical volatility.

Burry Discloses New GME Stock Buying

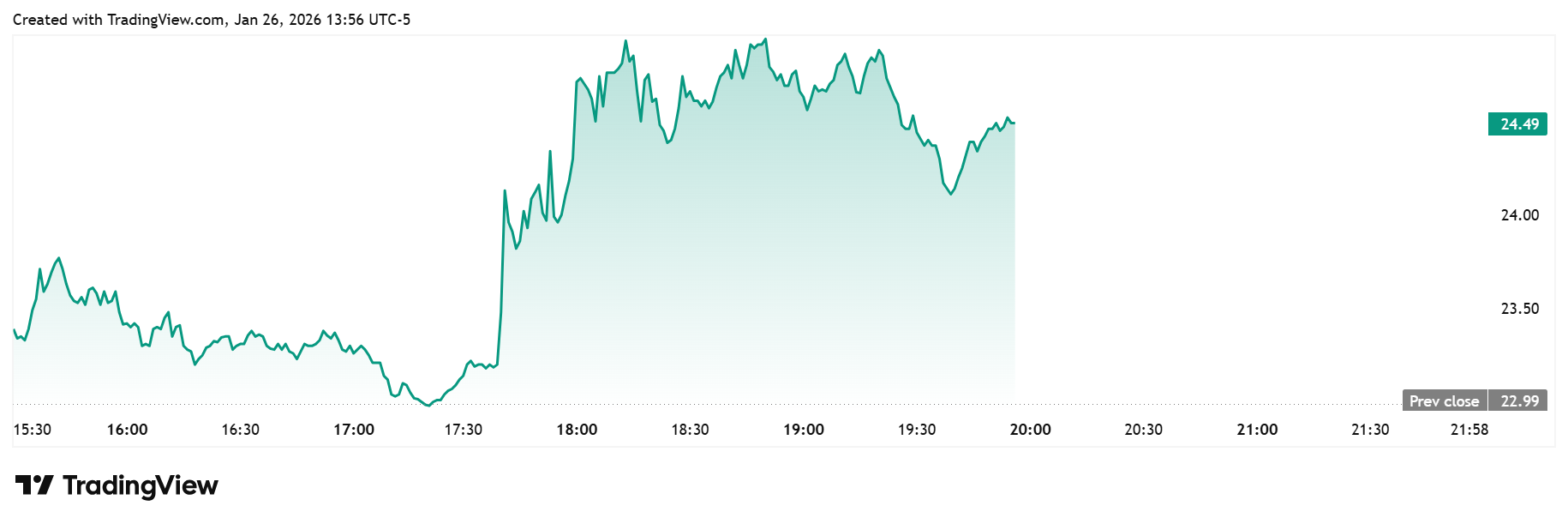

Burry, best known for his prediction of the U.S. housing market crash, said he had been buying up GameStop shares in recent weeks. In a Substack post describing the investment, he called it “a value long” rather than a speculative trade. “I expect I am buying at what may soon be 1x tangible book value / 1x net asset value,” he said. Following the Substack release, GME surged as much as 8%, reaching a 3-month high of around $25. At press time, the stock is still up over 6%, trading at around $24.50.

The famed investor stressed that his bullish outlook for GameStop is predicated on the company’s fundamentals and management, not on more meme-fueled rallying. He also expressed faith in CEO Ryan Cohen’s leadership style, capital allocation plans, and the company’s long-term vision. Burry said he is fine with being in the position for multiple years and doesn’t anticipate a short squeeze profit.

The GME stock was notably the beneficiary of a short squeeze five years ago, when coordinated buying pressure from retail traders drove the stock to new highs, liquidating hedge funds that had been shorting it. Meanwhile, amid Burry’s praise for Cohen, it is worth noting that the GameStop CEO recently bought 1 million shares, a move that has contributed to the year-to-date (YTD) gains the stock has recorded this year.

The ‘Big Short’ investor also touched on GameStop’s move to acquire Bitcoin as a reserve asset. He admitted he didn’t know anything about the BTC strategy, but couldn’t argue with the company’s move so far.

GameStop already appears to have abandoned its Bitcoin strategy, just less than a year after acquiring the flagship crypto. As CoinGape reported, the retailer moved all its BTC holdings to Coinbase, in a move that signals a sell-off.

Bullish Fundamentals For The Stock

In an X post, GME stock commentator Reese highlighted several bullish fundamentals. First, he alluded to the CEO’s recent purchase of 1 million shares, a move Cohen described as a way to further strengthen alignment with stockholders.

The GameStop CEO isn’t the only insider who recently acquired the stock. Reese mentioned that two other board members added to their positions. An SEC filing shows that the company’s director, Lawrence Cheng, purchased 5,000 shares of common stock on Jan. 23 at an average price of approximately $22.87 per share. This raised his direct stake in the company’s common stock to 88,000 shares through his investment vehicle, Cheng Capital LLC.

Reese also noted that DOMO Capital Management, an OG investor, is long GME stock. He credited all these factors for the stock’s 20% YTD gain. GME is up despite the decline in other crypto stocks. Interestingly, the stock has climbed since the company sparked speculation of the sale of all its BTC holdings after moving them to Coinbase. The decline in other crypto stocks follows Bitcoin’s recent drop to as low as $86,000, erasing its YTD gains in the process.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs