Ripple price leaves dust in its wake as bulls focus on settling above $1

- The flagship cross-border token hit a multi-year high at $1.1.

- The trend is in the bull’s hands despite the hunt for higher support.

- A correction under $1 would trigger declines likely to test $0.8 and $0.6.

Ripple has been like Usain Bolt on steroids over the last few days. The cross-border token had significantly suffered following the lawsuit filed against Ripple Labs and its top executives in December. The Securities and Exchange Commission (SEC) alleges that the blockchain company sold unregistered securities to investors and stayed away from regulation for nearly eight years.

Although the lawsuit is still ongoing, there is reasonable progress to believe that Ripple Labs will be cleared while XRP is allowed to operate as a whole cryptocurrency. Meanwhile, investors took action into their hands during the Easter holiday to incredibly pump the token’s price.

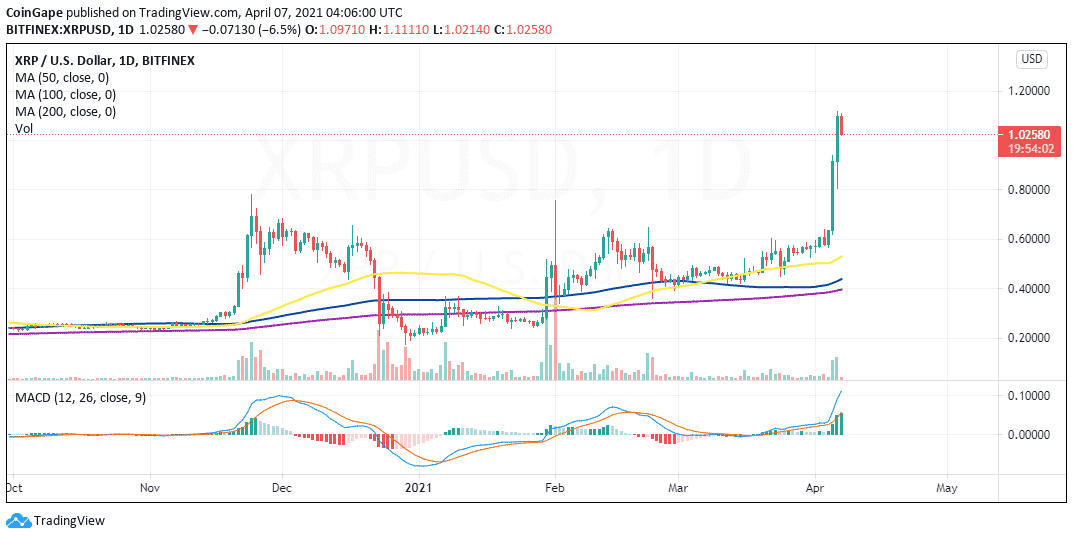

Ripple rose above several key resistance zones, including $0.6, $0.65, $0.75 and the critical $1. The bullish leg did not stop there but took advantage of the tail force to achieve a three-year high of $1.1.

At the time of writing, Ripple is teetering at $1.05 amid a corrective move from the multi-year high. The primary goal is to secure higher support, preferably above $1. Note that the Moving Average Convergence Divergence (MACD) indicator shows buyers are in control. The wide gap made by the MACD line (blue) above the signal line confirms the bullish outlook.

XRP/USD four-hour chart

It is worth noting that XRP may correct under $1, marking the dumping period’s beginning. If support at $0.8 fails to hold, Ripple will seek refuge at $0.6. The 50 Simple Moving Average (SMA), the 100 SMA and the 200 SMA are in line to prevent losses as far as $0.4.

Ripple intraday levels

Spot rate: $1.05

Trend: Bearish

Volatility: Low

Support: $1, $0.8 and $0.6

Resistance: $1.1

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs