Bitwise Solana Staking ETF (BSOL), Canary Litecoin and HBAR ETFs to Launch Today

Highlights

- Bitwise Solana Staking ETF (BSOL), Canary Litecoin ETF (LTCC), and Canary HBAR ETF (HBR) to launch today.

- Grayscale Solana ETF (GSOL) will launch on Wednesday.

- Language change in applications, Form 8-A by issuers, and CERT filings makes crypto ETFs auto-effective.

Exchanges have filed listing notices for Bitwise Solana Staking ETF (BSOL), Canary Litecoin ETF (LTCC), and Canary HBAR ETF (HBR) to launch today. Also, trading of the Grayscale Solana ETF (GSOL) is set to begin on Wednesday, according to Bloomberg ETF analysts. This happens due to the language change in applications by issuers with respect to a guidance letter from the US SEC.

Solana, Litecoin, HBAR ETF by Bitwise and Canary Debut Today

The CERT filing with the U.S. SEC on October 27 highlighted approval from NYSE Arca to list Bitwise Solana Staking ETF (BSOL). Two other CERT filings revealed Nasdaq’s approval to list Canary Litecoin ETF (LTCC) and Canary HBAR ETF (HBR) under the Form 8-A 12(b).

Bloomberg senior ETF analyst Eric Balchunas further confirmed that Bitwise Solana Staking ETF (BSOL), Canary Litecoin ETF (LTCC), and Canary HBAR ETF (HBR) to launch on October 28. In addition, the converted Grayscale Solana ETF (GSOL) to start trading on October 29.

Canary Capital CEO Steven McClurg said, “Litecoin and Hedera are the next two token ETFs to go effective after Ethereum. We look forward to launching tomorrow.”

🚨NEW: @CanaryFunds spot $HBAR and $LTC ETFs are now effective and will begin trading on the NASDAQ tomorrow, according to CEO @stevenmcclurg.

“Litecoin and Hedera are the next two token ETFs to go effective after Ethereum,” McClurg told me in a statement. “We look forward to… https://t.co/tPjsjLEE3R

— Eleanor Terrett (@EleanorTerrett) October 27, 2025

Crypto ETFs Approval Despite US Government Shutdown

Despite the U.S. government shutdown, crypto ETFs will get effective with the 8-A and CERT filings. Notably, 8-A is the formal registration of ETF shares under the 1934 Act for trading on an exchange.

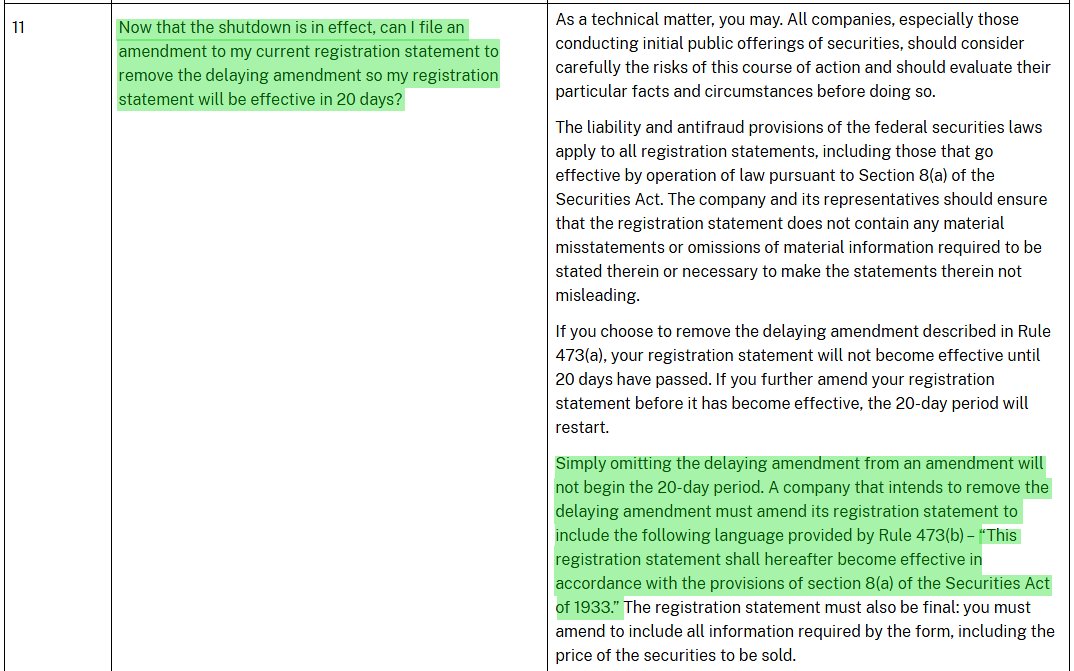

The issuers amended S-1 with language that lets them automatically go effective 20 days after filing. If the SEC misses the final deadline in circumstances such as the government shutdown, the S-1 filing goes automatically effective without SEC intervention.

Bloomberg ETF analyst James Seyffart claimed he expects the Solana, HBAR, and Litecoin ETFs to start trading this week. This happened due to language in a guidance letter from the SEC’s Division of Corporate Finance, which came in the form of Q&A.

Replying to Seyffart, corporate legal expert Scott Johnsson said removing the delaying amendment is not a new process. However, it carries some additional risk, such as stop orders when the government shutdown ends or increased fraud risks.

Bitwise Solana Staking ETF (BSOL) Launches Today

$15 billion AuM Bitwise Asset Management to launch the Bitwise Solana Staking ETF (BSOL) today on NYSE Arca. It will become the first ETF in the United States to offer 100% direct exposure to SOL with built-in staking.

Bitwise Solana Staking ETF set 0.20% as the management fee, with the fee set at 0% for the first three months on the first $1 billion in assets. Matt Hougan, Chief Investment Officer of Bitwise, said:

We believe Solana is one of the most exciting crypto investment opportunities that exists today. Its ability to transact huge volumes with high efficiency and low cost makes it a serious competitor for the stablecoin and tokenization markets.

The fund aims to provide investors with a best-in-class solution that maximizes staking rewards and oversight by leveraging Bitwise’s in-house staking expertise and Helius’ leading Solana staking technology.

SOL price is expected to rally after the ETF launch today. The price is up 1% in the last 24 hours and 9% in a week. However, trading volumes dropped by 2% over the last 24 hours, indicating a lack of support from traders.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs