Spot Bitcoin ETFs and Crypto Stocks Rally as BTC Price Breaks $48000

Highlights

- All spot Bitcoin exchange-traded funds (ETFs) and crypto-related stocks opens higher on Friday

- Coinbase, MicroStrategy, and Bitcoin mining stocks saw massive rally

- Spot Bitcoin ETF recorded third largest inflow of $405 million inflow

- Bitcoin price breaks above $48,000

All spot Bitcoin exchange-traded funds (ETFs) and crypto-related stocks opened higher after recording massive rise in pre-market hours on Friday as BTC price breaks above $48,000. Experts think it’s because investors, including whales, are moving money back into the crypto market.

Massive Pre-Market Trading in Crypto Stocks and Spot Bitcoin ETF

Stocks such as Coinbase (COIN) and MicroStrategy (MSTR) opens over 6%, and Robinhood Markets (HOOD) up 2% amid a rally in BTC price.

Moreover, Bitcoin mining stocks such as Marathon Digital, Riot Blockchain, TeraWulf, CleanSpark Inc, and others also rally on bullish sentiment on Bitcoin. CleanSpark stock price jumped 27% due to strong earnings report and plans to buy four mining facilities.

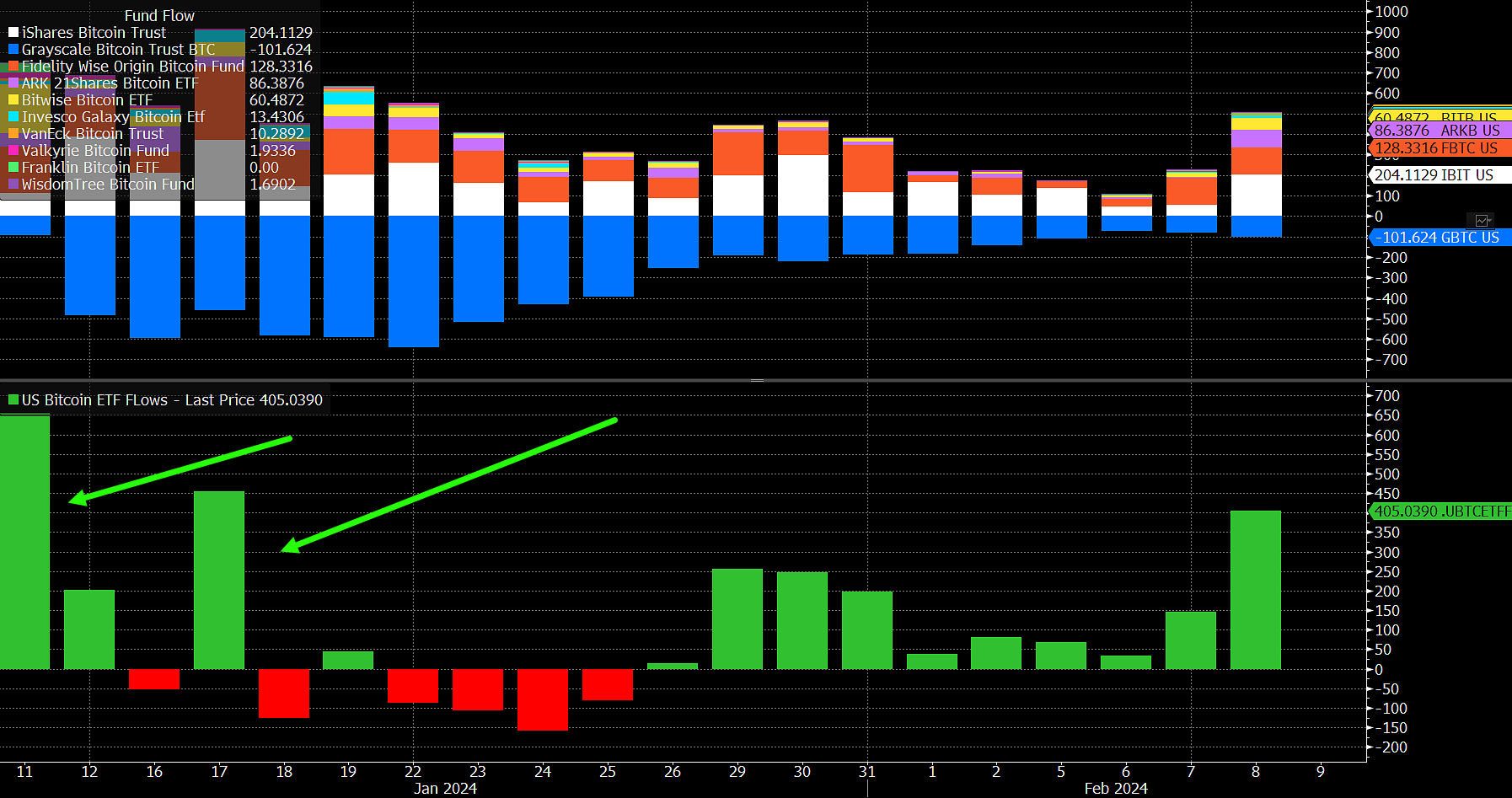

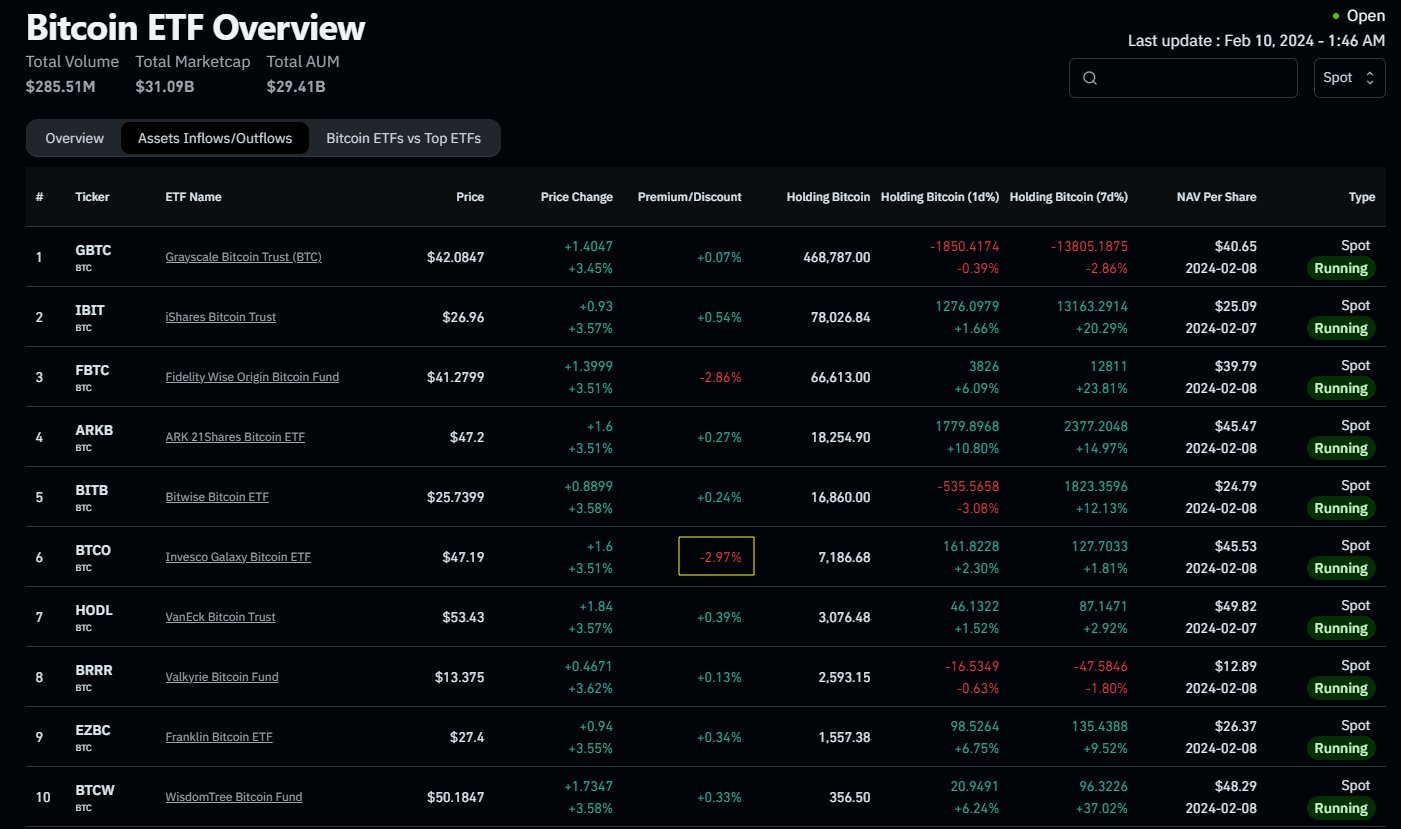

All spot Bitcoin ETFs also open much higher, indicating massive demand for Bitcoin today. Bloomberg ETF analyst James Seyffart noted Thursday was the 3rd biggest inflow day for the spot Bitcoin ETFs since their launch. First day inflow was over $655 million and Jan 17 was more than $453 million.

CoinGape reported that Bitcoin price rise beyond $47,000, with high odds of breaking above $48,000, which corresponds with a notable $405 million inflow into spot Bitcoin ETFs listed in the US. BlackRock (IBIT) and Fidelity (FBTC) spot Bitcoin ETF lead the inflow. GBTC outflow rose more than $100 million.

Adding to the bullish sentiment is the surge in Bitcoin Futures Open Interest (OI), which has risen by 5.51% in the last 24 hours to reach 444.81K BTC or $20.74 billion, according to CoinGlass data. Leading the charge in OI growth is the CME exchange, which saw a surge of 9.79% to 117.23K BTC or $5.46 billion. Binance follows closely behind with a 5.78% increase to 109.76K BTC or $5.12 billion in the same timeframe.

Also Read: Ethereum Dencun Mainnet Upgrade: ETH Breaks $2,500 As Geth Releases Crucial Update

Bitcoin Price Breaks Above $47,000

Spot flows even more important today, especially around the late US session, analyst Skew said. All Bitcoin ETFs by BlackRock, Fidelity, Bitwise, Ark 21 Shares, and others open higher after a premarket jump of over 4%.

He said, “It’s worth keeping an eye on the larger holders of BTC when there’s a discount and high volume day.”

BTC price jumped 6% in the last 24 hours, with the price currently trading at $48,012. The 24-hour low and high are $44,909 and $48,152, respectively. Furthermore, trading volume has increased by more than 30%.

Also Read: Ripple Vs SEC: Judge Torres Grants Ripple’s Request for Remedies-Related Discovery

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand