Spot Bitcoin ETFs Saw $100M Inflow Reversal But Risks Still Looms

Highlights

- Spot Bitcoin ETFs recorded $100.80 inflows after two consecutive outflows in last two days.

- Fidelity Bitcoin ETF (FBTC) led the spot Bitcoin ETF buying with an inflow of $50.6 million.

- Whales are trading BTC and not holding them as BTC saw massive volatility to the downside.

Spot Bitcoin ETFs in the U.S. witnessed over $100 million inflow on Wednesday, June 12, making a reversal from two-day consecutive outflows. It follows as both headline and monthly CPI inflation in the United States dropped and investors immediately brought a rebound in Bitcoin price, recording a broader crypto market recovery. However, the Federal Open Market Committee (FOMC) signaled a single rate cut this year after it held interest rates unchanged.

Spot Bitcoin ETFs Record Inflow After Two Outflows

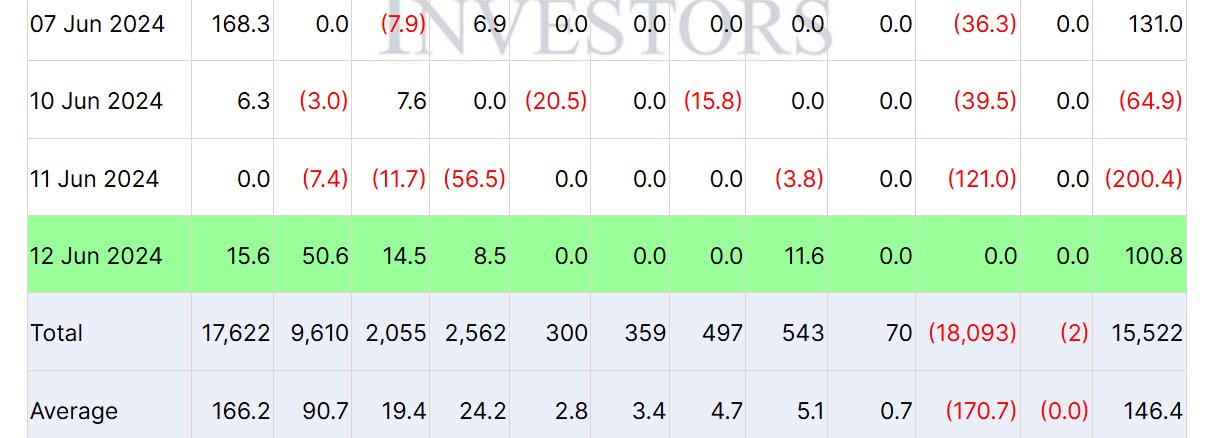

The U.S.-based spot Bitcoin exchange-traded funds (ETFs) recorded a net inflow of $100.8 million, as per Bloomberg and Farside Investors data on June 13. The reversal from two consecutive days of outflows to an inflow is critical for market sentiment as traders await key U.S. PPI inflation data on Thursday and Bank of Japan interest rate decision on Friday.

BlackRock’s iShares Bitcoin ETF (IBIT) saw $15.6 million in inflow and raised hopes of witnessing huge inflows in the next few weeks. Following the latest inflow, BlackRock’s net inflow hit over $17.6 billion and BTC holding climbed to $20.86 billion.

Fidelity Bitcoin ETF (FBTC) led the spot Bitcoin ETF buying on Wednesday, recording an inflow of $50.6 million. Followed by Bitwise Bitcoin ETF (BITB), VanEck Bitcoin ETF (HODL), and Ark 21Shares (ARKB) Bitcoin ETF with $14.5 million, $11.6 million, and $8.5 million, respectively. Other spot Bitcoin ETFs saw zero net inflows.

Grayscale Bitcoin Trust (GBTC) also recorded zero inflow after a net outflow of $237 million in the previous four days. GBTC sold 3434 BTC over the previous four trading days and 335K BTCs since launch.

Also Read: BTC ETF To Impact Price Stability In Long Run

BTC Price To Stay Under $70,000 This Month

Wall Street giants anticipate a Fed rate cut in September despite the FOMC hinting at only one rate cut, which helped in bringing back buying in spot Bitcoin ETFs. In addition, options traders also have room to sell BTC ahead the monthly crypto expiry on June 28. The max pain point for Bitcoin is at $55,000.

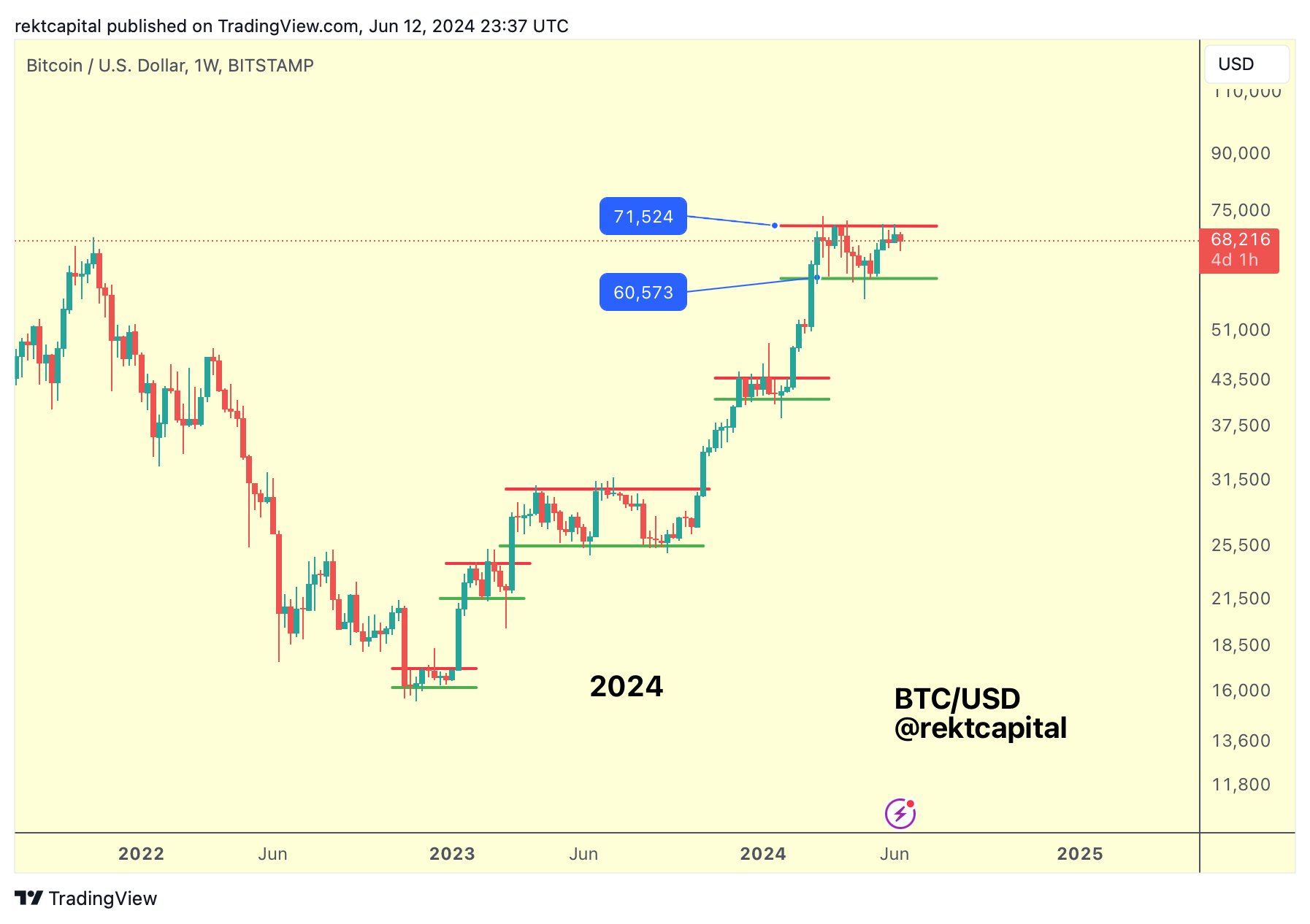

Rekt Capital said “This cycle has been a cycle filled with Re-Accumulation ranges which inevitably break to the upside over time,” hinting at buy-the-dip opportunities. Whales are not holding, but trading BTC after the price continues to move in a range.

BTC price fell again below $67,500 as traders adjusted positions based on the Fed’s dovish outlook on rate cuts. The price is currently trading at $67,559, with a 24-hour low and high of $67,028 and $69,977, respectively. Furthermore, the trading volume has increased by 18% in the last 24 hours, indicating a rise in interest among traders.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs