Spot XRP ETF Records First Outflow of Over $40 Million, Here’s Why

Highlights

- Spot XRP ETF recorded first-ever outflow of $40.80 million.

- 21Shares XRP ETF (TOXR) saw $47.25 million in outflow as WisdomTree exits race.

- On-chain data signals negative sentiment among whale and investors.

- Ripple moves $148 million in XRP to Binance.

In the major XRP news today, spot XRP ETF saw its first-ever outflow. This indicates a significant shift in investor sentiment after weeks of consistent inflows. Here are the possible reasons behind the outflow.

Spot XRP ETF Saw Over $40 Million in Net Outflows

The U.S.-listed spot XRP ETFs recorded their first net outflow of $40.80 million, according to SoSoValue data on January 8. This marks the end of an impressive 36-day streak of uninterrupted positive flows, during which the ETFs saw over $1.25 billion in net inflows.

The outflow was primarily driven by 21Shares XRP ETF (TOXR), which saw $47.25 million in redemptions. Notably, this is similar to outflows from spot Solana ETF triggered by 21Shares’ TSOL. A few days after the listing, TSOL saw massive outflow, causing Solana ETFs to break their inflow streak.

Bitwise led with $2.44 million in inflows, while Canary Capital’s XRPC added $2.32 million. Grayscale’s GXRP bought $1.69 million in XRP, but Franklin’s XRPZ had no inflows. Despite the setback, the spot XRP ETF continues to hold almost $1.60 billion in assets under management. Investors

The XRP Army attributes the outflow to recent news of profit-taking and increased volatility in the broader crypto market. Although one day of outflows may not signal a long-term trend, investors should keep an eye on regulatory developments and market dynamics.

Reasons Behind $40 Million in ETF Outflows

The main reason for the outflow was the 21Shares XRP ETF. This happened right after WisdomTree filed to withdraw its XRP ETF application with the US SEC.

This outflow happened alongside large outflows from other major crypto ETFs. Spot Bitcoin ETFs lost $486 million, and Ethereum ETFs saw over $98 million in outflows. These moves came after a strong early-2026 crypto rally, when XRP rose 30% to $2.40 before pulling back.

CryptoQuant Exchange Liquidation metrics indicate a brutal session, with both long and short positions getting hammered. Binance started to witness increasing liquidations following a massive wipeout of long positions.

These liquidations increased XRP selling pressure near $2.40. Notably, more than $21 million in XRP liquidations over the past 24 hours sparked heavy profit-taking, pushing XRP price below $2.10.

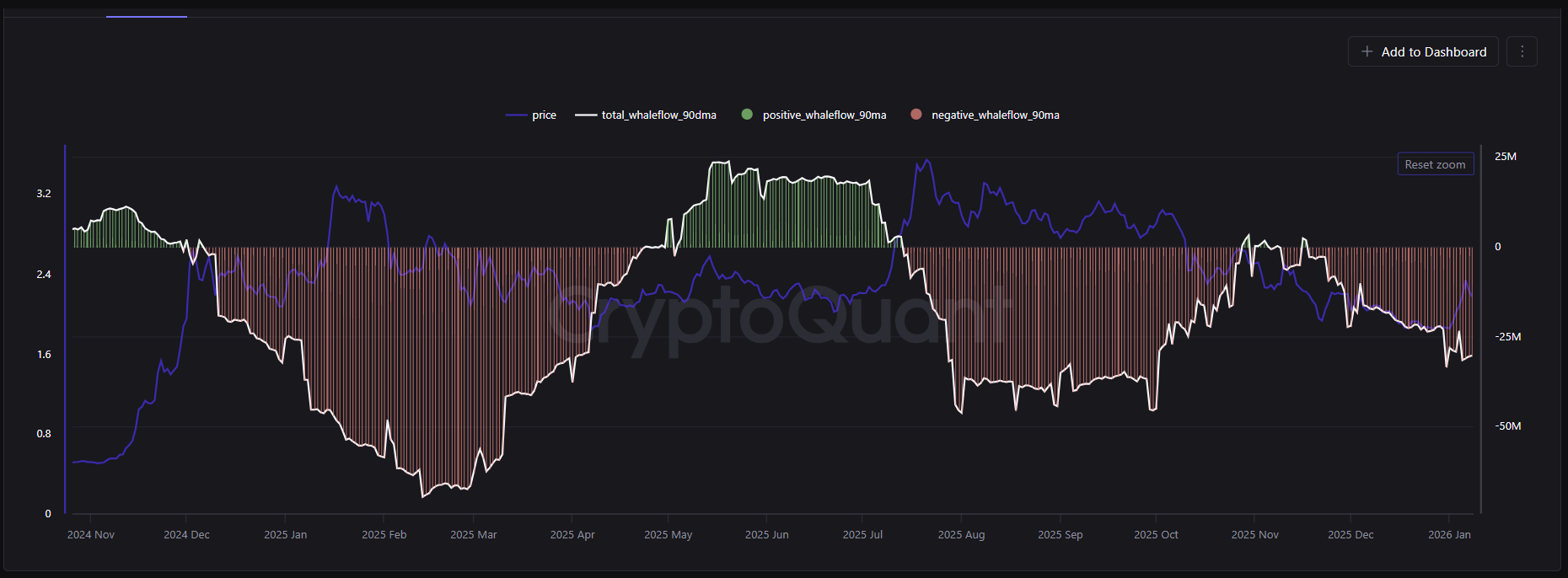

Moreover, the XRP Whale Flow 30-DMA remained in negative territory during the latest rebound in prices. It indicates that sell pressure continued to remain due to whale distribution.

While selling pressure has eased, it still hovers around $30 million in daily outflows. Ripple also moved 68,110,611 XRP worth over $148 million to Binance, breaking investor sentiment once again.

🚨 🚨 🚨 🚨 🚨 🚨 68,110,611 #XRP (148,368,372 USD) transferred from unknown wallet to unknown wallethttps://t.co/UuLRxYy2fU

— Whale Alert (@whale_alert) January 8, 2026

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand