Is USD Stablecoin Rise Fueled by Chinese Demand for Bitcoin and Crypto?

- Tether prints another 120 million USDT to its inventory as the total amount of USDT issued now equals $6,803,667,043.90.

- Reportedly, the global demand for the US Dollar is manifesting itself via Tether, as Chinese crypto exchanges dominate deposits.

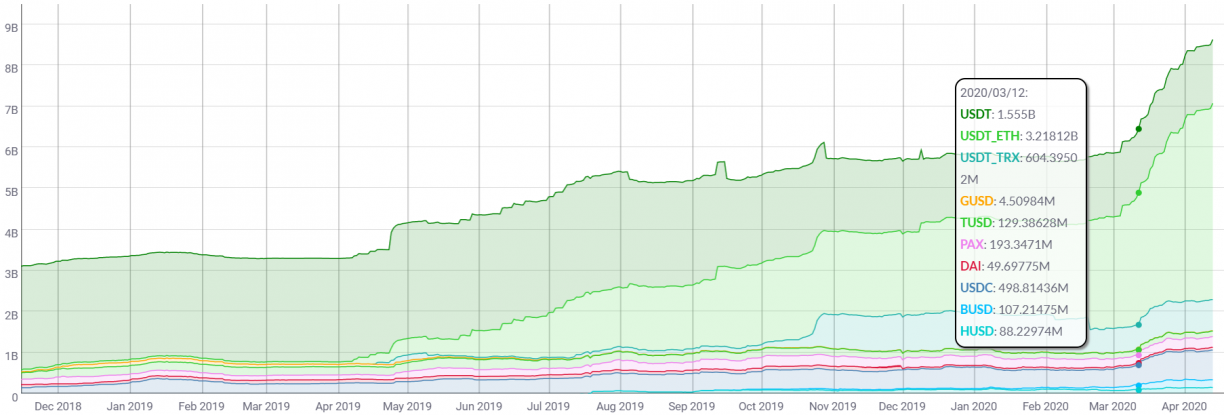

USDT (Tether) total market capitalization is now up more than 40% since March. The trend has been consistent with other stablecoins (such as GUSD, TUSD, PAX, DAI, USDC, HUSD BUSD) as well.

The recently issued $60 million to the inventory on 2nd April 2020 has been replenished in less than 10 days, as the firm moves to print $120 million more.

Huobi and Okex Leading according to Research Report for 14 Exchanges

According to a report by JGZ.com, a total of $1.68 billion worth of USDT was officially distributed in March. Of this, the total net deposits at the top 14 exchange platforms amounted to a total of $672 million USDT. Huobi led the total deposits in March accounting for nearly 50% ($323 million) of the total $672 million.

The 14 crypto exchanges which they reported on included Binance, Okex, Huobi, Bitfinex, Gate, HitBTC. Moreover, 90% of the deposits among the 14 exchanges was accounted for at Huobi, Okex and Binance.

Some of the popular exchanges which were not included in the list were Coinbase, Kraken, Poloniex, and so on. Nevertheless, while the data is incomplete it gives an idea of how the deposits are flowing across the world.

Reference from the Past

In the past, the increasing demand for USDT has acted as a precursor for a rise in the crypto markets. Last year, during the same time, the increasing supply of USDT was followed by a crypto bull run.

Moreover, notice how increase paused before May as the crypto-bull run began suggesting conversion of USDT to Bitcoin.

In the current macroeconomic environment, the increasing demand for USD is also causing a rise in USDT volume. Light (alias), a crypto trader and analyst tweeted,

Demand for dollars manifesting itself through Tether, with $2.2B issued since mid-March.

Since crypto trading in China faces banking restrictions, traders have used stablecoins to bypass them.

Moreover, even in case of a sell-off from crypto markets, the USDT supply would have eventually converted to non-crypto US Dollar (in banks and cash). However, the fact that traders are choosing a cryptographic version is bullish for the markets.

Do you think that we’ll see a conversion of USDT to crypto or back to FIAT currencies/stocks? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs