Terra Luna Classic Successfully Undergoes v2.3.2 Upgrade, Will LUNC Price Rally?

Terra Luna Classic core developer L1TF has successfully completed the v2.3.2 upgrade to resolve the sequence mismatch issue affecting some validators after introducing dyncomm module. Validators are back online and continue to interact with the Terra Classic chain.

Traders anticipate a recovery in LUNC and USTC, but prices seem under pressure due to low trading volumes in the last few days and a crypto market correction looking this week.

Terra Luna Classic v2.3.2 Is Live

The Terra Classic upgrade for the deployment of terrad client v2.3.2 was executed at block 15751600 on December 8 at 12:38 UTC. The core developer L1TF changed the proposal to an upgrade to allow validators and node operators to implement changes as the chain halts automatically.

The Terra Luna Classic community passed Proposal 11890 “Upgrade to v2.3.2 (Sequence Mismatch Issue Resolution)” last week. The proposal received major support from the community, with 99.99% “Yes” votes. Among 66 validators who participated, all have voted “Yes”. This includes top validators including Allnodes, Interstellar Lounge, Interstake One, StakeBin, JESUSisLORD, and others.

Meanwhile, L1TF developer Vinh Nguyen on Thursday announced the formation of Terra Classic Coalition group to contribute to the Terra Classic chain developments as per the pay-per-job model. It is a group formed by key members of the community including Vinh, former L1TF developer Fragwuerdig, L1TF developer Gevik, developer StrathCole, and validator and creator Happy Catty Crypto.

Also Read: Bitcoin Price Can Hit $50,000 Next Week, Predicts Popular Crypto Analysts

LUNC and USTC Prices Moving Sideways

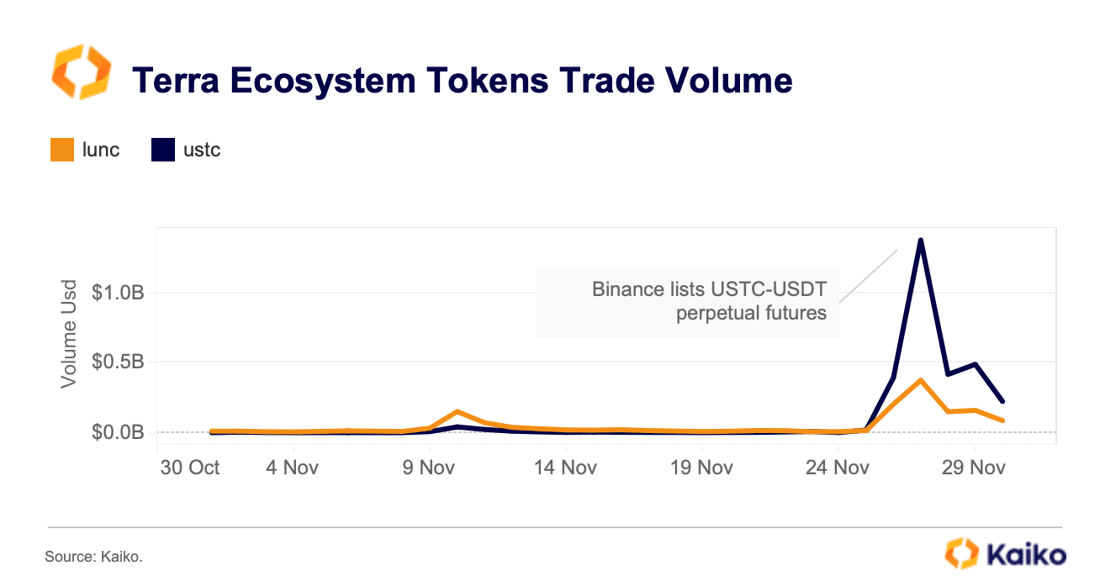

LUNC and USTC prices continue to move sideways after profit booking by traders. Terra Luna Classic ecosystem tokens saw massive trading volumes daily after Binance listed USTC perpetual contract trading and added new USTC trading pairs and LUNC/TRY pair.

LUNC price jumped nearly 1% in the last 24 hours, with the price currently trading at $0.00019. The 24-hour low and high are $0.000199 and $0.000216, respectively.

Meanwhile, USTC price trades at $0.042, up nearly 2% in 24 hours. The 24-hour low and high are $0.0418 and $0.0512, respectively. Trading volumes for both LUNC and USTC fell in the last few days.

Also Read: Fidelity Spot Bitcoin ETF Added To Active ETF And Pre-Launch List

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs