This On-Chain Bitcoin Indicator Hints Huge Bullish Potential, Is Bear Market Over?

The world’s largest cryptocurrency Bitcoin (BTC) made a strong move above $30,000 last week, however, it has been facing some selling pressure since then. As of press time, Bitcoin (BTC) is trading 1.4% down at a price of $29,560 and a market cap of $571 billion.

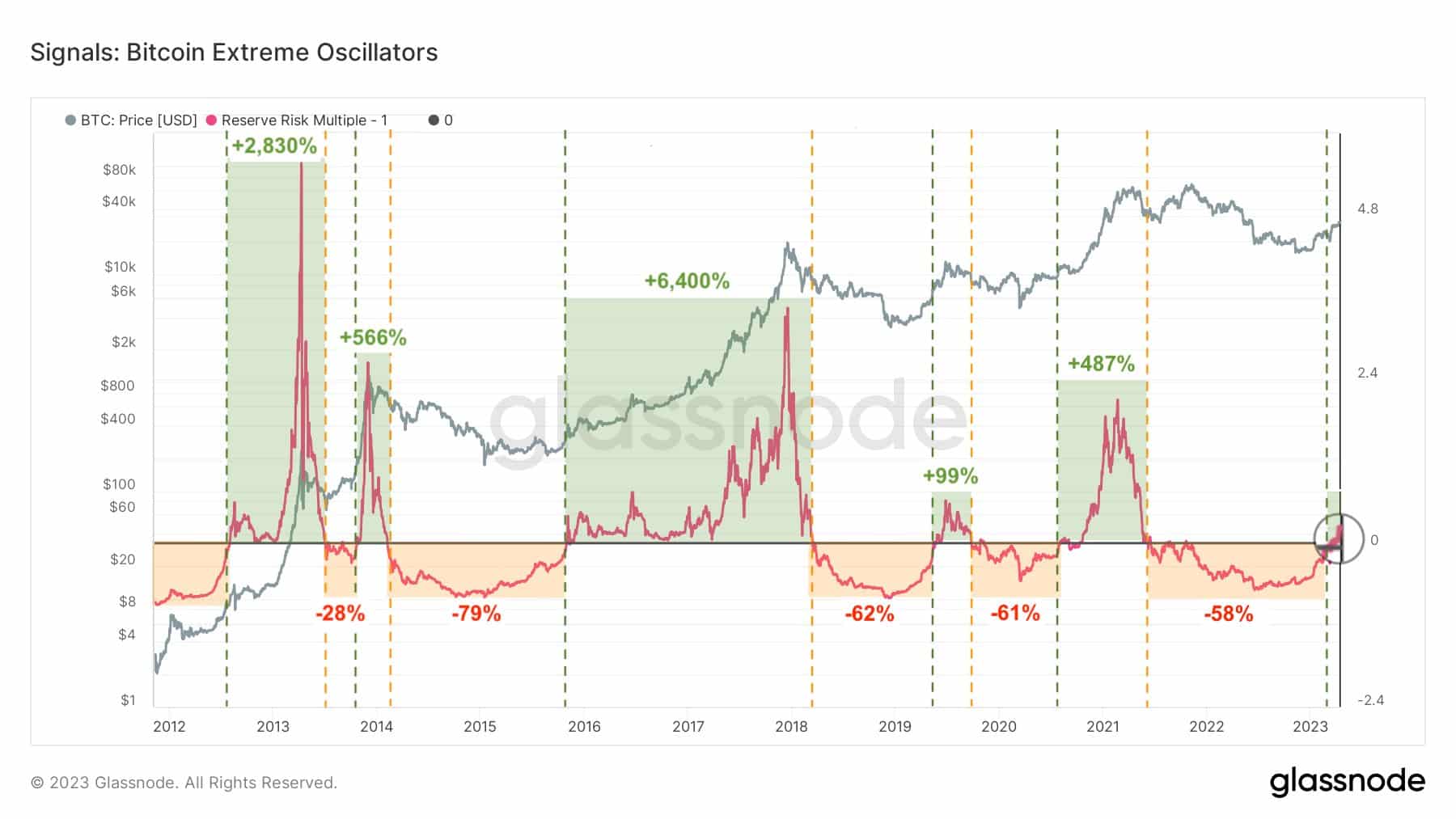

With the BTC price already giving up an 80% run-up since the beginning of 2023. Crypto market analyst Ali Martinez points out one on-chain indicator aka the Bitcoin Reserve Risk which hints at a strong bullish momentum for Bitcoin going ahead. He wrote:

This #Bitcoin indicator signals huge potential! When the $BTC Reserve Risk moves above 0, it signals parabolic price moves. In 2012, 2013, 2015, 2019, and 2020, it resulted in gains of 2,830%, 566%, 6,400%, 99%, and 487%, respectively. Reserve Risk just crossed 0 again!

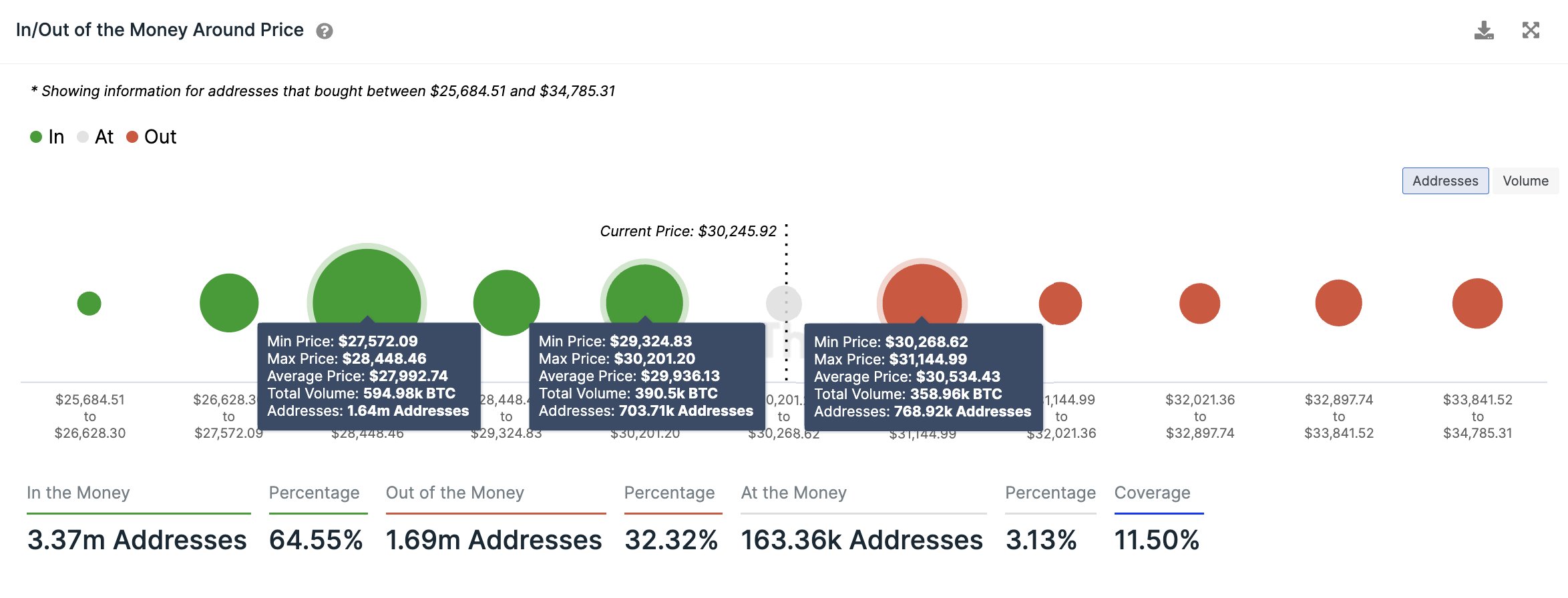

Based on the purchases by ethereum addresses, Martinez also wrote about the strong support and resistance levels for Bitcoin. He wrote:

The $30,270-$32,150 resistance remains a tough hurdle for #Bitcoin where 770K addresses bought 360K $BTC. Meanwhile, the $29,330-$30,200 support holds strong where 700K addresses bought 390K $BTC. Be cautious if this level breaks, the next key support is at $27,600-$28,450.

Is the Bitcoin Bear Market Over?

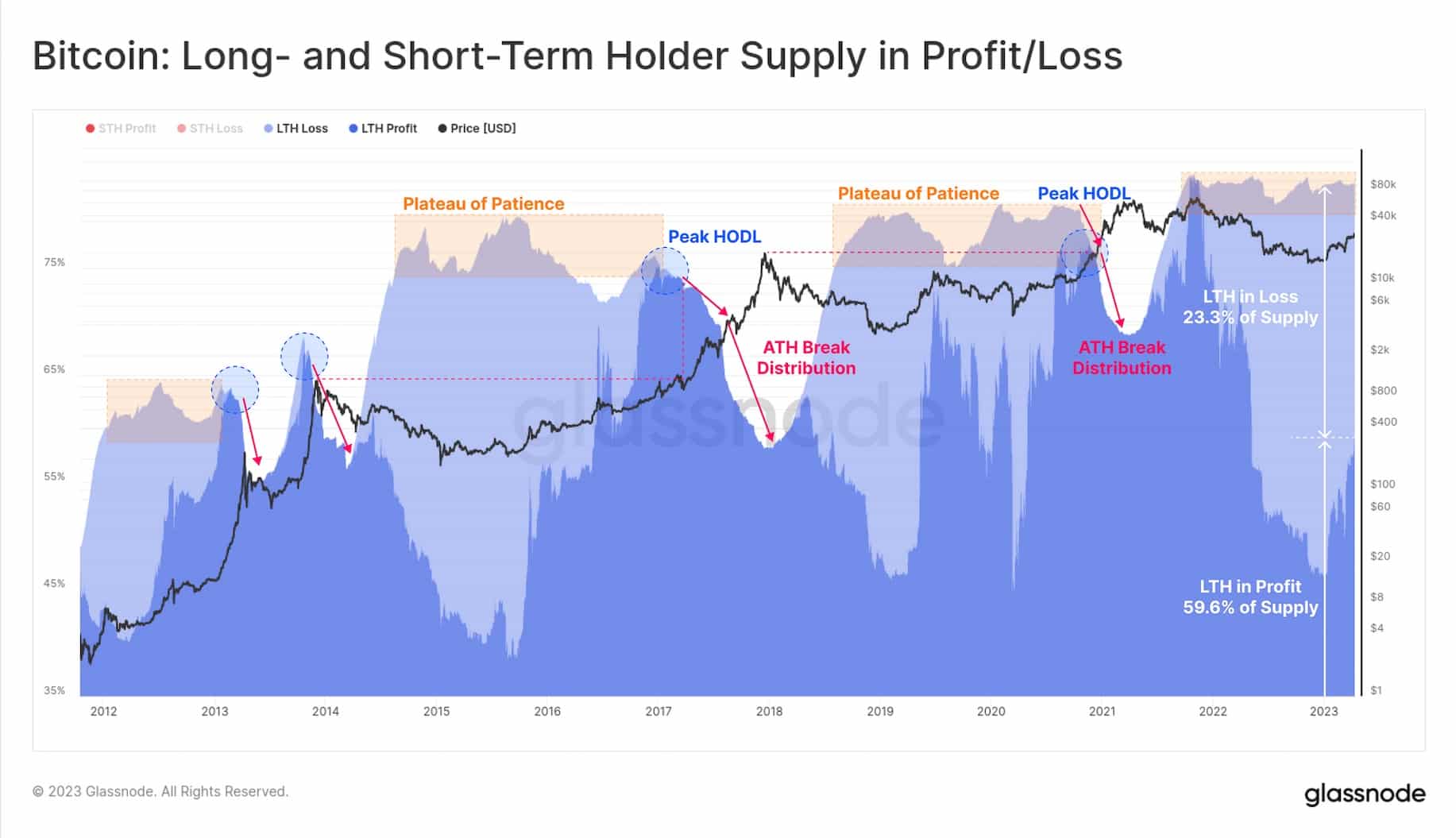

In order to take an overview of whether the Bitcoin bear market is over or not, let’s understand the supply dynamics for Bitcoin’s long-term holders (LTHs) and short-term holders (STHs).

As per on-chain data provider Glassnode, “over 23.3% of the supply held outside exchanges owned by LTHs who are underwater on their position,” showing similarities to early 2016 and early 2019.

Also, Glassnode notes that amid the Bitcoin price rally of 2023, a total of 6.2M BTC have returned to profit (32.3% of supply). Thus, with so many coins currently in unrealized profits, the incentive to spend and sell Bitcoins with every price rise will grow further.

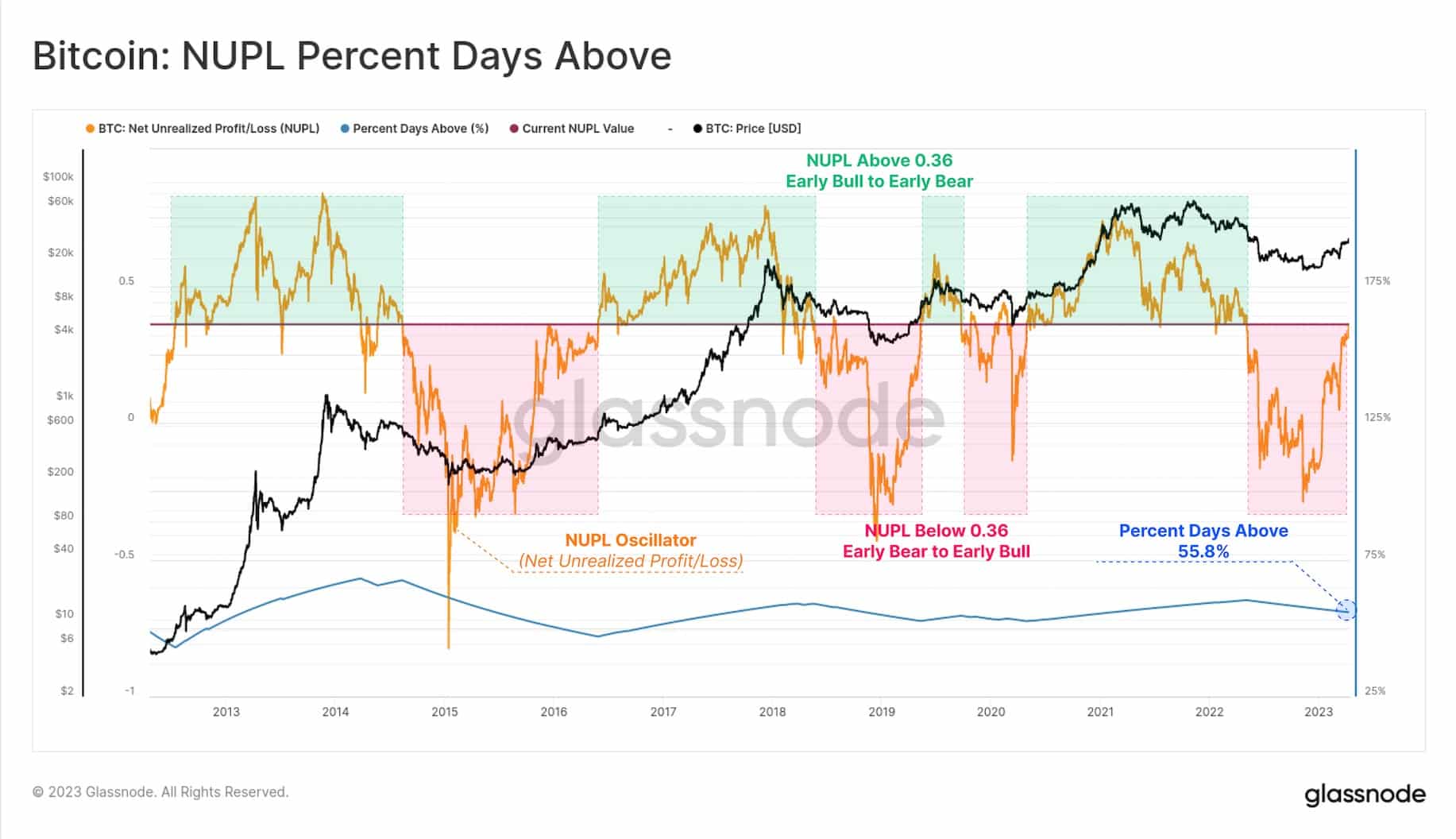

Glassnode also points out another interesting metric dubbed NUPL which measures how the Bitcoin market cap is currently positioned against the unrealized profit. Glassnode explains:

At the current reading of 0.36, the market is at a very neutral level, with 55.8% of days recording a higher reading, and thus 44.2% being lower. It also suggests that the market is neither heavily discounted (like it was at $16k), nor heavily overvalued (like at the $60k+ peak).

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card