Tidal Trust Files For ‘Bitcoin AfterDark ETF’, Could Off-Hours Trading Boost Returns?

Highlights

- Tidal Trust has officially filed for the first-ever Bitcoin AfterDark ETF.

- The product is designed to hold BTC only during U.S. overnight trading hours.

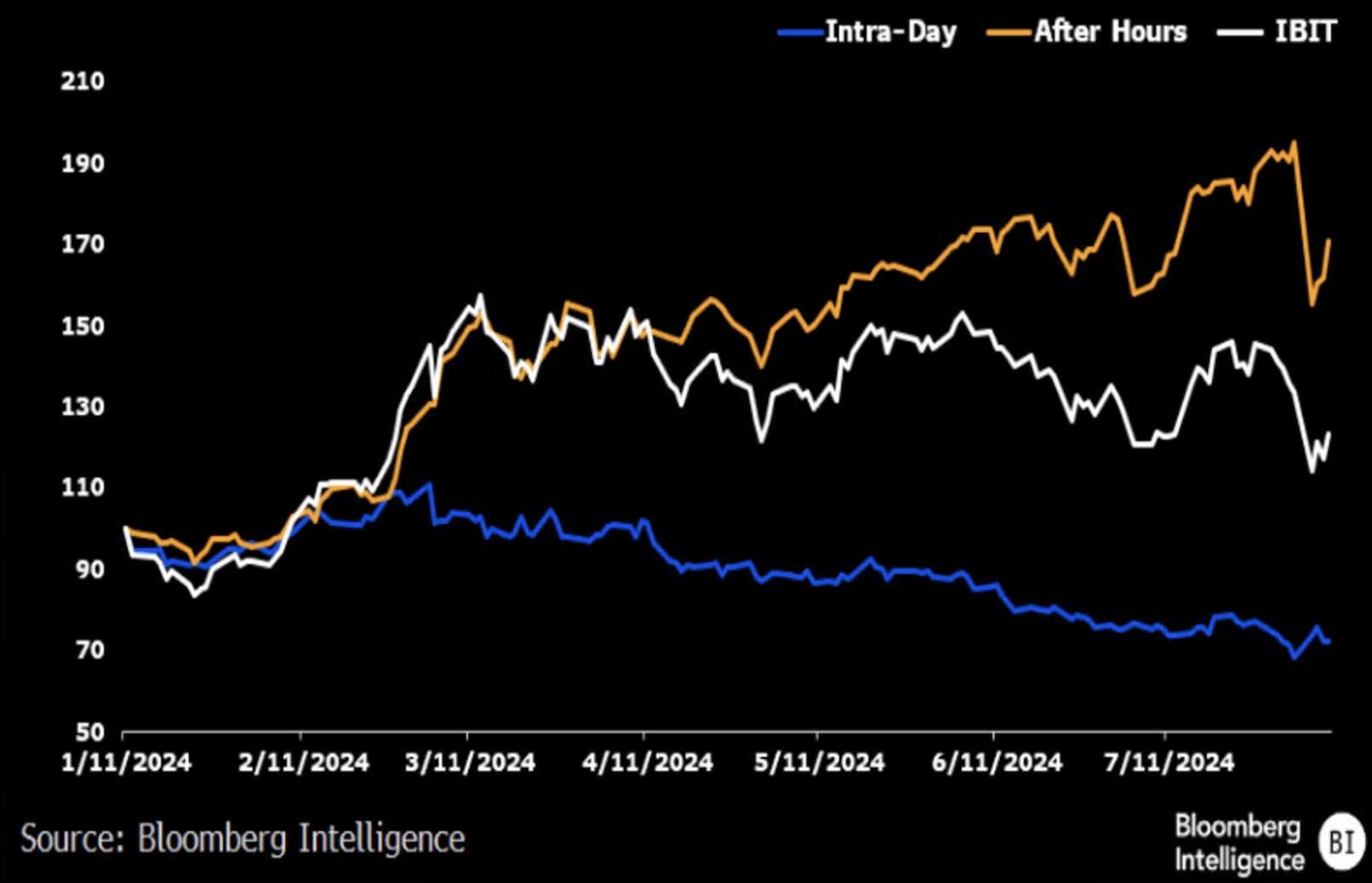

- Eric Balchunas notes that most historical Bitcoin gains occur outside U.S. market hours.

Tidal Trust has filed for the first Bitcoin AfterDark ETF with the U.S. SEC. The product looks to capture overnight price movements of the token.

What Is the Bitcoin AfterDark ETF?

Tidal Trust has filed with the SEC for its proposed Bitcoin AfterDark ETF product. It is an ETF that would hold the coin only during non-trading hours in the United States. This filing also seeks permission for two other BTC-linked products managed with Nicholas Wealth Management.

According to the registration documents, the ETF would buy Bitcoin at the close of U.S. markets and then sell the position the following morning upon the reopening of trading. In other words, it will effectively hold BTC only over the night

“The fund trades those instruments during U.S. overnight hours and closes them out shortly after the U.S. market opens each trading day,” the filing said.

During the day, the fund’s assets switch to U.S. Treasuries, money-market funds, and similar cash instruments. That means even when the fund has 100% notional exposure to Bitcoin overnight, a substantial portion of its capital may still sit in Treasuries during the day.

Eric Balchunas, senior ETF analyst cited earlier research and said, “most of Bitcoin’s gains historically occur outside U.S. market hours.” If those patterns persist, the Bitcoin AfterDark ETF token will outperform more traditional spot BTC products, he said.

Balchunas added that the effect may be partly driven by positioning in existing Bitcoin ETFs and related derivatives activity.

The SEC has of late taken an increasingly more accommodating approach toward crypto-related ETFs. This September, for instance, REX Shares launched the first Ethereum Staking ETF. It represented direct ETH exposure and paid out on-chain staking rewards.

Also on Tuesday, BlackRock filed an application for an iShares Staked Ethereum ETF. The filing states that Coinbase Custody will be the main custodian.

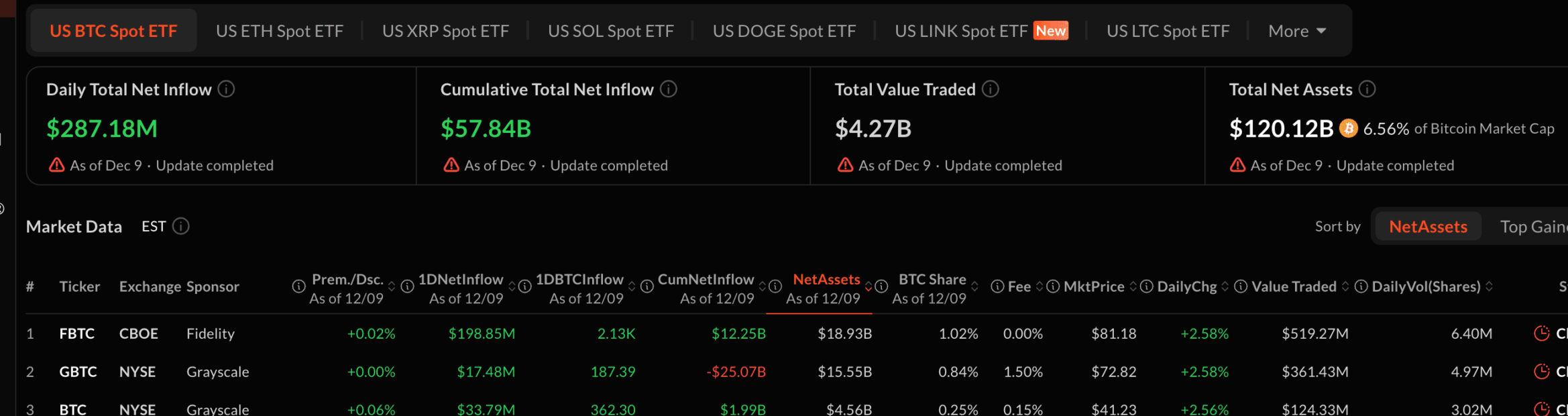

Bitcoin Price Rises Before Fed Rate Decision

BTC briefly reached $94,000 but then stabilized around $92,000 as traders awaited the Federal Reserve’s interest-rate decision. On December 9, BTC ETFs also saw $287.18 million in net inflows. This is the largest it has seen in more than two weeks.

Forecasts are becoming more positive. Standard Chartered predicted that Bitcoin might reach $100,000 by the end of the year. He also shared a long-term target of $200,000

Meanwhile, many major banks expect the Fed to lower rates later today. This is part of the reason the crypto market is up today.

- OCC Confirms That Banks Can Facilitate No-Risk Crypto Transactions

- Bitcoin, Ethereum, XRP, Solana Rally Ahead of Fed Rate-Cut Decision

- Bitwise Multi-Crypto ETF Featuring Bitcoin, Ethereum, XRP, Solana, Cardano Goes Live

- Standard Chartered Lowers Bitcoin Year-End Target to $100K Amid Crypto Sell-Off

- Breaking: USDC Issuer Circle Taps Into Privacy Trend with USDCx Launch on Aleo

- HYPE Price Drops 7% as $2.2M Shift and 10M Token Unlocks Stir Fear — What’s Next?

- Ethereum Price Breaks $3,390: What’s Driving 10% Surge?

- Shiba Inu Price Surges as Whale Transfers Hit Highest Levels Since June

- Bitcoin Price Alarming Patterns Point to a Dive to $80k After FOMC Decision

- Pi Network Price Could Surge to 15%, But Watch Out for This

- Cardano Price Prediction – Analyst Eyes 56% Rally as Taker Buy Dominance Strengthens