Top Bitcoin Analyst Says This Data Is Crucial Than Bitcoin Halving

Highlights

- Top analyst Markus Thielen believes a next week's data is more crucial for markets than Bitcoin halving.

- BTC price to fall back to $62,000 and ETH price to $3,100.

- US CPI inflation is key for positive price action after Bitcoin halving.

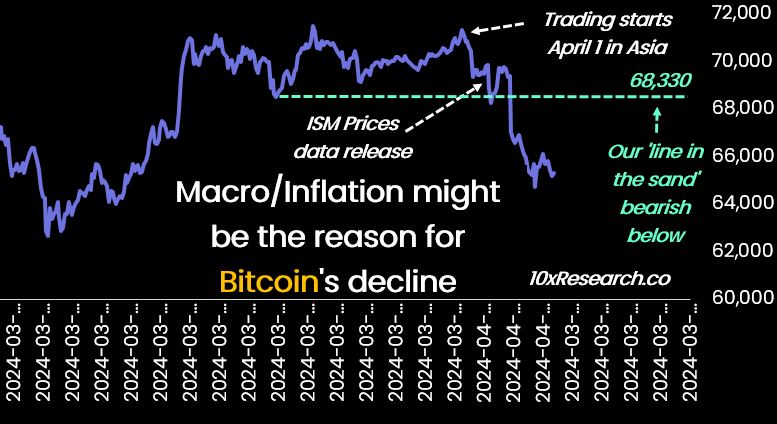

Bitcoin price has dropped more than 17% ahead of Bitcoin halving, the most-awaited event of the year. Experts have pointed out different reasons for the drop including historical pre-halving drop, repricing of US Fed interest rate cut expectations, and on-chain data. Top analyst Markus Thielen believes a next week’s data is more crucial for markets than Bitcoin halving.

Bitcoin Correction to Continue Next Week?

After an urgent update to its clients that Bitcoin and Ethereum are breaking crucial support levels, Markus Thielen, CEO of crypto research firm 10x Research, in a new report reveals a key event next week to trump Bitcoin halving’s impact.

Crypto returns are typically defined by two significant factors – the cycle and the macro environment. Bitcoin has a four- year cycle and macro factors have certainly impacted BTC price direction.

In Oct 2022 when Markus Thielen was at crypto services provider Matrixport, he forecasted bottom in Bitcoin and BTC price prediction of $63,000 in March before Bitcoin halving. Their models predicted a sharp decline in CPI inflation that would cause a massive rally in Bitcoin and tech stocks.

“Although changes in growth, inflation, and central bank policies didn’t impact Bitcoin crypto prices for the last twelve months, those macro factors might now be the most critical again, says Markus Thielen.

As CoinGape reported traders pared some bets after a stronger-than-expected ISM manufacturing PMI, considering the Fed will ease monetary policy in June. The US dollar index (DXY) climbed over 105, the highest level since mid-February due to the ISM manufacturing PMI data. Moreover, the US 10-year Treasury yield also increased to 4.389%, its highest level since November, and Bitcoin moves in the opposite direction to DXY and the 10-year treasury yield. Thus, macro factors have now turned crucial for predicting Bitcoin price direction.

Also Read: BitMEX’s Arthur Hayes Predicts Ethena (ENA) Rally To $10

CPI Data Due Next Week More Crucial

U.S. Bureau of Labor Statistics to release Consumer Price Index (CPI) data for March, which Thielen believes is more crucial than Bitcoin halving. The CPI rose by 3.2% year-over-year in February, following a 3.1% increase in January and slightly exceeding the market consensus of 3.1%. CPI data release next Wednesday, April 10 is crucial as PCE and PPI data also came higher recently.

10x Research predicts BTC price to fall back to $62,000 and ETH price to $3,100 amid a lack of trading volumes. Traders must keep an eye on major levels for Bitcoin at $68,330 and Ethereum at $3,460. Moreover, Bitcoin has a CME gap to close near $63,500 for bullish order book. BTC price currently trades at $66,386 and ETH price is trading at $3,342, at the time of publishing.

#Bitcoin inventory, including paper BTC, continues to trend the right way for longer term bullishness.

I'm looking forward to May, once we clear the halvening volatility. pic.twitter.com/8OZG3AScBu

— Willy Woo (@woonomic) April 3, 2024

Also Read: XRP-Linked Flare Network (FLR) Open Interest Shoots 45%, Here’s Why

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter