Top Coinbase Executives Dump COIN Shares, Will It Impact Stock Price?

Four top executives at American cryptocurrency giant Coinbase, including CEO Brian Armstrong, have reportedly sold significant amounts of company stock. This development comes as Coinbase grapples with regulatory scrutiny and trading volume stagnation within the cryptocurrency market.

Coinbase Executives Dump COIN Shares

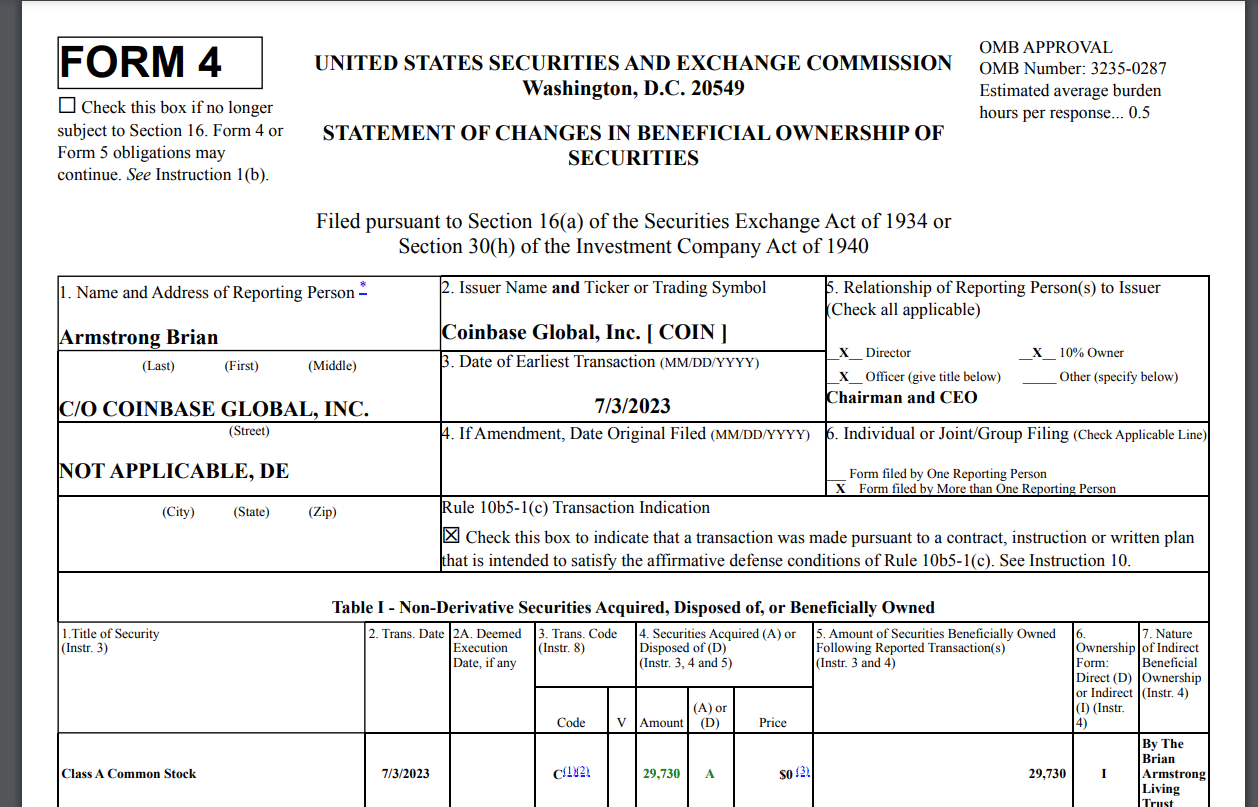

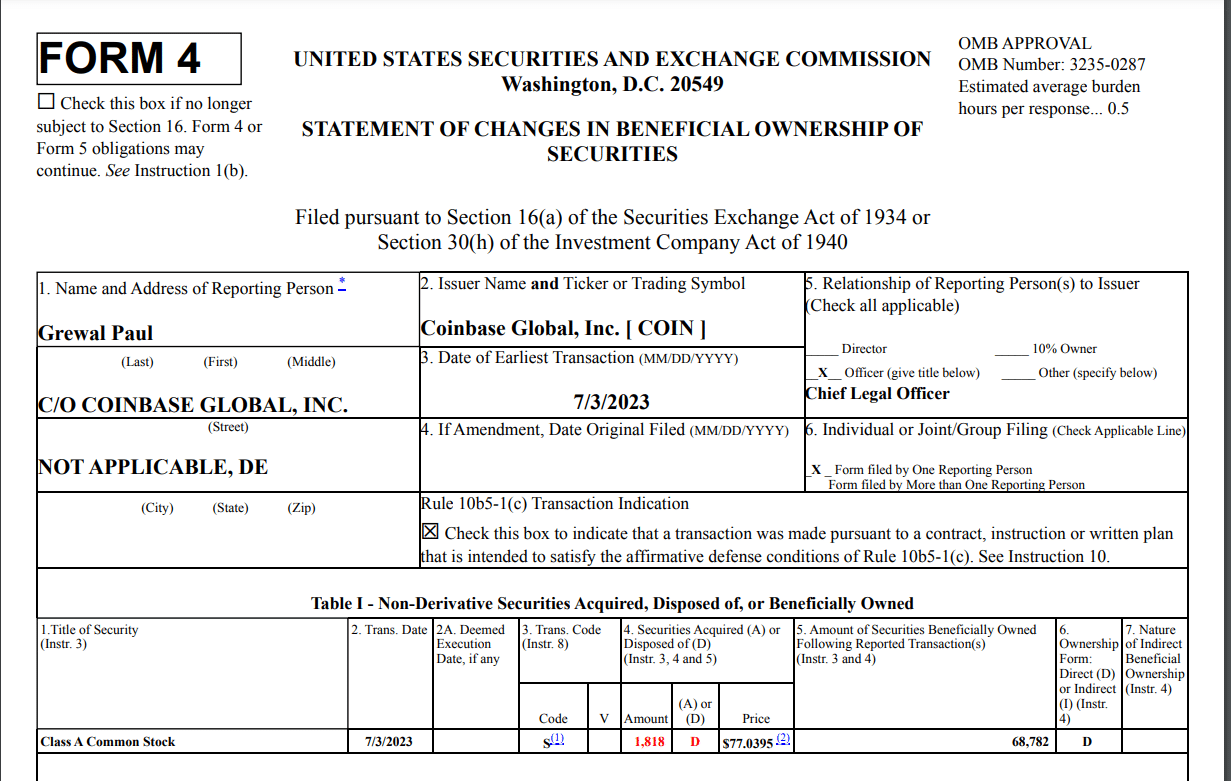

The filings submitted to the U.S. Securities and Exchange Commission (SEC)- Form 04 shed light on the stock sales by Coinbase executives. The Form 4 filing submitted to the SEC disclosed the stock sales made by Coinbase executives, including the Chief Legal Officer Paul Grewal, Chief Accounting Officer Jonnes Jennifer N., and the CEO Brian Armstrong.

This week, Armstrong sold over $5.8 million worth of shares, marking his largest-ever sale. Additionally, he sold shares worth $2.6 million on May 25. Armstrong has previously disclosed his plan to sell his 2% stake in Coinbase over the next year, with the proceeds funding science and technology developments in his co-founded companies, including NewLimit (a biotechnology company) and ResearchHub (a scientific research firm).

Post shareholder lawsuit accusing the CEO and investors of unloading shares to avoid substantial losses in 2021, there have been multiple reports of Coinbase executives selling of their shares. Read More..

Will It Affect COIN Price?

Shares in Coinbase Global have rallied more than 125% this year, reflecting positive investor sentiment. However, regulatory pressures and stagnant trading volumes in the depressed crypto market have raised concerns about the stock’s future performance.

Coinbase Global Inc’s stock, currently priced at $78.72, has experienced a 30.57% gain over the past year. The downgrade stems from ongoing U.S. regulatory scrutiny and the lawsuit filed by the Securities and Exchange Commission (SEC) against the exchange. The SEC alleges that the company offered some unregistered securities, posing a threat to Coinbase’s core trading business.

COIN stock price increased by 12% when BlackRock updated Bitcoin ETF through Nasdaq and Coinbase being listed as a partner under a surveillance sharing arrangement.

Read CoinGape’s report on What’s Next for $COIN Stock Price after 70% Rally in a Month?

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For the Week Ahead: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs