“Actual” Total Value Locked in DeFi is Only About 50% of Reported Value: Analyst

Reportedly, the recursive compounding of collateral on different DeFi project using the same initial capital tends to inflate the value locked in DeFi by almost 50%.

Data analytics websites reporting the ‘total value locked’ in DeFi, determine the value by analysing individual projects. However, the ecosystem has remarkable interoperability. DAI loaned in one project is used as the collateral to take out another loan on a separate platform.

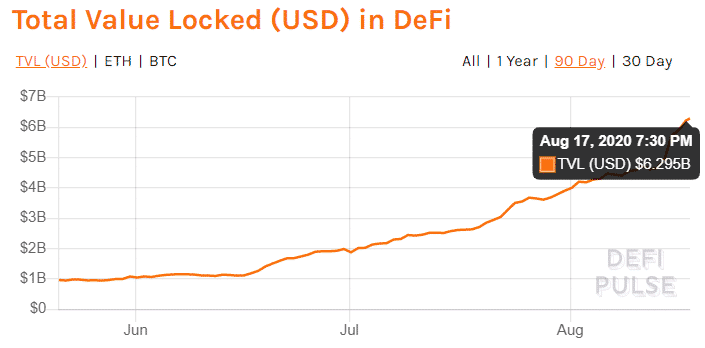

The above chart from DeFi Pulse shows that the TVL is $6.29 billion. According to the estimates of Damir Bandalo, an investor and code developer, the ‘actual’ total value locked in DeFi is about 50% less. He tweeted,

…all of them count the same $ many times. So I did my own calc to find out how much is actually locked in top 15 DeFmarketi protocols. Answer: $3.5bil. (compared to $6.7bil on @defipulse)

Currently, Uniswap is leading the pool size race followed by Balancer and Curve. Whereas, Compound, MakerDAO, and Aave are the leading lending platforms. Nevertheless, Bandalo sees more room from growth, he tweets,

Only 3.85% of ETH & 0.18% of BTC is locked in DeFi. A lot of room to grow.

By contrast 29% of USDC is locked and 62% of TUSD. (which actually has very little adoption outside the ycrv product)

For crypto markets, this is nothing new. Earlier estimates from analysts have pointed out that usually, an actual dollar invested in Bitcoin or crypto is multiplied 10-20 times on the price scale of the index.

Moreover, wash trading on exchanges to over-estimate the volume of trading of a cryptocurrency is still an aching issue for the crypto markets. In the past, it was standard practice among a majority of the exchanges. Switching of yields in DeFi is not only a marketing tactic, but also enables higher yields for farmers. However, it also increases the risk of collapse.

Remember 2008?

Remember the housing bubble of the 2000s? It was built upon CDOs which was essentially employing similar tactics of over-leveraging the collateral up to the brink of collapse.

Furthermore, different governance tokens have different tokenomics. Nevertheless, the volume of borrowing and lending along with TVL are important factors for its’ growth. Repeated yields from non-addition of new value further inflates the DeFi token bubble as well.

For Bandalo exclusion of some of the tokens in the calculation was a no-brainer, like in the Synthetix Network.

There is a lot of value created but it’s not accurate to count both the synthetic tokens and SNX.

The rate of growth of the TVL further inflates the bubble by yielding hefty rewards. Nevertheless, a small vulnerability can lead to widespread liquidations; and due to the strong link between projects a crumbling effect on the entire ecosystem. Most recently, YAM underwent such a collapse, but crypto markets went past the hurdle just as easily.

Do you think that the rate of growth of DeFi is supported by a robust system? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Is the Bitcoin Price Correction Really Over or Is This a Bear Market Trap?

- ‘Gambling Is Not Investing’: New Group Pushes Crackdown on Prediction Markets

- XRP News: Ripple Prime to Move Post-Trade Activity to XRPL via NSCC Link

- Fed Rate Cut at Risk: Janet Yellen Flags Inflation Concerns Amid US-Iran War

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs