Total Value Locked in Defi crosses $200 billion for the first time

Defi dominance has skyrocketed in 2021, with recent reports displaying a Total value locked in DeFi hitting an all-time high at $210.5 billion today, according to Defi Llama charts. This is exceptional growth, especially when compared to last year’s October 8 records displaying just $8.61 Billion Total Value Locked in Defi.

India leads the Defi growth chart

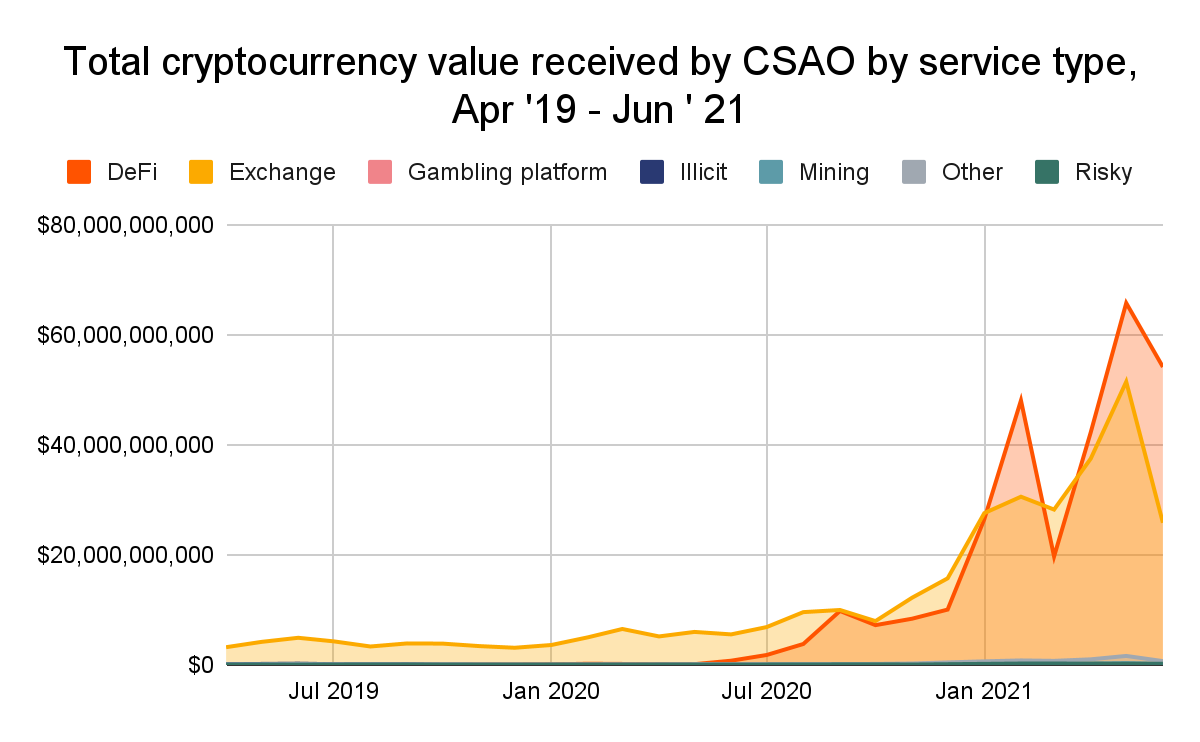

The latest virtual currency adoption report by blockchain-based analysis firm, Chainalysis also stated this surge of the Defi market in merely one year. The report noted that the Central and Southern Asia and Oceania (CSAO) region has seen the most cryptocurrency usage with Vietnam, India, and Pakistan topping the charts, according to the Global Crypto Adoption Index.

Furthermore, it elaborated that Defi activity has leaped through, as a share of all transaction volume dedicated to Defi activity hiked, beginning from May 2020, and further-reaching above 50% by February. This activity has primarily been driven by Uniswap, Instadapp, and dydx, with significant activity on Compound, Curve, AAVE, and 1inch as well. Additionally, India appears to be at the top of these Defi activities, amounting to 59 percent participation in the Defi industry.

“India has a much bigger share of activity taking place on Defi platforms at 59%, versus 47% for Vietnam and 33% for Pakistan.”, stated the Chainalysis report.

Defi Growth served with a side of Hacks

Defi has enjoyed this extraordinary growth but has also suffered as the Defi hack trend spread like wildfire in the community. Leading protocols continue to lose million as Defi attackers join the hacking trend. Defi platforms including, CREAM Finance, PolyNetwork,

Neko Network, the DEX protocol – NowSwap, pNetwork, and the latest hack of StakeSteak have borne the burn of multi-million dollar exploits. However, most of these protocols saw the hackers return the stolen amount soon after the exploit. Industry experts claim that these returns are coming in lieu of convenience, as laundering stolen crypto on such a scale, is a bigger task than stealing it.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs