Blackrock’s Ethereum ETF Pulls Single Largest Daily Inflow, But Lags Behind Bitcoin’s $3.63B Netflow

Highlights

- BlockRock's Ethereum ETF, ETHA, recorded its highest single-day inflow of $45M on May 20.

- Fidelity's FETH comes second, pushing the total ETH ETF inflows for the day to $63.8M.

- Bitcoin ETF still dominates with nearly 5x inflows driven by strong adoption.

The spot Ethereum ETF is pumped with the inflows on the institutional demand as they hit the single-day record of $64.8M on May 20. Earlier, as the stocks and crypto market struggled with Trump tariff news, these exchange-traded funds were also affected significantly, affecting investors’ sentiments and demand. However, ETH and Bitcoin ETF are now returning to momentum, as clear in the previous week’s records.

Ethereum ETF Records 3-Day Inflow Streak

According to the Farside Ethereum ETF inflows stats, the 9 ETFs cumulatively gained a total net inflow of $64.889M on May 20, which is among the largest single-day inflows recorded. Interestingly, this made the three 3-Day streak, as before this, they gained $13.7M and $22M on May 19 and May 16, 2025, revealing high institutional demand.

In yesterday’s milestone, the top contributor is BlackRock’s ETHA, which had its largest daily inflow of $45M. Fidelity’s FETH is next in line, receiving $19.8M, respectively. As a result, the total ETH ETF AUM is at $8.7B, and the cumulative Net inflow is $2.6B. Additionally, the Ethereum price surpassed $2.6k mark momentarily.

Although the milestone is significant, it is nowhere near the Bitcoin ETF’s normal inflow, let alone the peak.

Bitcoin Vs Ethereum ETF: Why Bitcoin is Dominating the Inflows?

Bitcoin and Ethereum are the biggest cryptocurrencies in the market and have been competing with each other ever since. The same competition is also persistent in the ETF inflows, and Bitcoin leads the race by multiple folds.

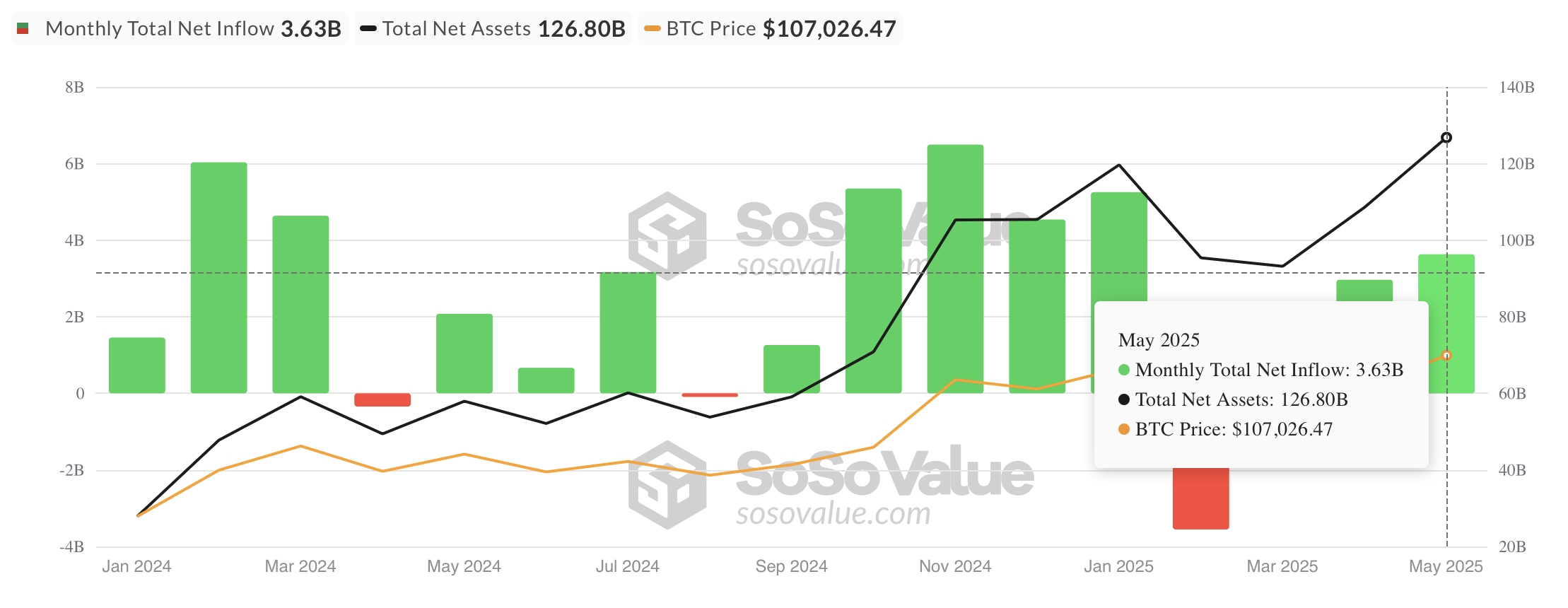

On the day the Ethereum ETF received its biggest single-day inflow, BTC hit $329M, almost 5x more. In this, BlackRock’s IBIT took the lead with $287 million in inflows. Some experts speculate that BlackRock will overtake Satoshi Nakamoto in terms of BTC holdings, as its netflow is of $3.63B.

Interestingly, there are many reasons behind this difference in inflows between the two. First, Bitcoin is seen as digital gold and has the first-ever digital asset spot ETF approval from the SEC. Its higher adoption and visibility, including the U.S. Strategic Bitcoin Reserve plans, give it the upper hand.

Additionally, its market size and liquidity are higher than ETH’s. Besides, institutional involvement, like MicroStrategy BTC buying, and other push investors towards this crypto and its exchange-traded fund, hence the high inflows.

Interestingly, this has been happening from day one and is likely to continue unless Ethereum witnesses significant updates and demands. The SEC decision on Bitwise’s ETH ETF with staking and other updates could influence the ETFs’ collective inflows.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What caused the recent surge in Ethereum ETF inflows?

2. What are the top Ethereum ETF contributors who record inflows?

3. How does the ETH ETF's performance compare to the Bitcoin ETFs?

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs