Ethereum Price Is Down—But Why Are Investors Still Choosing It?

Highlights

- Despite the Ethereum price crash, the whale data and ETF inflows show institutional demand.

- Experts believe investors see it as a safer long-term investment, resulting in its demand.

- Other altcoins are crashing, sending investors towards Ethereum.

The ongoing crypto market correction is also taking a toll on the Ethereum price. The token, which has surged to $4,891.7 in its prime, is trading at nearly half in the current scenario; however, despite that, the on-chain data reveals that investors are continuously investing in the token. Some even see it as the safe bet in the tumbling market. Let’s discuss.

Ethereum Price Crash But Investor Activity Skyrockets

With a 14% crash over the week, Ethereum price is currently at $2,243 with a market capitalization and trading volume of $270.82B and $24.87B. Not only that, its ATH target stands at 54% away from the current level, which it has failed to achieve in the last four years. However, despite that, on-chain activity reveals high whale accumulation and high Ethereum ETF inflows, showcasing its high demand.

On June 21 alone, the Ethereum whale bought over 116,893 ETH, which is equivalent to $26.21M today. The data has been high for weeks now as experts believe institutional buyers are buying the dip amid the broader crypto market crash.

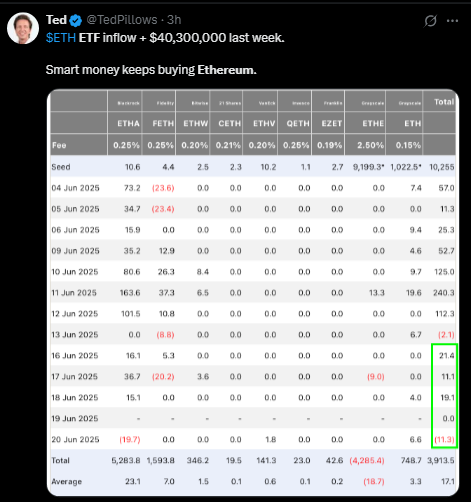

Additionally, the Ethereum ETF net flows have been on another level, even beating Bitcoin on many days, showcasing high investor activity. In the last week, the inflows surpassed the $40.3M mark.

Why Are Investors Bullish on Ethereum Despite Price Crash?

ETH is the second biggest cryptocurrency in the market, with a history of stability and reputation among investors. Due to the same, investors have been all in on the token to buy the dip and profit when the price recovers.

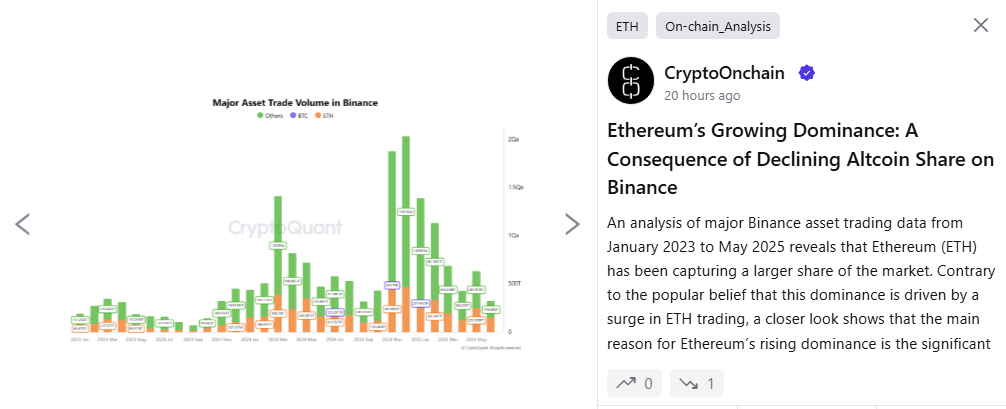

CryptoOnchain report notes that Ethereum’s (ETH) market share is rising on Binance trading data (Jan 2023 – May 2025). Moreover, despite the crypto market turbulence, its trading volume has remained relatively stable between 300T and 490T. Notably, Ethereum’s trading activity remained stable, while others’ crashed, signaling its increasing dominance in altcoins.

However, they noted that this increase in dominance is not due to growth in ETH; instead, it is because of the declining activity in the rest of the tokens. Overall, they conclude that the investors’ interest in the token is not related to its hype or price surge but to the trust it has built.

Besides, the long-term Ethereum price prediction is bullish, so the investors’ buying behavior and actions are based on that.

Frequently Asked Questions (FAQs)

1. Why is the Ethereum price down despite strong investor interest?

2. Why investors are still choosing Ethereum?

3. Will the Ethereum price recover next?

- U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again?

- Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates