Is Solana Outshining XRP in the Spot ETF Race? XRP Odds Crashes to 75%

Highlights

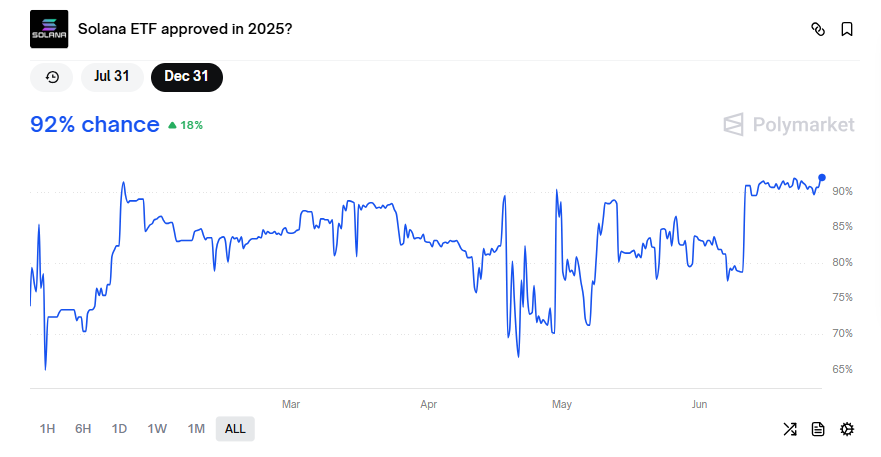

- XRP Spot ETF approval odds dropped to 75% while Solana’s surged to 92%.

- The ongoing legal uncertainty in the Ripple lawsuit affects investors' confidence in ETF approval.

- Despite XRP’s odds falling, experts' forsee bounce back once clarity on the lawsuit emerges.

The Solana and XRP Spot ETF are gaining popularity in the crypto market, with experts having high prediction odds for these two. However, as the SEC’s delays put a hold on these, investors’ confidence is declining, especially in the XRP ones. Currently, its odds have plummeted from above 90% to as low as 70%, whereas the odds of Solana are rising. Why? Let’s discuss.

XRP Spot ETF Odds Crash to 75% While Solana Hits 92%

The most prominent candidates for approval are the XRP and Solana spot ETF. Although many more crypto ETFs are also in line for approval, the Polymarket and expert odds suggest that these two have high chances. However, today, SOL is leading the race as the Polymarket odds for the Ripple token crashed to 75% before bouncing to 78%.

For the first time, the Ripple ETF approval odds on Polymarket have dropped below 80% since April, signaling building doubt among investors. At its prime, the odds were 98.2% at the beginning of the month, but it’s crashing now as the Ripple vs SEC lawsuit continues.

Notably, Ripple has dropped its cross-appeal against the SEC, but the case is far from over. Former SEC lawyer Marc Fagel argues that the case is still active unless the SEC formally votes to drop their appeal. With this update, the investors’ sentiments have been affected, crashing XRP spot approval odds.

Interestingly, the confidence in Solana spot ETF approval is rising amid this, currently at its ATH of 92%.

Why Solana Spot ETF Leading While XRP Crashes?

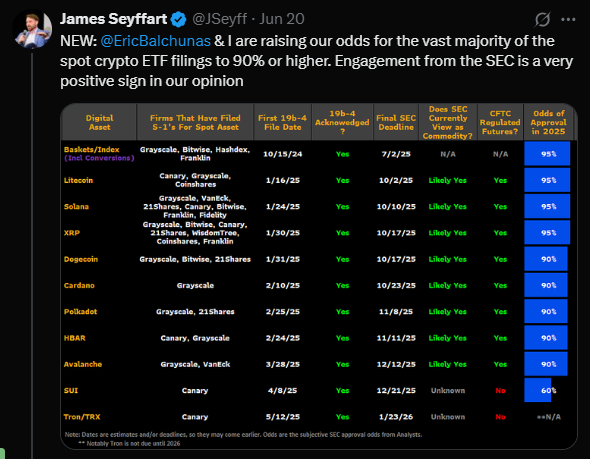

Solana is definitely ahead in the number of ETF filings, with a total of 9 issuers awaiting the SEC’s decision. The most recent application is from Invesco and Galaxy Digital, aiming to list it under the QSOL ticker.

Besides its gaining dominance due to strong institutional interest, favorable SEC engagement, and its technical advantage. Unlike XRP, SOL is free from any lawsuits and doubts over its commodity status. More importantly, it stands apart from other exchange-traded funds, as it offers 8% annual returns with staking-enabled functionality.

Not to mention, Solana blockchain speed, low fees, and upcoming hard fork make it highly scalable and efficient. As a result, investors are more drawn towards it.

Notably, the drop in XRP spot ETF approval odds is likely temporary as the lawsuit news affected investors. With better clarity on the situation, it may bounce back. Besides, Bloomberg analysts have kept their prediction at 95% chances at press time, so it’s still in the race.

In conclusion, Solana is dominating, but there’s still high uncertainty about who will get approval first.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What are the current approval odds for Solana and XRP ETFs?

2. Why are XRP spot ETF approval odds declining?

3. How many ETF filings does Solana have pending with the SEC?

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs