Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed

Highlights

- Morgan Stanley flips its Fed outlook for 2025 with two rate cuts forecasts, starting in September.

- Powell's Jackson Hole speech changed the rate cut odds, with investors betting 80-85% chances.

- Political pressure and labor market risk are increasing the odds of rate cuts, but there’s also uncertainty.

Morgan Stanley and many other organizations had a ‘no change’ outlook on the Fed’s interest rate decision. Even the Fed kept the interest rate unchanged for the fifth time in the July FOMC meeting, but different results are anticipated for the upcoming one, especially after this bank’s stance is changing.

Morgan Stanley Predicts a 25bps Rate Cut in September

Until recently, Morgan Stanley has kept its interest rate cut call to zero for 2025, as they expect the U.S. Fed to keep the interest rate unchanged until March 2026. However, that changed, with the bank forecasting two rate cuts within this year, starting as soon as September and another in December.

Notably, Reuters reported that the banks now expect a 25 bps rate cut in September, another in December. Additionally, they have predicted quarterly cuts through 2026. Morgan Stanley also noted that a 50 bps cut is only possible if the payroll data shows a major decline in jobs.

The Fed could also face internal issues if the cuts come too soon, so there’s a lot to consider. However, if the cuts happen, the rates could decrease to 2.75-3.00% by the end of 2026.

Why Morgan Stanley Changed Its September Rate Cut Call?

A major shift in the global prediction for the U.S. interest rate came with the Fed Chair Jerome Powell’s Jackson Hole speech. Even in that, Powell’s tone, as he highlighted growing risks in the labor market instead of emphasizing inflation, hinted at the possibility of an interest rate cut.

As a result, many changed their stance on the September rate cut, including Barclays, Deutsche Bank, and even Morgan Stanley. The bank highlights that Powell’s speech suggests that they may tend to protect jobs.

Another potential reason is the building political pressure on the Fed, especially as President Donald Trump plans to remove Fed Governor Lisa Cook. She is alleged to be involved in a mortgage fraud, and rest officials, including Fed Chair Jerome Powell, have been threatened with being fired on the job.

- Source: The Kobeissi Letter, Donald Trump vs Fed Feud

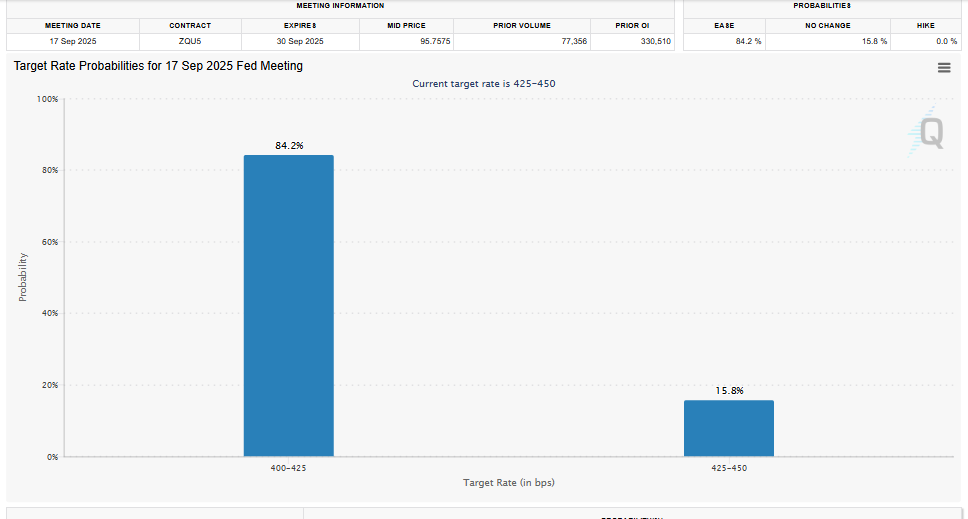

A shift in investors’ sentiments and bets on September cut also came after Powell’s speech. The CME FedWatch now shows an 84.2% chance of the cut, whereas Polymarket shows 83%. Out of which, 77% bets are for a 25 bps decrease.

- Source: CME FedWatch, September Interest Rate Cut Odds

Now, Morgan Stanley’s flipped outlook on the Fed is gaining attention as they have shifted from no rate cut to two in 2025. This analysis is based on market consensus and political pressure; however, uncertainty still looms. Notably, Bank of America still expects no cut this year, going against the majority.

Frequently Asked Questions (FAQs)

1. What was Morgan Stanley’s original outlook for 2025?

2. What’s Morgan Stanley’s new outlook?

3. Why are the odds of September rate cut increasing?

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?