The “Safe Asset” Illusion? Jean Tirole Warns Stablecoins Could Spark Crises

Highlights

- Nobel-Prize Prize-winning economist Jean Tirole warns that stablecoins could trigger a financial crisis.

- Tirole highlights risks associated with stablecoins tied to the low yield U.S. government bonds.

- He also questions the regulator's ability to act diligently due to a conflict of interest.

Stablecoins are grabbing worldwide attention, but the Nobel Prize-winning economist, Jean Tirole, sees hidden concerns as he unveils crisis warnings in a recent interview. Contrary to the beliefs that stablecoins are more stable than other digital assets, he foresees a major fumble if they lag in supervision.

Jean Tirole Warns Stablecoins Aren’t That Safe

As the adoption of the cryptocurrency industry skyrockets, the demand for stablecoins is continuously growing, especially as investors appreciate their pegging to traditional assets. However, the Nobel Prize winner Jean Tirole argues that there are risks.

In an interview with the Financial Times, Tirole warned investors that the insufficient supervision may end this safe asset illusion. He says that without supervision and investor demand, these assets could bring large-scale losses.

His concerns mainly targeted the oversight of stablecoins, where he fears that without proper supervision, a minor loss in the investors’ confidence could spark withdrawals, leading to the depeg. More importantly, he added that stablecoins could push the government into a multibillion-dollar bailout if these pegged tokens depegged.

“If it is held by retail or institutional depositors who thought it was a perfectly safe deposit, then the government will be under a lot of pressure to rescue the depositors so they don’t lose their money,” he said.

Stablecoins at Threat With US Government Bonds’ Low Yield

Jean Tirole, currently working as a professor at the Toulouse School of Economics, claims that the stablecoins pegged to U.S. government bonds could struggle since the underlying assets are becoming unpopular due to their low yields.

He gave a few examples, especially when the returns on these bonds were negative for years. More importantly, the payouts after inflation were even less, becoming a threat to stablecoins.

Notably, he also questioned whether regulators have adequate resources and incentives to act diligently. Tirole flagged that some members of the U.S. administration might have a conflict of interest, which could compromise the regulatory clarity.

Some regulatory members have already questioned Donald Trump’s conflict with his crypto project. One of the WLFI is getting launched on top exchanges today.

Stablecoins’ Explosive Growth Projections Add Urgency

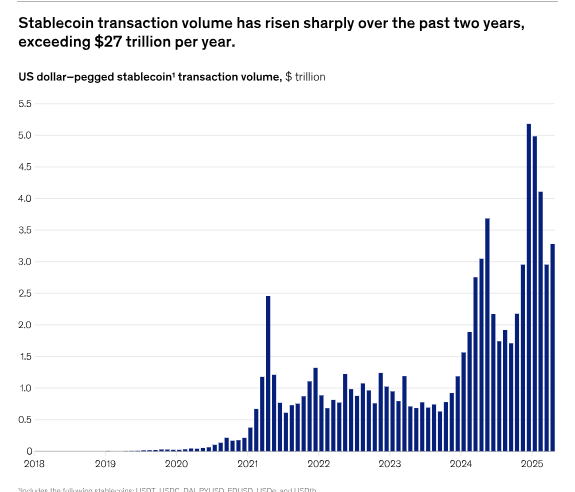

Notably, the stablecoin market is growing exponentially and is already worth $280 billion (market capitalization). Experts like Citi predicted at least $500 billion to $3.7 trillion for these cryptos by 2030.

- Source: McKinsey & Company

Adding to the enthusiasm, the U.S. Treasury estimates a $2 trillion market cap by 2028. In this, the passing of the GENIUS Act into law in the U.S. and the Stablecoin Ordinance issuers’ license in Hong Kong is adding to the optimism

Although it is bullish for crypto, the massive growth also concerns experts like Tirole due to lagging government oversight.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Who is Jean Tirole?

2. Why does Jean Tirole believe that stablecoins aren’t that safe?

3. How fast is the stablecoin market growing?

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs