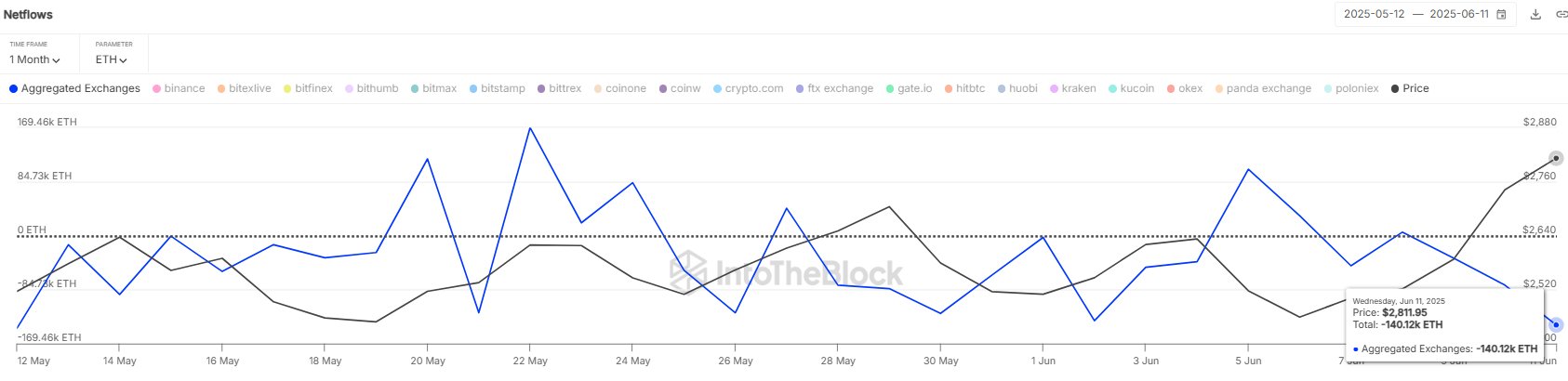

Why Did 140K Ethereum Leave Exchanges in One Day?

Highlights

- 140k Ethereum were withdrawn from exchanges in 24 hours, signaling investor confidence.

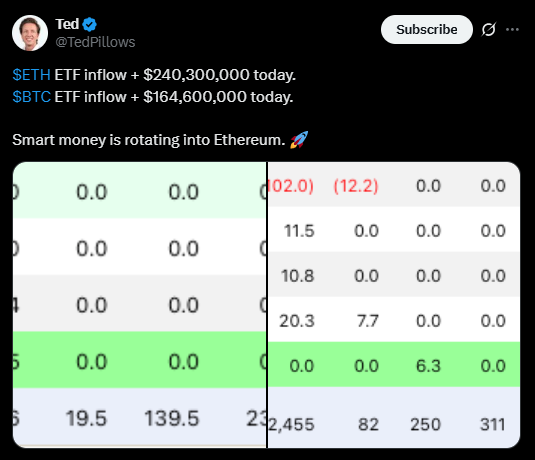

- Ethereum ETFs also saw the highest inflows on June 11, totaling $240.7M, and ETH whale activity is high, signaling strong demand.

- Despite demand, the Ethereum price has crashed and could descend further if key support breaks.

Ethereum has faced massive outflows in the last few days, with 140K tokens leaving the exchanges alone in 24 hours. These millions worth of tokens were withdrawn from the exchanges on June 11, marking the largest single-day inflow of the ETH token in nearly a month. However, these are not associated with the price rally, but rather a correction. Let’s discuss the details.

Ethereum Price Crash, But 140K ETH Withdrawal Hint Otherwise

The Ethereum price is struggling amidst the crypto market volatility fueled by the US CPI data release and Claims and PPI data. As the macroeconomic events affect the investors’ trading activities, ETH is declining on charts, currently trading at $2,719.39, with a market capitalization of $328.31B.

Despite the dip, the investors’ confidence in the top altcoin continues to build as 140k ETH tokens, equivalent to $393M, have left exchanges. The number of ETH outflows is higher for the 48-hour interval. Not only that, its Future Open Interest also rose, $40.72B at press time, adding to investors’ demand.

This withdrawal represents investors’ strong confidence in the digital asset, as they moved their tokens from crypto platforms to self-wallets, signaling holding sentiments. With inflow data and other factors, it is certain that the token’s price is moving differently from investor interest.

Ethereum ETF Inflows’ New High, Whale Buying & More

The on-chain reports highlight that the whale activity for the altcoin is significantly high. Even the Bitrue hacker has spent $8.3M to buy 2,999 ETH tokens. In addition, the ETFs are witnessing high inflows, $240.7M on Wednesday alone, marking the highest ETH ETF inflows since February.

Interestingly, the net flows have been positive for 18 consecutive days and even outpace BTC ones. This growing momentum clearly hints at investors’ rising confidence in this asset, which could cater to Ethereum price recovery once the momentum builds.

However, the possibility of further sell-off is higher for the short term. Crypto analyst Muthoni adds that the MVRV indicator is flashing sell signals, as the short-term holders are now sitting on unrealized gains, creating the possibility of profit taking. As a result, the traders may sell their holdings, putting downward pressure on the token’s price.

If ETH price fails to hold $2,410 support, it may crash further to $2,000 unless strong catalysts reverse the trend.

Frequently Asked Questions (FAQs)

1. Why did 140k Ethereum leave exchanges?

2. How are Ethereum ETFs performing amid the price drop?

3. What is the key support level to watch?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?