Why Is the Crypto Market Declining Today?

Despite many uncertainties, the crypto market was performing well, actually bullishly, until today. The market gained stability after a recovery period last month and the results of US employment data. The US government added 272,000 jobs in May, a much higher number than any expectations and predictions. However, the ongoing political shifts and other causes led to market declining conditions. In this blog, let us discuss why the crypto market is declining today and the possible reasons behind this.

Overall Crypto Market Conditions

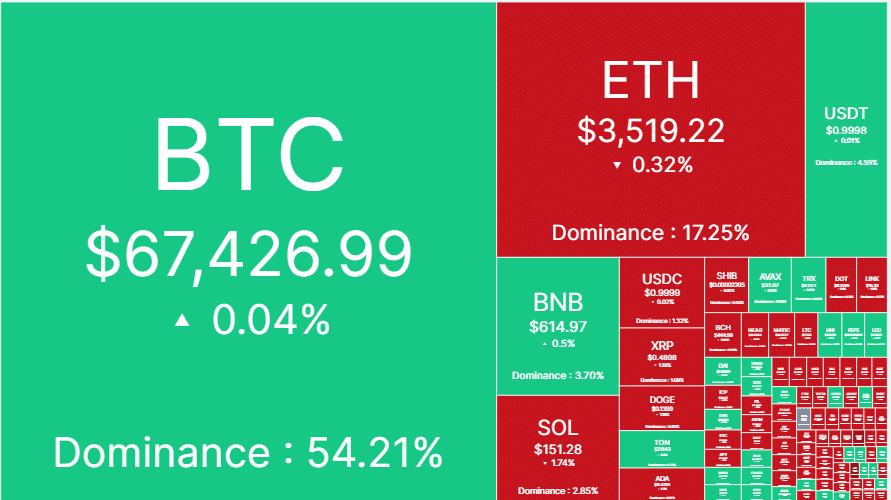

As per the fear and greed index, the sentiments have shifted from greed to neutral today, followed by days of decline in global market capitalization. The market cap is now at $2.45 Trillion after a big drop in the prices of individual cryptocurrencies. Almost every other cryptocurrency is following a downtrend today, and the crypto market heatmap is in red.

On analyzing the categories individually, the market has somewhat improved for meme coins market cap has regained some strength from yesterday’s 3.38% decline, whereas the Solana networks market cap is still in a decline of 1.88%. More importantly, the biggest decline was in the Gaming cryptos, where a 5.5% drop is noticeable, followed by AI tokens with 3.16%.

Top Reasons Why Crypto Market Declined Today

The biggest impact on the crypto market must have come from the EU Parliament election results. These results have influenced the sentiments of crypto users regarding the upcoming regulations and discussions in this industry. Additionally, the economic factors became another factor when the European Central Bank introduced the 25 basis points rate cut, which is good news, but economic growth might impact cryptocurrencies. Now, as the US FED meeting is in session, it is also disturbing the investor’s sentiments as three inflation rate cuts are supposed to happen this year.

Furthermore, the Indian election results have impacted the performance of the Indian stock market, whose effect is also considerable on the crypto market. With the predictable yet not fully satisfactory results, the investors are spooked, causing consolidation periods for both markets.

Lastly, the Bitcoin charts earlier exhibited the presence of the bear flag pattern, resulting in the price drop. Bitcoin has a major impact on the crypto market’s performance because of its dominance. The Bitcoin dominace has crossed the 54% mark, currently at 54.2% which is quite high. With the BTC price dropping to $67,452, the rest of the cryptos have declined as well. However, analysts don’t expect a continuous fall in Bitcoin price, which is good. But any further decline can bring the market even down as the Ethereum price is already struggling, and another major drop is not favorable for investors.

Continue Reading 10 Top Cryptos Which Outperformed Bitcoin This Year

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs