Tron Eye The Multi-Million Dollar DeFi Industry With a New App, DJED; Justin Sun Challenges MakerDAO

Decentralized Finance (DeFi) is coming to Tron, a smart contracting platform similar to Ethereum but scalable and secure. Justin sun, the co-founder of Tron, took to Twitter to announce the new lending app called DJED.

DJED may bear some similarities with MakerDAO, critics allege, but like all open source projects, growth is inevitable.

Something new. #DJED #TRON #TRX $TRX pic.twitter.com/k0rbDtjT0Y

— Justin Sun (@justinsuntron) March 28, 2020

DeFi is concentrated on Ethereum

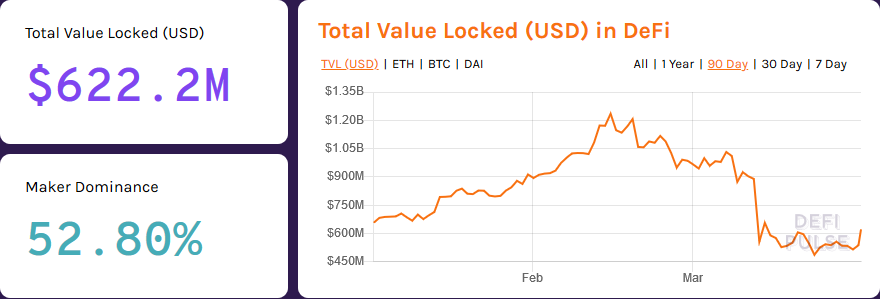

DeFi is a multi-billion industry. At the time of going to press, $622 million were locked in different DeFi applications, most of which are concentrated in Ethereum.

Different reports reveal that DeFi applications are the main attraction in Ethereum.

Supplementing findings by DappRadar also show that newbies drawn to Ethereum in 2019 were attracted with DeFi.

Dominance of MakerDAO

Still, MakerDAO is dominant, and most lending activities is concentrated on the platform despite technical hitches that resulted in an $8 million loss. Although MakerDAO minted extra tokens and auctioned them to compensate victims of the exploit, the underlying problem wasn’t fixed.

Ethereum remains slow and grapples with scalability problems.

When ETH sunk by 47% on Mar 12, the network screeched to a halt, and the smart contract controlling collateral auction couldn’t function as designed, a costly lapse that exposed Ethereum’s and MakerDAO’s underbelly.

Tron and DJED

DJED is based on Tron.

Tron is scalable, with a high throughput.

Although there are concerns about Super Representatives, critics say it introduces centralization, it is a choice availed by dPoS systems, there is nonetheless speed and the Tron network is under-utilized judging by the current TPS.

DJED, which in ancient Egypt means stability, will operate just as MakerDAO. With a Collateralized Debt Positions (CDP), borrowers will need to hand over TRX, not BTT, as collateral to access loans. A stable coin, USDJ, will be issued out to borrowers. A stability fee determined through an executive vote by the DJED risk team will also be paid.

“DJED is a new DeFi project developed by the TRON community. They’ve learned a lot from all open source DeFi projects & TRON is open to collaborating w/ all of them.”

#DJED is a new Defi project developed by TRON community. They’ve learned a lot from all open source Defi projects & TRON is open to collaborating w/ all of them. I want to give @MakerDAO a shoutout because it is the best amongst all! #USDJ #JED

— Justin Sun (@justinsuntron) March 31, 2020

JED will be the governance token based on Tron.

Holders will take part in voting and determine the rate of the stability fee and other changes that may be made on the protocol.

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- BlackRock Signals $257M Bitcoin and Ethereum Sell-Off Ahead of Partial U.S. Government Shutdown

- XRP News: Jane Street Emerges Among Key Institutions Driving XRP ETF Inflows

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15