Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

Highlights

- The January U.S. CPI inflation data came in at 2.4%, below expectations of 2.5%.

- Core CPI came in at 2.5%, in line with expectations.

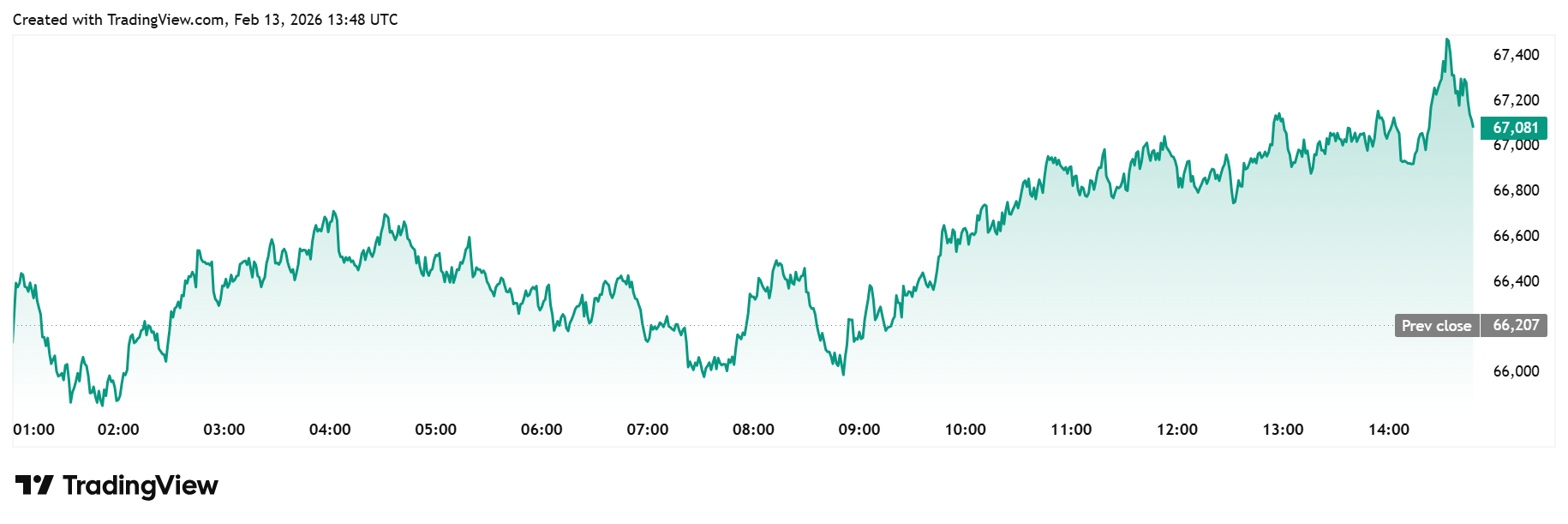

- Bitcoin sharply climbed above $67,000 on the back of the inflation release.

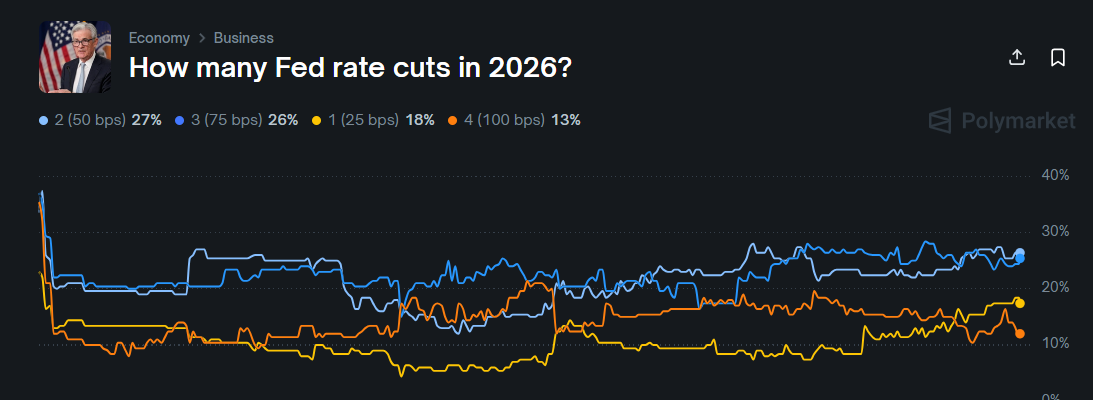

The U.S. CPI inflation has come in cooler than expectations, providing a bullish outlook for the crypto market, with Bitcoin rising amid this data release. Notably, crypto traders have again increased their bets on Fed rate cuts for this year following this macro data.

CPI Inflation Comes In At 2.4%, Bitcoin Climbs

Bureau of Labor Statistics data show that the CPI rose 2.4% year over year (YoY) in January, below expectations of 2.5%. Notably, this marks its lowest level in over four years, signaling that inflation may be trending towards the Fed’s 2% target.

Meanwhile, the CPI inflation data came in at 0.2% month-over-month (MoM), below expectations of 0.3%. Furthermore, Core CPI came in at 2.5% YoY, in line with expectations, and the lowest level since 2021, while it rose to 0.3%, also in line with expectations.

The January data aligns with Wall Street’s prediction of a soft inflation reading, lower than the figures recorded in December. Bitcoin climbed on the back of this data release, rising to as high as $67,500. TradingView data shows that the leading crypto is now trading at around $67,000, up over 1% on the day.

The CPI inflation reading is a positive for the BTC price and the broader crypto market, as it strengthens the case for additional Fed rate cuts. Moreover, it comes at a time when some Fed officials, including Fed Presidents Beth Hammack and Lorie Logan, are signaling their support for a pause in more cuts over concerns that inflation is rising.

Furthermore, the CPI release follows the strong U.S. jobs report earlier this week, which reduced expectations for the number of rate cuts this year, as it suggested the labor market is rebounding. However, with this soft CPI inflation reading, crypto traders are increasing their bets on the number of rate cuts that the Fed could make this year.

Odds Of Three Fed Rate Cuts Rise Again

Polymarket data show the odds of three Fed rate cuts this year have climbed again to 26%, up from 24%. CoinGape reported earlier this week that crypto traders had reduced their bets on the number of cuts this year, favoring two cuts over three.

As market commentator The Milk Road also noted, following the CPI inflation release, traders are now also pricing in the possibility of a cut in April, with there being a 30% chance of that happening. This is significant because these traders weren’t expecting any cut until June, when a new Fed chair will take office.

The Milk Road noted that if inflation continues to trend lower, then a rate cut could happen before June. They added that the CPI is also timely as it helps stabilize sentiment after yesterday’s sharp market sell-off, with investors needing a calming point.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs