U.S. Treasury To Ease Tax Rule on Unrealized Bitcoin Gains, Aiding Saylor’s Strategy

Highlights

- The U.S. Treasury and IRS issued an interim guidance on plans to revise the CAMT rule.

- Strategy has already filed with the SEC that it doesn't expect to pay tax on its unrealized BTC gains under the new guidance.

- Senator Cynthia Lummis commended the new tax guidance.

The U.S. Treasury and IRS have released an interim guidance, which highlights plans to ease the Corporate Alternative Minimum Tax (CAMT) rule that mandated tax on unrealized Bitcoin gains. With this new guidance on the Treasury CAMT rule, companies like Strategy no longer expect to be subject to the rule due to its unrealized gains on its BTC holdings.

Details About The Interim Guidance On The Treasury CAMT Rule

In a release, the Treasury Department and IRS announced plans to withdraw the CAMT partially proposed regulations and issue revised proposed regulations. Under the earlier proposed regulations, companies like Strategy would have had to pay tax on their unrealized Bitcoin gains. The rule would have applied to Strategy from next year.

The Treasury CAMT rule proposes a 15% minimum tax on large corporations’ financial statement income. Meanwhile, due to the Financial Accounting Standards Board (FASB) rules, companies like Strategy had to record their BTC holdings at the mark-to-market price, which would have meant that they had to pay tax based on the BTC’s current value, rather than the amount they had paid for it.

However, the interim guidance clarifies that these corporations may disregard unrealized gains and losses on crypto holdings when computing their adjusted financial statement income (AFSI) for determining if they are subject to the 15% CAMT.

Strategy and top crypto exchange Coinbase were among the industry leaders that had pushed back against the CAMT proposed regulations, urging the Treasury to exclude crypto gains, noting that this tax rule was unfair, as it didn’t apply to traditional assets.

Pro-crypto Senator Cynthia Lummis had also advocated against this Treasury CAMT rule, notably introducing a tax bill that aims to eliminate double taxation and promote innovation. Following the release of this latest guidance from the Treasury and IRS, Lummis remarked that the Trump administration just delivered for American innovation.

She noted that the interim guidance addresses the CAMT issue that threatened unrealized gains on Bitcoin. The senator added that this leadership clears the way for the U.S. to become the world’s BTC superpower.

The Trump administration’s Treasury just delivered for American innovation—fixing the CAMT problem that threatened unrealized gains on Bitcoin.

This leadership clears the way for the U.S. to become the world’s #Bitcoin superpower. 🇺🇸

Thank you @USTreasury & @realDonaldTrump.

— Senator Cynthia Lummis (@SenLummis) September 30, 2025

Strategy Expects To Be Exempt From The Rule Under New Guidance

In an SEC filing, Michael Saylor’s Strategy stated that, in line with the interim guidance on the Treasury CAMT rule, it plans to exclude its unrealized gains and losses from the calculation of its AFSI for purposes of determining whether it is subject to CAMT.

Based on this, the company no longer expects to become subject to CAMT due to unrealized gains on its Bitcoin holdings. Strategy currently holds 640,031 BTC, which it acquired for $47.35 billion. These holdings are worth around $74 billion at the current BTC price.

The company had registered an unrealized gain of $14 billion on its Bitcoin holdings in the second quarter of this year. This led it to disclose back then that it would become subject to the Treasury CAMT rule in tax years beginning in 2026.

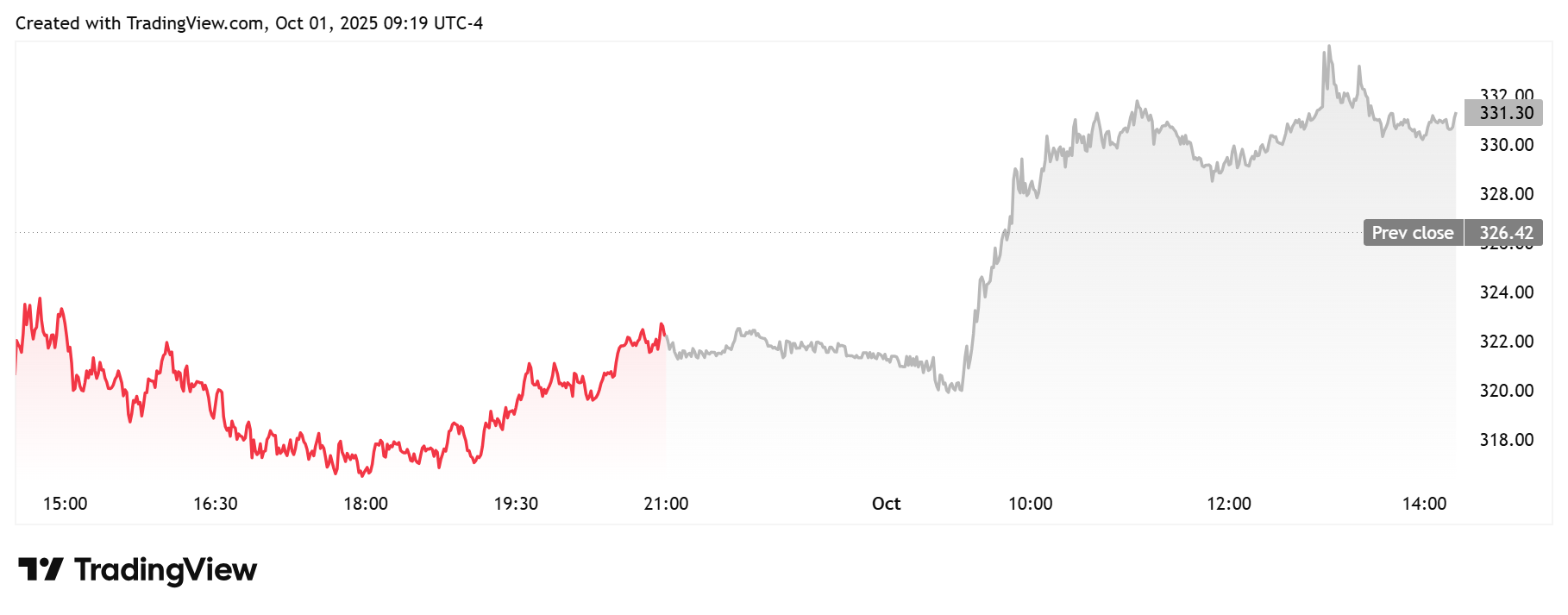

The Strategy stock is up almost 3% today following the new tax guidance. TradingView data shows that the stock is currently trading at around $331, up from yesterday’s close of $322.

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown