UniSwap Technical Analysis: UNI Soars 14% But Is The Trend Sustainable?

- UniSwap bounces off support at $2.4, bringing hope to investors that recovery is imminent.

- UNI/USD hit a barrier at $3.4, throwing bulls out of balance but the RSI suggests that the uptrend could continue.

UniSwap dropped significantly following its launch in September. The cryptocurrency found it difficult to sustain the uptrend amid decreasing volume and liquidity. Questions also came up whether UniSwap, the decentralized exchange, and liquidity provider platform in the decentralized finance (DeFi) ecosystem released UNI to distance itself from the then embattled Sushi (SUSHI) token.

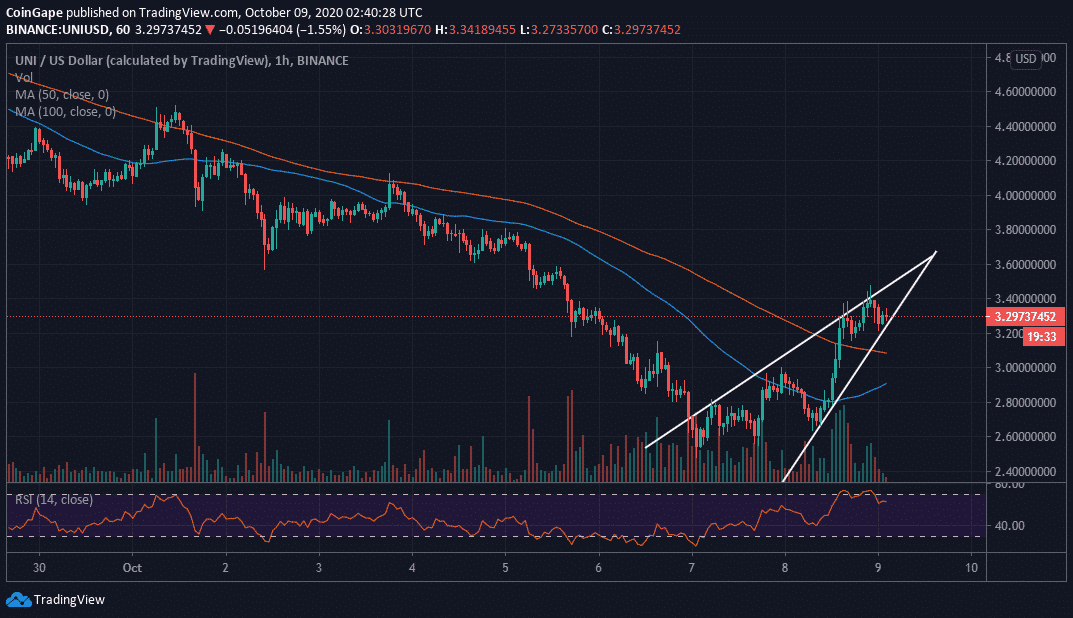

Formidable support was recently established above $2.4, allowing buyers to regain control of the price. UNI/USD embarked on a recovery journey. The 4-hour chart shows remarkable price action from the support. UNI has climbed above the 50 Simple Moving Average (SMA) and the 100 SMA.

On the upside, resistance at $3.4 has been tested but little action has taken place beyond that. UNI/USD is dancing at $3.3 amid a developing bullish momentum. The Relative Strength Index shows that buyers are not about to give up on their mission to return UNI to its glory.

UNI/USD 4-hour chart

It is essential that short term resistance at $3.4 is brought down to allow bulls to shift their focus on higher levels at $4 and $5, respectively. The volume appears to be building as UNI closes in on the initial resistance. If the 50 SMA crosses above the 100 SMA, it will cement the bulls’ position and influence in the market, thereby encouraging more buying entries.

It is worth mentioning that the formation of a rising wedge pattern could sabotage the bullish narrative and set UNI on a reversal. Support is envisaged at $3.2, the moving averages, $2.6, and the crucial $2.4.

UniSwap Intraday Levels

Spot rate: $3.31

Relative change: -0.03

Percentage change: -1.4%

Trend: Bullish

Volatility: Expanding

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- $40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k

- ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch