DeFi News: Uniswap [UNI] Liquidity Pool Crosses $2B, UNI Price Gains 25% in Last 24 Hrs

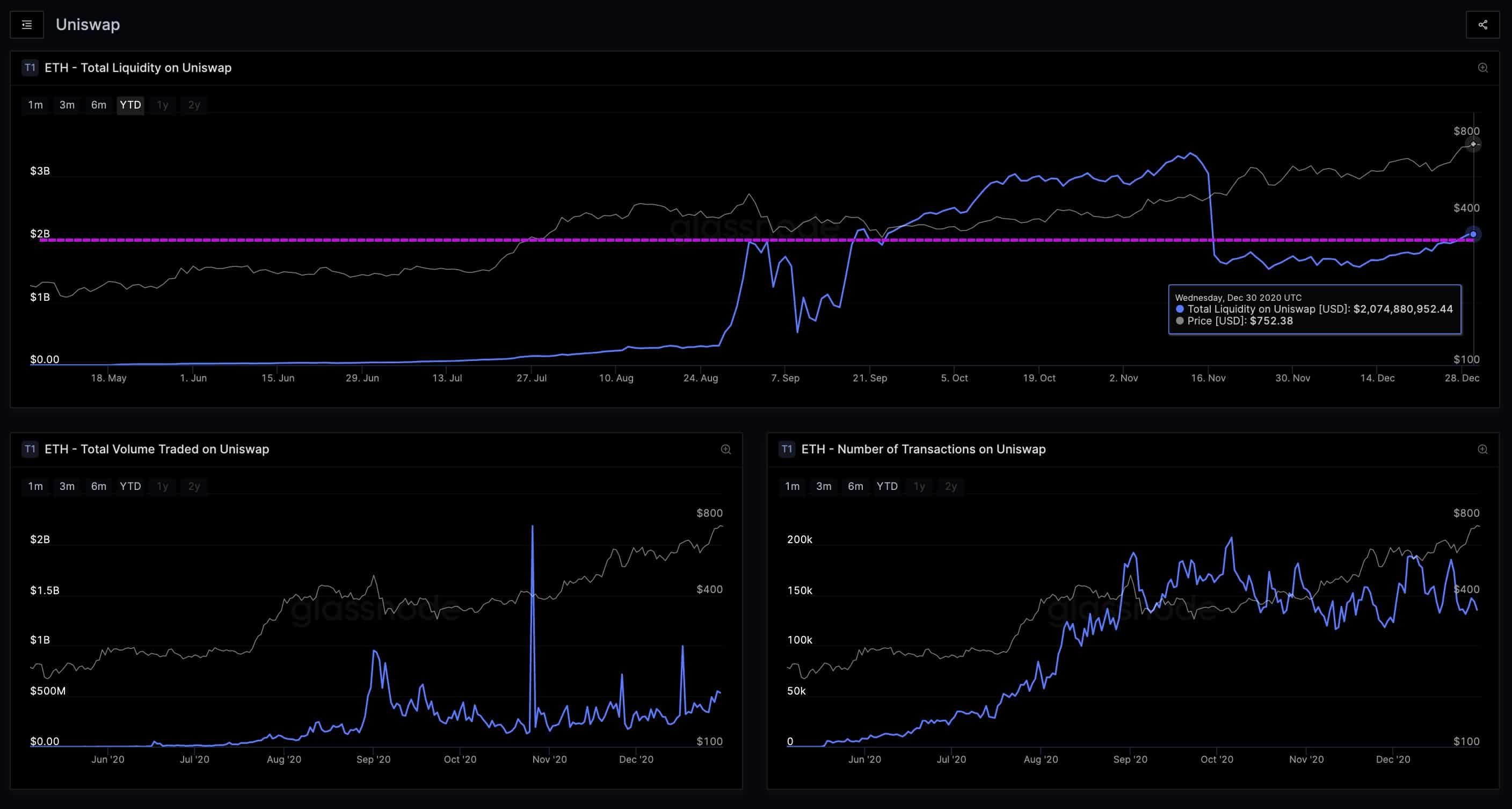

Unsiwap, a popular DEX protocol finally saw its liquidity pool cross $2 billion while the UNI price soared by 25% in last 24hrs. Uniswap market cap crossed $2 Billion for the first time after the termination of the popular UNI farming program in November this year. UNI Farming program rewarded traders for providing liquidity to the Uniswap pools, however, the prevalent yield farming had a limited life span which ended in November leading to a 45% plunge in the liquidity of the DEX platform.

Decentralized Finance (Defi) is one of the most popular use cases to emerge out of the cryptocurrency space. Defi protocols and tokens really brought the idea of passive income to the mainstream where traders offered liquidity to various DEXs and returns were rewarded with the token.

The liquidity of Uniswap DEX peaked just prior to the end of UNI Farming rewards at about $3.31 billion, however, the recent rise in liquidity could also be attributed to the rising ETH price. The second-largest cryptocurrency by market cap has given better returns than Bitcoin and currently trading at $747 after breaking the key resistance of $700 after more than 2 years.

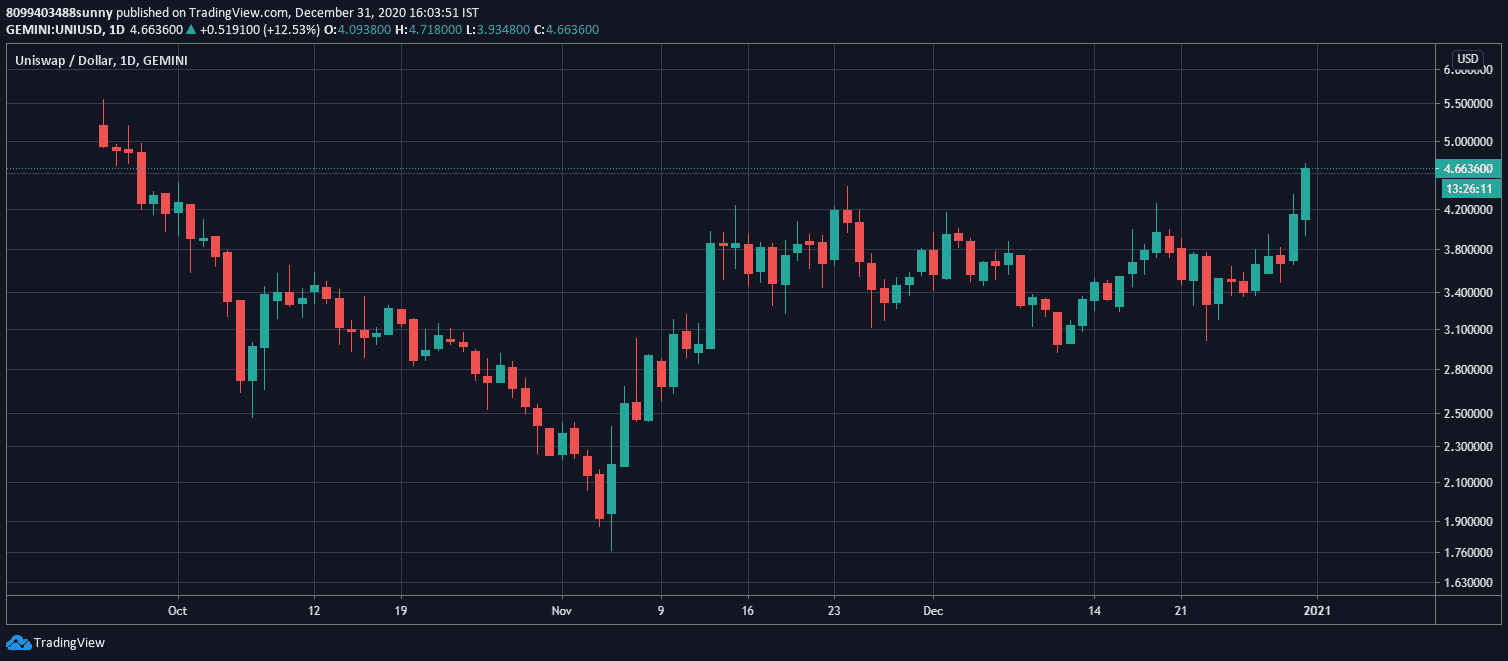

UNI Price Rallies More Than 25%

The UNI price also rallied by 25% over the past 24 hours rising to a daily high of $4.69. The UNI price has risen more than 40% over the past week primarily because of the rising liquidity and ETH price rally.

UNI token is currently ranked third among the defi tokens with over $926 million trading volume. Uniswap’s market dominance might have depreciated post-termination of its liquidity reward program, however, at the peak of its popularity, it was generating more volume than many centralized exchanges combined.

Defi continues to expand its reach and market cap in 2020 and as its popularity soared so did the number of scams and exploits the most recent being the COVER protocol exploit. Defi ecosystem is new but has great potential as it looks to go mainstream in 2021 with several use cases in digital banking systems and Forex traders.

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15