VanEck Bitcoin ETF Surpasses $200M Investment Amid Fee Waivers

Highlights

- VanEck's Bitcoin ETF surpasses the $200 million investment mark amid fee waivers until March 2025.

- Intense competition among ETF issuers drives strategies like fee waivers and reductions.

- BlackRock Inc. and Fidelity Investments emerge as formidable contenders in the crypto ETF space.

The VanEck Bitcoin exchange-traded fund (ETF) has witnessed a surge in investments, surpassing $200 million, following the decision to waive fees for the first $1.5 billion in assets until March next year. This move comes amid intensifying competition in the crypto ETF space, driven by soaring investor demand for Bitcoin exposure.

Meanwhile, with the recent surge in Bitcoin price which sends its price to a new all-time high, the race among ETF issuers to attract investors has escalated.

VanEck Bitcoin ETF Notes $200M Inflow Amid Competitive Landscape

VanEck’s Spot Bitcoin ETF has garnered significant attention from investors, with inflows exceeding $200 million in just two days, propelled by fee waivers until March 2025. Since its launch in January, the VanEck Bitcoin Trust (HODL) has experienced robust growth, managing approximately $516 million in assets, as reported by Bloomberg.

Meanwhile, the robust inflow follows the recent fee reduction, from 0.20% to 0%, further bolstering investor confidence and resulting in a net inflow of $333 million, particularly notable over the past two days. This development underscores the increasing appetite for Bitcoin exposure among institutional and retail investors alike.

It’s worth noting that the market participants are keeping a close watch on the U.S. Spot Bitcoin ETF, amid robust inflow into the investment instruments. Besides, the significant inflow also reflects the growing confidence of the Wall Street players towards the crypto, which has also contributed to the recent rally in Bitcoin price.

Also Read: ETH Price Set for $5000 After Ethereum Dencun Upgrade- Derivatives Data

Intensified Competition In The Market

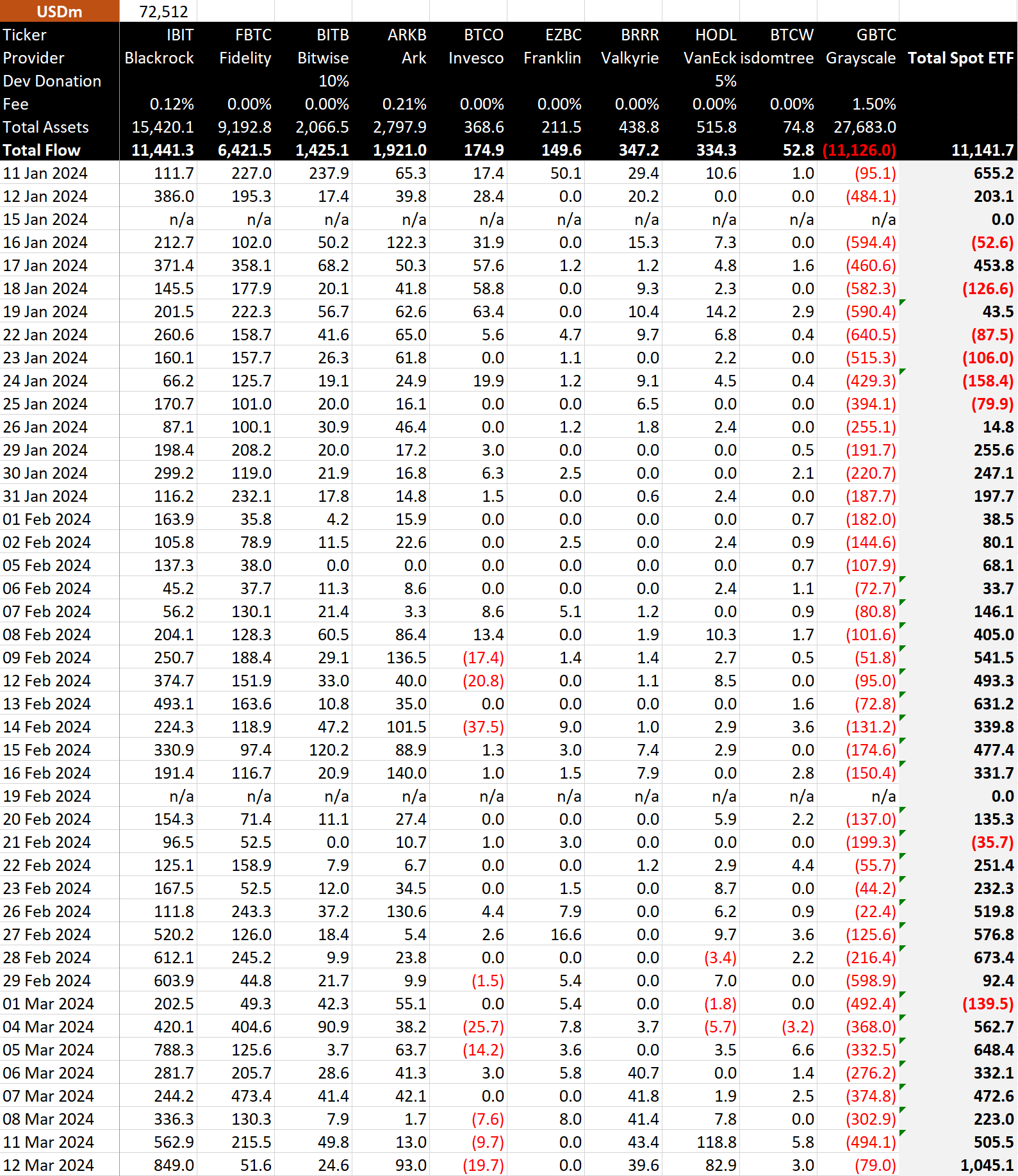

The competition in the crypto ETF arena intensifies as issuers vie for investor attention. Notably, BlackRock Inc. and Fidelity Investments have emerged as formidable contenders, attracting net inflows of $11.4 billion and $6.4 billion, respectively.

To stay competitive in the space, various other ETF issuers like VanEck, which includes Bitwise and Invesco Ltd., have opted for temporary fee waivers or reductions. On the other hand, Grayscale Investments LLC, facing pressure from low-cost rivals, recently launched the Grayscale Bitcoin Mini Trust, following substantial outflows from its existing Bitcoin Trust.

Despite charging the market’s highest fee of 1.5%, the Grayscale Bitcoin Trust has experienced significant net outflows, amounting to over $11 billion since January 11. However, recent data indicates a decline in outflows, signaling potential stabilization for Grayscale’s offerings amid the evolving landscape of crypto ETFs.

Meanwhile, the fee wavering of VanEck seems to have fuelled confidence among the investors, as seen by the robust inflow following the strategic move.

Notably, as of writing, the Bitcoin price was up 2.02% to $73,298.80, with its one-day trading volume soaring 18% to $64.16 billion. The flagship crypto has touched a high of $73,637.47 in the last 24 hours, suggesting the strong confidence of the investors towards the crypto.

Also Read: Bitcoin Price- Smart Whale Nabs Colossal Profits As BTC Tops $73K

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- Ripple CEO Hints Crypto Bill Is Near Deal, Sets April as Approval Timeline

- Wall Street Giant Signals XRP Price ‘Long Winter’ After Cutting Target By 65%

- Shark Tank Kevin O’Leary Warns Bitcoin Crash as Quantum Computing Threats Turns Institutions Cautious

- Japan’s SBI Clears XRP Rumors, Says $4B Stake Is in Ripple Labs Not Tokens

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling