VanEck Files for Ethereum Strategy ETF Tracking ETH Futures, Key On-chain Metrics

Global asset management giant VanEck is smart at diversifying its bets! After filing for a Bitcoin strategy ETF last week, VanEck has now applied for an Ethereum Strategy ETF that will track ETH Futures. The financial giant submitted its filing to the U.S. Securities and Exchange Commission (SEC) on Wednesday, August 18. The SEC filing notes:

The Fund is an actively managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective by investing, under normal circumstances, in Ether (“ETH”) futures contracts (“ETH Futures”), as well as pooled investment vehicles and exchange-traded products that provide exposure to ETH (together with ETH Futures, “ETH Investments”). The Fund does not invest in ETH or other digital assets directly”.

The world’s second-largest cryptocurrency Ether (ETH) has had a solid run over the last two weeks. Besides, despite the current selling pressure, it is strongly holding its support of $3000.

On-Chian Metrice suggesting Bullish Momentum Ahead

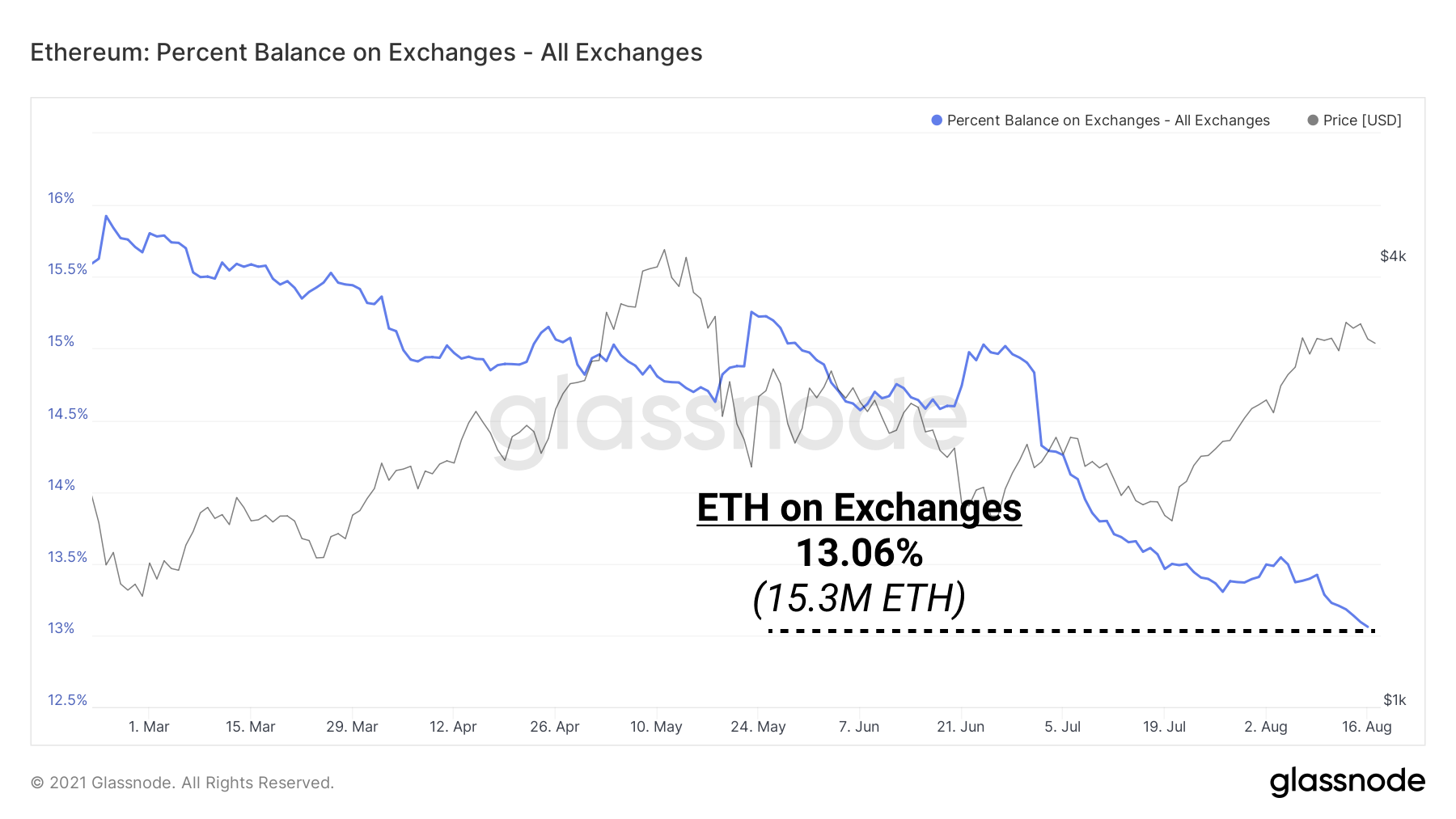

The total number of ETH available on the exchanges has touched an all-time low. On the other side, the total number of ETH staked with Ethereum 2.0 has touched new highs.

On the side of network growth, the daily active addresses have been holding their ground with no significant upside nor downside. Furthermore, on-chain data provider Santiment writes:

“Interestingly, we are seeing the lack of new participants while prices are going up, which isn’t exactly a healthy action. That said, could it be that this rally was driven by institutions, while the retail folks remain in “disbelief”?

As of data, over 230K addresses have purchased ETH in the price range between $2,970 and $3,080. Any drop below it might encourage more investors to book profit.

The IOMAP shows that #Ethereum holds above stable support. Over 230K addresses had previously purchased 7.33M $ETH between $2,970 and $3,080.

Any downswing below this price range could encourage investors to book profits quickly before their investments go "Out of the Money." pic.twitter.com/gGC0qNLXpS

— Ali Martinez (@ali_charts) August 18, 2021

At press time ETH is down 1.50% and trading at $2986 levels. It means it is dangerously close to downside support. Hopefully, ETH manages to sustain these levels and resumes its northward journey soon.

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- Dalio’s Warning on World Order Sparks Fresh Bullish Outlook for Crypto Market

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value