VanEck Registers Lido Staked Ethereum Trust in Delaware, LDO Up 7%

Highlights

- VanEck is incorporating the Lido staked Ethereum Trust in Delaware.

- According to the filing, VanEck intends to include this staking ETF to its crypto portfolio.

- The Lido DAO token is also rising in price, gaining 7% in the last day.

VanEck has formally registered its VanEck Lido Staked Ethereum ETF in Delaware. If approved, this would expand its crypto exchange-traded funds (ETF). Anticipation of greater adoption by investors reflected in the LDO price rising above 7%.

VanEck Registers Lido Staked Ethereum ETF with Delaware Trust Filing

Based on the official document, it is registered as a statutory trust, with the agent being CSC Delaware Trust Company. The move is a significant step towards offering staked Ethereum products to all categories of investors.

The first step for most ETFs is usually a filing in the state of Delaware before approval is sought from the U.S. Securities and Exchange Commission (SEC). The registration does not guarantee an approval. However, it indicates VanEck is interested in providing additional crypto products.

The launch of the first Ethereum staking ETF has already shown how demand for such products can accelerate investor interest in ETH.

The firm already manages spot Bitcoin and Ethereum ETFs, which have seen notable inflows since their approval. By tying the new product to Lido’s staked Ethereum, VanEck is aiming to capture growing investor demand for yield-generating digital assets.

VanEck Eyes Edge in Growing Staked Ethereum Market

Staked Ethereum represents tokens locked on the Ethereum network to secure transactions. Currently, the best platform for this purpose is Lido because it provides liquidity to the user. If not, their assets would have been locked.

Investors can continue to receive staking rewards through liquid staking and also trade Ethereum. Integrating this model into an ETF structure allow large investors to receive staking returns without needing to understand blockchain specifics.

Institutional adoption of crypto products is accelerating after the launch of spot Ethereum ETFs. The filing may be a part of VanEck’s strategy to remain ahead of competitors like BlackRock and Fidelity, who might also explore staking-related investment vehicles.

Lido Token Jumps as VanEck Filing Sparks Optimism

Delaware has become the main jurisdiction for registering new funds because of its favorable trust laws. Most statutory trusts begin here before advancing toward SEC evaluation. The SEC recently granted generic listing approval for Grayscale Ethereum ETFs, showing how quickly the regulatory landscape for such products is evolving.

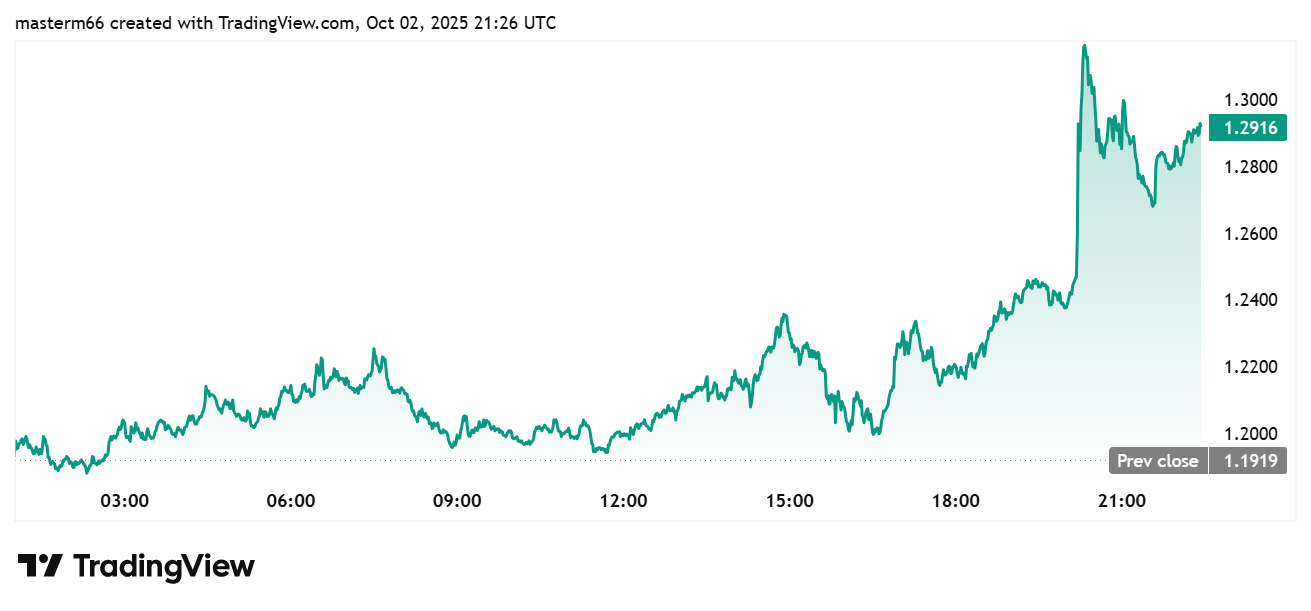

The listing of CSC Delaware Trust Company as the registered agent follows a common structure for large asset managers. The news had an effect on the price of Lido DAO (LDO) token. According to TradingView, LDO went up by 16.25% over the past week and 53.78% over the past six months.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs