Whales Dump As Bitcoin Price Breaks Below Short-Term Average Realized Price

Highlights

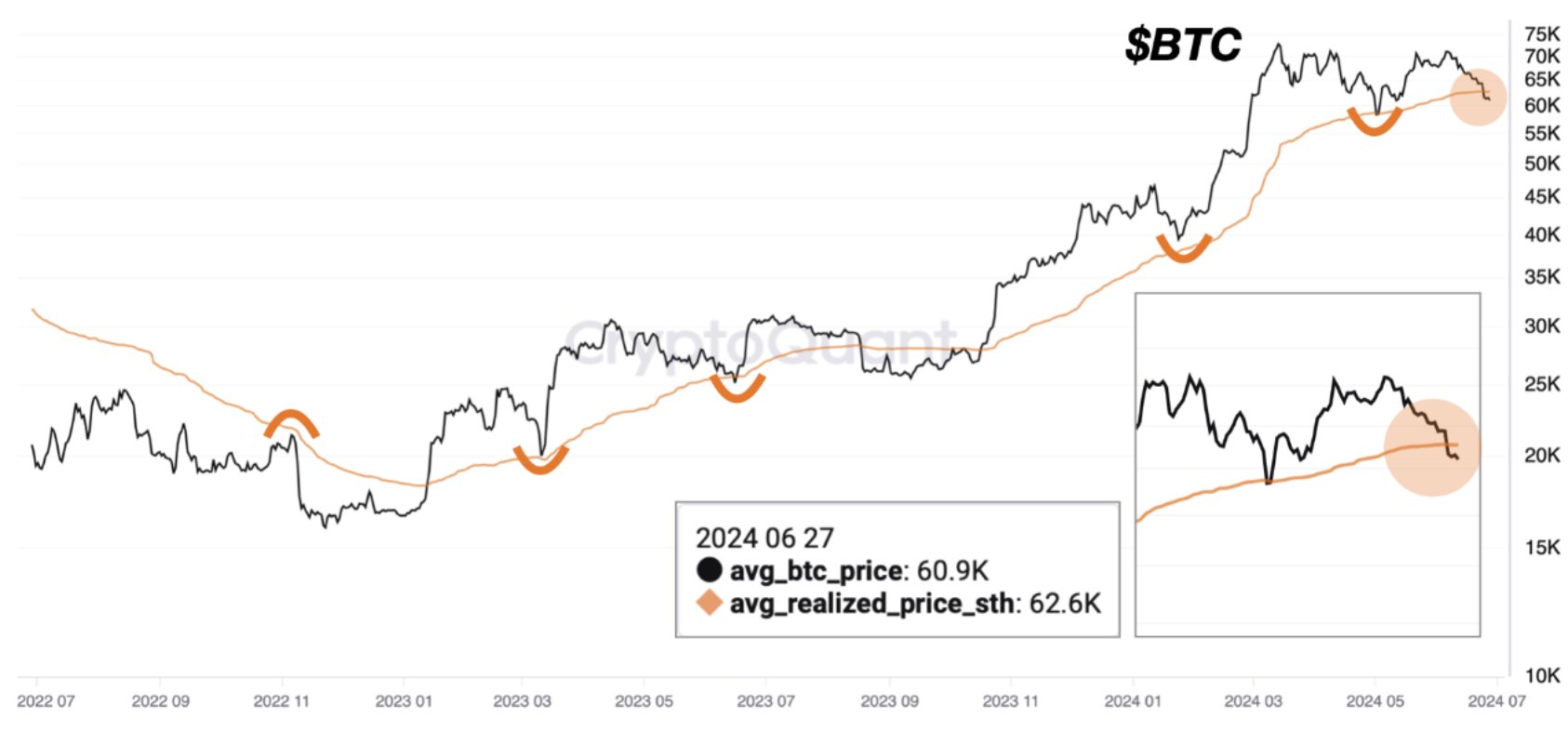

- BTC price has dropped below the short-term average realized price at $62.6k.

- Whales, miners, entities are selling Bitcoin in million in anticipation of BTC price fall to $57k.

- BTC price currently trades at at $61.9k.

Whales have again started to dump Bitcoin as on-chain data and technical charts indicate weakness. BTC price has even dropped below the short-term average realized price of $62.6k, risking a drop to $57k. It is in line with the max pain price for Bitcoin options expiry on Friday.

Bitcoin Price Crash Risks Mounts As Whales Liquidate

Short-term average realized price (sth price) metric is a key level that acts as resistance in bear markets and support in bull markets. BTC price has rebounded from the short-term average realized price two times this year but it has dropped below the sth price, risking long liquidations and shorting by traders.

According to CryptoQuant, if the price does not move above the sth price of $62.6k in the next few days, it will likely turn into a resistance level for the BTC price. The decline in sentiment indicates a rebound may not come until next week due to multiple key macro events due next week.

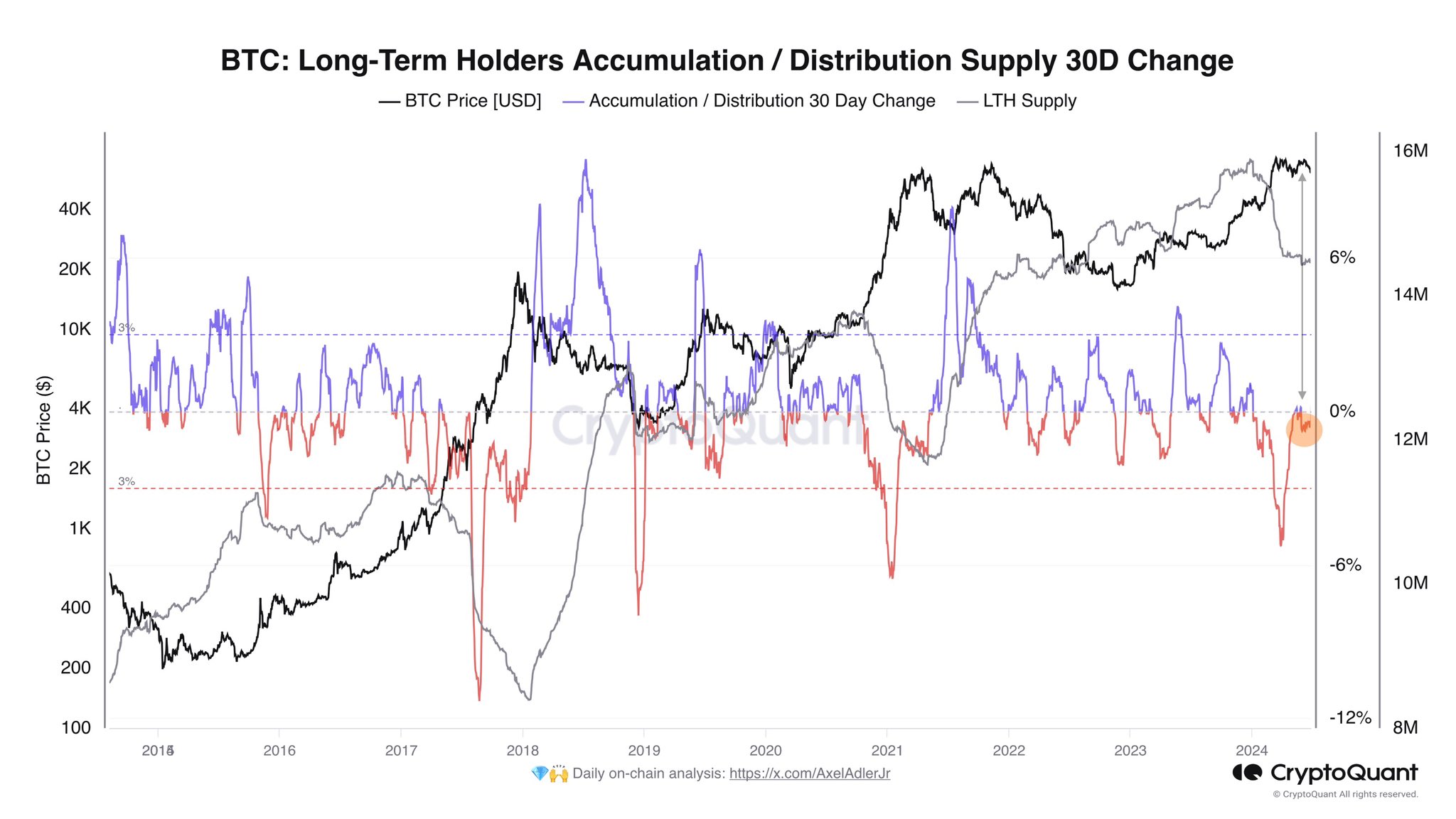

The pessimism in the broader crypto market has turned traders cautious and there’s no major rebound observed in the crypto market. The Long-Term Holders (LTH) on-chain data revealed a lack of interest among long-term holders. It would need massive BTC buy by investors, which is most likely to come from US spot Bitcoin ETF.

Whales And Entities Selling BTC

Whales And Entities Selling BTC

As CoinGape earlier reported, a Satoshi-era Bitcoin miner wallet woke after 14 years of dormancy and moved 50 BTC to the Binance crypto exchange today. Bitcoin maxi Fred Krueger took a contrary stand on the matter, stating “These miners no longer matter to the price of Bitcoin.”

Whale Alert reported that whales have transferred 1200 BTC worth over $73 million to Binance and another whale dump 1710 BTC worth 104 million to Kraken. Whales are heavily dumping BTC ahead US PCE inflation and options expiry tomorrow.

Also, Genesis Trading transferred 1000 BTC valued at $61.95 million to crypto exchange Binance. On-chain analyst Lookonchain said smart whales are depositing BTC to crypto exchanges on anticipation of a fall in BTC price to $57k.

Popular crypto analyst Ali Martinez in a new price prediction said BTC price action is shaping an Adam & Eve bottoming pattern, signaling a potential 6% rise toward $66,000. However, it can only happen if a candlestick close above $62,200.

BTC price jumped 0.60% in the past 24 hours, with the price currently trading at 61,951. The 24-hour low and high are $60,580 and $62,333, respectively. Furthermore, the trading volume has decreased by 6% in the last 24 hours, indicating a decline in interest among traders.

Also Read: Popular Analyst Predicts BTC Price Reversal After A Dip To This Level

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- Will Crypto Market Crash as U.S.–Iran War Reportedly Imminent?

- Bitcoin Quantum Threat: CryptoQuant’s CEO Flags Risk of Losing Satoshi’s 1M BTC Stash to Hackers

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

Whales And Entities Selling BTC

Whales And Entities Selling BTC