Crypto Whales Heavily Shorting XRP, DOGE, PEPE, Altcoins Ahead of Jerome Powell’s Speech

Highlights

- Whales opened short positions on XRP, Dogecoin (DOGE), Pepe Coin (PEPE) and altcoins.

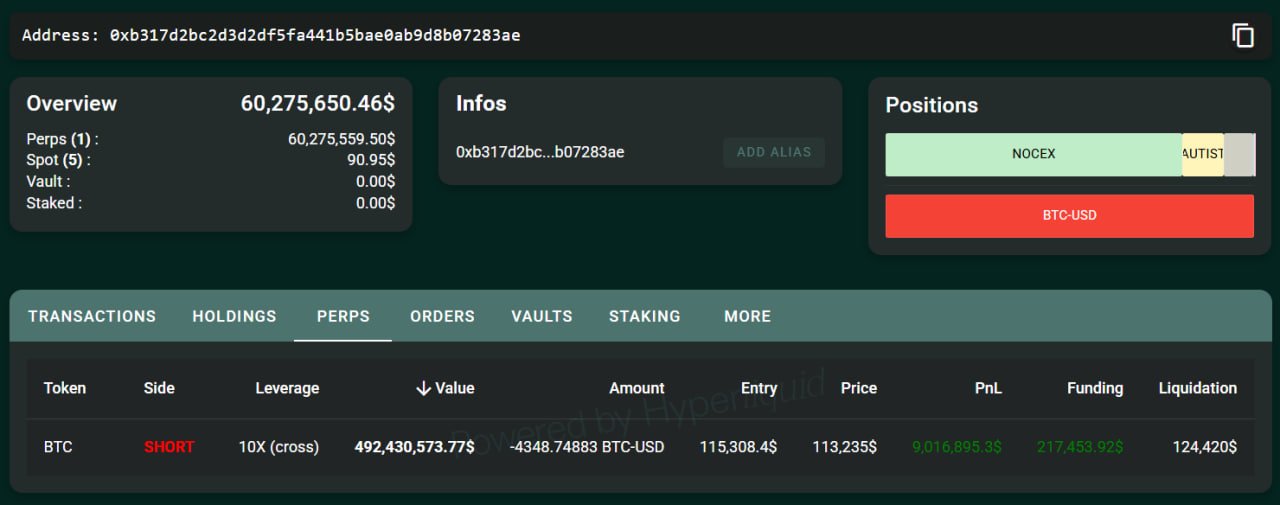

- Trump insider whale has further increased his BTC short position to $492 million.

- Crypto market falters ahead of FED Chair Jerome Powell speech today.

Crypto whales are opening short positions on Bitcoin and other altcoins such as XRP, Dogecoin (DOGE), and Pepe Coin (PEPE), anticipating another crypto market crash today. The ‘Trump Insider Whale’ who shorted BTC and ETH just before the largest-ever crypto market crash has also further increased its short position before FED Chair Jerome Powell’s speech.

Crypto Whales Going Short on XRP, DOGE, and Pepe Coin

Crypto whales sitting at massive profits are expecting another crash or major profit booking, on-chain data platform Lookonchain reported on October 14. They are going short on Bitcoin and top altcoins, with the “Trump Insider Whale” leading the charge.

Whale 0x9eec9, with $31.8 million in profit, currently holds $98 million in shorts across Dogecoin (DOGE), Ethereum (ETH), Pepe Coin (PEPE), XRP, and Aster.

Crypto whale 0x9263, with $13.2 million in profit, opened $84 million in short positions on Solana (SOL) and Bitcoin.

Meanwhile, the Bitcoin OG has further increased his BTC short position to $492 million, sitting at a floating profit of $9 million. The liquidation price is $124,420.

As CoinGape reported earlier, the whale opened a massive $340 million short position on Bitcoin. The whale is referred to as “Trump insider whale” as it shorted $700 million BTC and $350 million ETH just before the crypto market crash, making $200 million in profit.

Crypto Market Falters Ahead of Jerome Powell Speech Jitters

The crypto market awaits cues from FED Chair Jerome Powell’s speech today. Any mention of a Fed rate cut can trigger a rebound. Monetary policy, rising inflation amid a weak labor market, and economic concerns fueled by the US government shutdown are other topics expected.

XRP price fell nearly 2% in the past 24 hours amid profit booking by crypto whales, with the price currently trading at $2.53. The 24-hour low and high are $2.52 and $2.65, respectively. Trading volume dropped further by 17% in the last 24 hours.

Also, DOGE price has dropped more than 1% to $0.206. A further fall could trigger profit booking as it trades near the 200-day moving average. Meanwhile, Pepe Coin has pared some gains but is still up over 1% at $0.0576.

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?