Macroeconomic Factors Drive Bitcoin (BTC) Price Down Ahead of Key Economic Reports

Highlights

- Bitcoin price fell in response to US consumer inflation expectations data.

- Federal Reserve Vice Chairman Phillip Jefferson and Fed's Loretta Mester expressed mixed outlook on inflation.

- Over $212 million were liquidated across the crypto market.

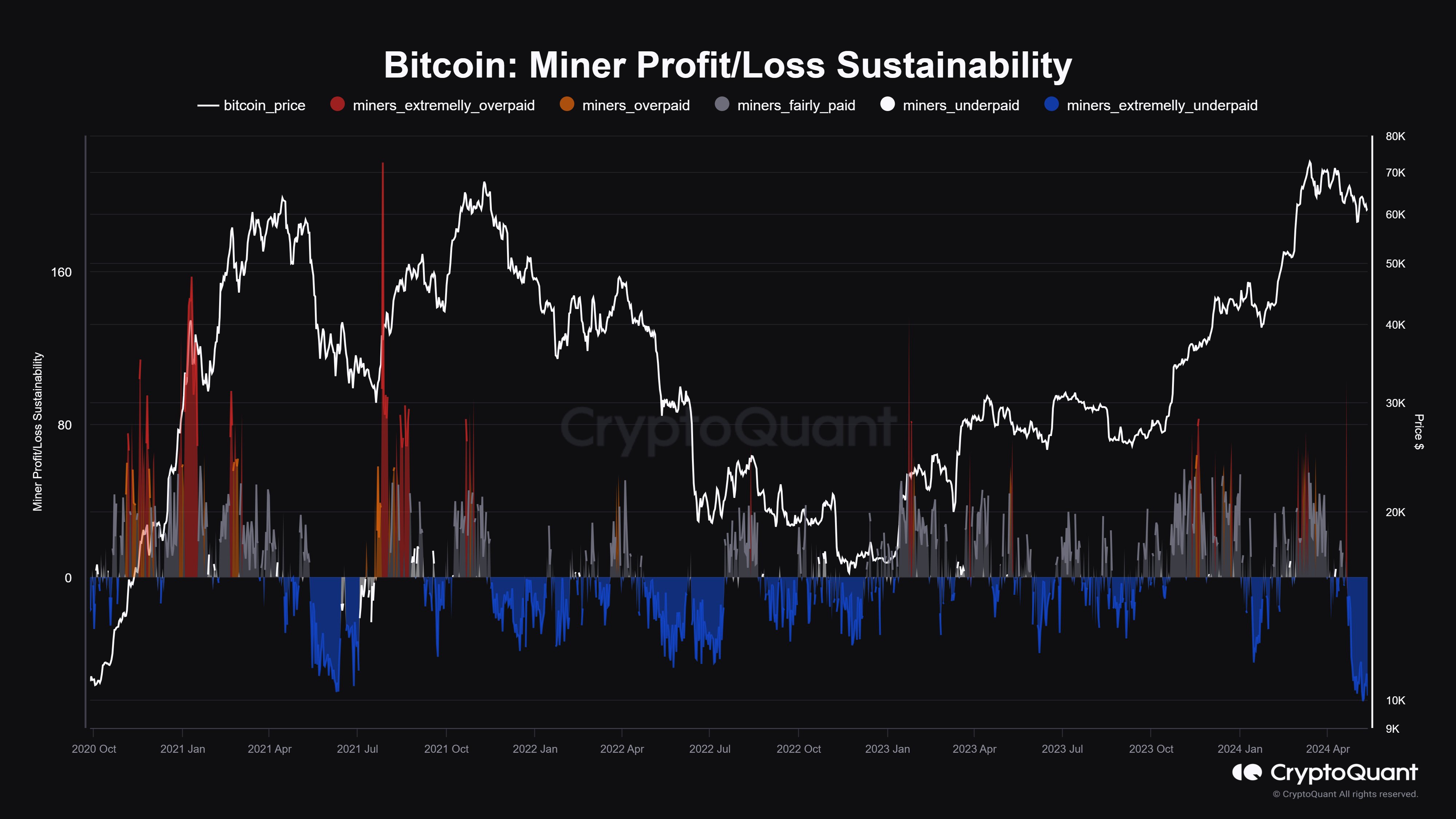

- Bitcoin miner faces capitulation risk.

Bitcoin’s price has started to decline, erasing earlier gains, as new macroeconomic data indicates that macro factors are currently key drivers. With the PPI, CPI, and Fed Chair Jerome Powell‘s speech scheduled for this week, BTC’s price is expected to remain under pressure and experience volatility.

The latest pullback in BTC price was a result of US consumer inflation expectations data. The inflation expectations for the year ahead came at 3.3%, the highest since November, from 3% in each of the previous four months. Moreover, the inflation expectations for five-year horizon increased to 2.8% from 2.6%.

Meanwhile, the hotter inflation remains a concern for the FOMC members, with Federal Reserve Vice Chairman Phillip Jefferson and Fed’s Loretta Mester expressed mixed outlook on inflation and rate cuts.

CoinGape recently reported University of Michigan consumer sentiment data caused BTC price to tumble below $61,000 as inflation expectations for the year ahead rose to 3.5% and the five-year inflation outlook hit 3.1% from 3.0%.

Crypto Market Saw Over $210 Million Liquidation

Coinglass data shows more than $212 million were liquidated across the crypto market in the last 24 hours. Among this, $132 million long positions were liquidated and nearly $80 million short positions were liquidated. Most of the liquidation happened in the last hour, which was recorded at over $50 million.

Over 90K traders were liquidated and the largest single liquidation order happened on crypto exchange Binance as someone sold ETH for BTC valued at $3.98 million. This was an interesting move by an investor or a whale.

BTC price fell by 2.80% in the last 24-hours to $61,248.17. The 24-hour low and high are $61,316.94 and $63,422.66, respectively. The prices are likely to maintain the weak momentum and fall to support levels of 61k.

Popular analyst Ali Martinez predicts a retrace toward $62,000 as Bitcoin is facing rejection by the 200-EMA on the 4-hour chart. The TD Sequential indicator also presents a sell signal. However, BTC will continue its upward trajectory if the candlestick closes above $64,000.

Also Read: Solo Miner Scoops Entire $3.125 BTC From Single Block, Here’s How

Miners Face Capitulation Risk

Bitcoin miners are facing significant capitulation risk after the recent Bitcoin halving of block subsidies and relatively low transaction fees. The trading volumes have also plummeted and caused a further increase in risks. On-chain analyst Maartunn said, “This is likely to cause substantial strain, especially for less efficient miners.”

According to crypto researcher firm Kaiko, the crypto market to see more selling pressure as Bitcoin miners with large holdings of the digital asset face a sharp drop in revenue. “Higher transaction fees offset lower miner rewards for firms in April, but this has since reversed,” it added.

Also Read:

- LUNC News: Terra Classic Community Makes Crucial Move With Allnodes

- Binance Subsidiary Receives Top Privacy & Security Certifications From BSI

- OpenAI ChatGPT Event Announcements: GPT-4o Model and Desktop Version

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?