Will Crypto Market Crash as U.S.–Iran War Reportedly Imminent?

Highlights

- Crypto Market Crash fears surge as U.S.-Iran tensions push investors into safe haven assets.

- Extreme Fear index at 13 indicates weakening confidence across Bitcoin and altcoins.

- Rising gold and oil prices suggest capital rotation away from high-risk crypto assets.

The crypto market is facing fresh crash fears as reports point to a possible U.S.–Iran war in the coming days. In the past 24 hours, the crypto market cap dropped 1.67% to $2.31 trillion, as risk appetite weakened globally. At the same time, the CMC Fear & Greed Index fell to 13, placing sentiment in “Extreme Fear.”

Crypto Market Drops as Fear Grips Bitcoin and Altcoins

The crypto market has remained under pressure as traders react to rising geopolitical risks and weakening investor sentiment. Bitcoin and altcoins often see sharp selling during sudden geopolitical shocks, as traders shift toward cash and safer assets. As a result, leveraged liquidations can accelerate losses across the broader crypto market.

Notably, analyst Ted reported that gold, silver, and oil are rising due to the U.S.–Iran conflict, while Bitcoin is falling as expected. Meanwhile, traders are also reacting to uncertainty around Federal Reserve rate cuts after recent inflation data.

Historical contexts also indicate how quickly crypto can slide during geopolitical tensions. During the 2025 U.S. and Israeli strikes on Iranian nuclear sites, Bitcoin’s price fell around 2% to 4% in the initial sell-off, dropping below $100,000 in some sessions and near $105,000 in others.

Ethereum declined more sharply, with losses between 7% and 8% over the same period. The broader crypto market also saw billions wiped out as forced liquidations hit leveraged traders. Recently, analysts have been predicting Bitcoin consolidation, with $60,000 viewed as key support. However, they also warned that additional macro shocks could push prices into the $50,000 range.

Polymarket Odds on U.S.-Iran War Rise

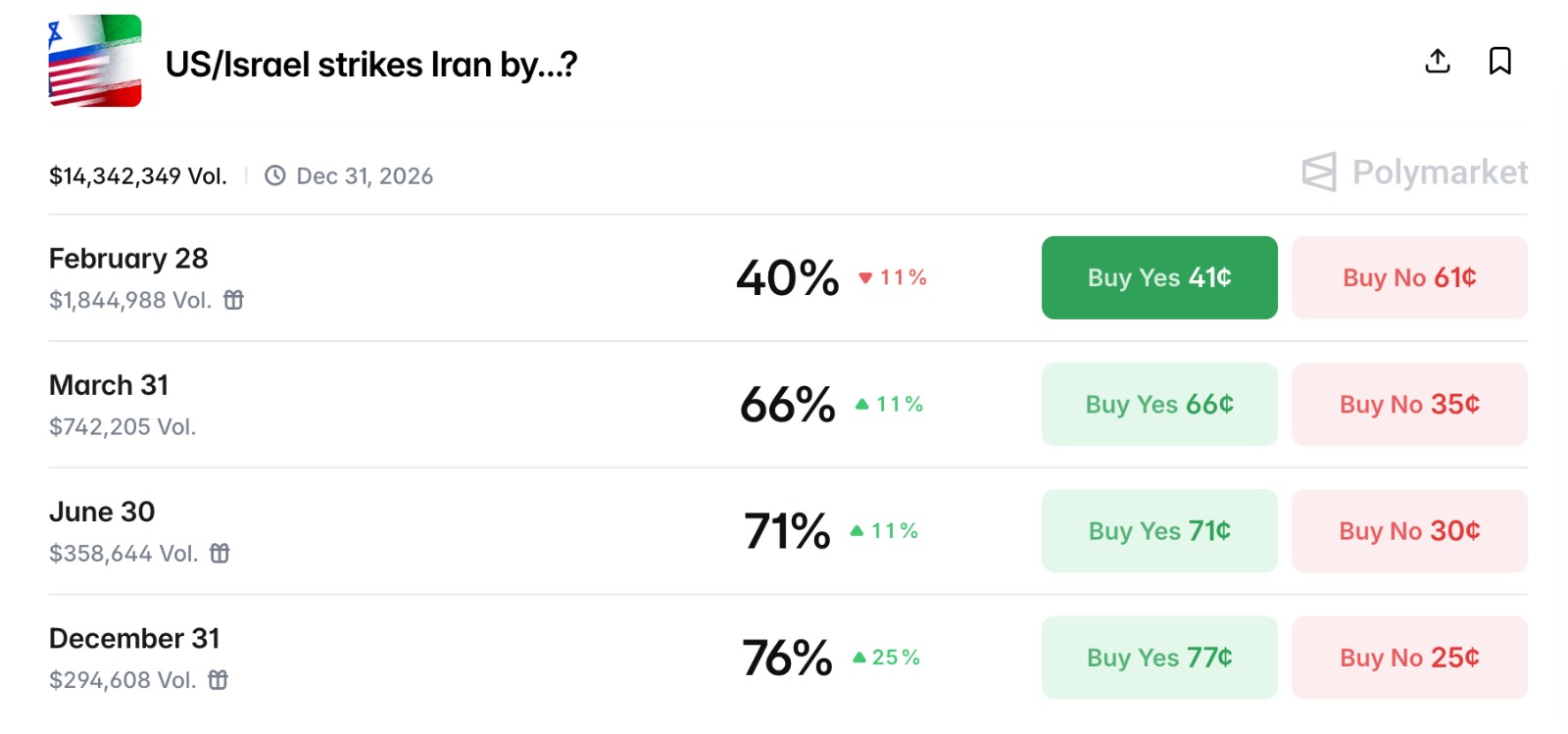

Alongside the crypto market decline talks, prediction markets have started assigning higher odds to a U.S.–Iran conflict. Polymarket data showed traders pricing in a 40% chance by February 28. That probability rose to 66% by March 31, reflecting growing concern.

The odds climbed further for longer timeframes. The platform showed a 71% probability by June 30 and 76% by December 31. These figures appeared as geopolitical tensions remained dominant.

Meanwhile, recent market activity has also shown defensive positioning. Investors have moved into commodities, with oil prices rising above $64 per barrel after the latest reports. As a result, risk assets such as crypto have struggled to hold recent levels.

Details of the U.S.–Iran War

Axios data stated there is evidence that a U.S. war with Iran is “imminent,” with Israel preparing for a scenario of “war within days.” Axios sources described a potential joint U.S.-Israeli campaign targeting Iran’s nuclear and missile programs. They also said the operation could become a weeks-long conflict.

Milk Road also reported that the Trump administration is weighing a major military campaign against Iran. According to Milk Road, indirect talks in Geneva showed some progress, although Iran is expected to deliver a detailed proposal within two weeks. However, Vice President JD Vance said Iran has not crossed key U.S. red lines yet.

Axios also reported major military buildup activity in the Middle East. The report cited two aircraft carriers, 12 warships, and hundreds of fighter jets, including F-35s and F-22s. It also noted over 150 U.S. cargo flights moving weapons and ammunition into the region.

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- Bitcoin Quantum Threat: CryptoQuant’s CEO Flags Risk of Losing Satoshi’s 1M BTC Stash to Hackers

- Crypto Regulation: Hyperliquid Launches Policy Group to Push DeFi Integration in U.S. Markets

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand