Will Crypto Market Recover As Bitcoin and Altcoins Test Crucial Support?

Highlights

- Crypto market recovery chances in the near-term look fragile as on-chain metrics hint caution.

- Significant Bitcoin inflows to Binance from whales, indicate strong selling activity.

- Altcoins are retesting a major trendline in a make-or-break situation.

The crypto market has seen a sharp correction this week, with many investors anticipating signals of recovery. Bitcoin (BTC) price and altcoins are trading at crucial junctions, which could be a make-or-break moment for the market. On-chain metrics share key insights on what happens next.

Will the Crypto Market Recover Anytime Soon?

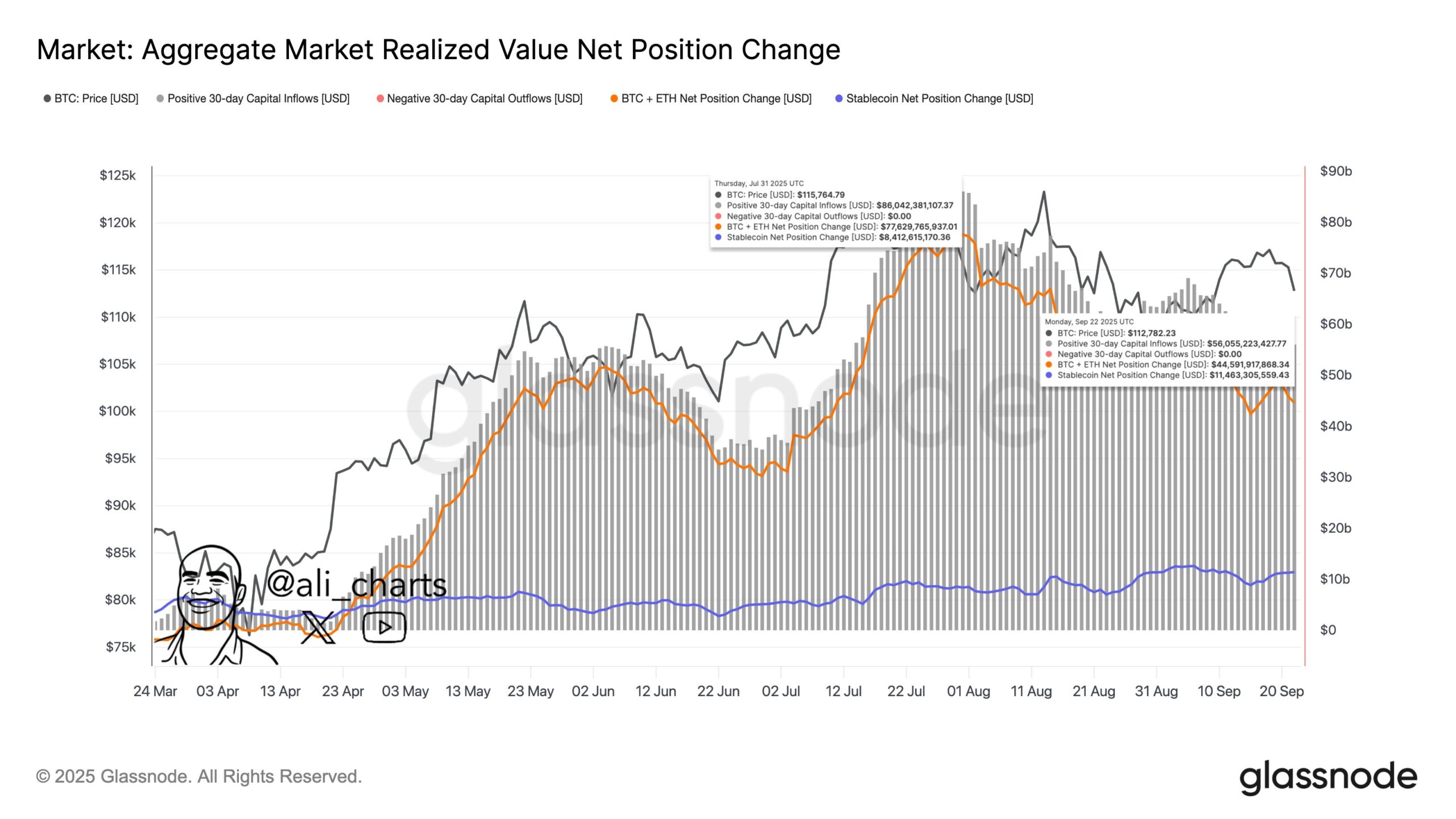

Three on-chain metrics suggest some key developments taking place in the crypto space, as investors pull out funds from the market in this crypto market crash. Crypto analyst Ali Martinez has reported a sharp decline in capital inflows into the cryptocurrency market. He noted that investors have pulled $30 billion from the crypto market over the past two months.

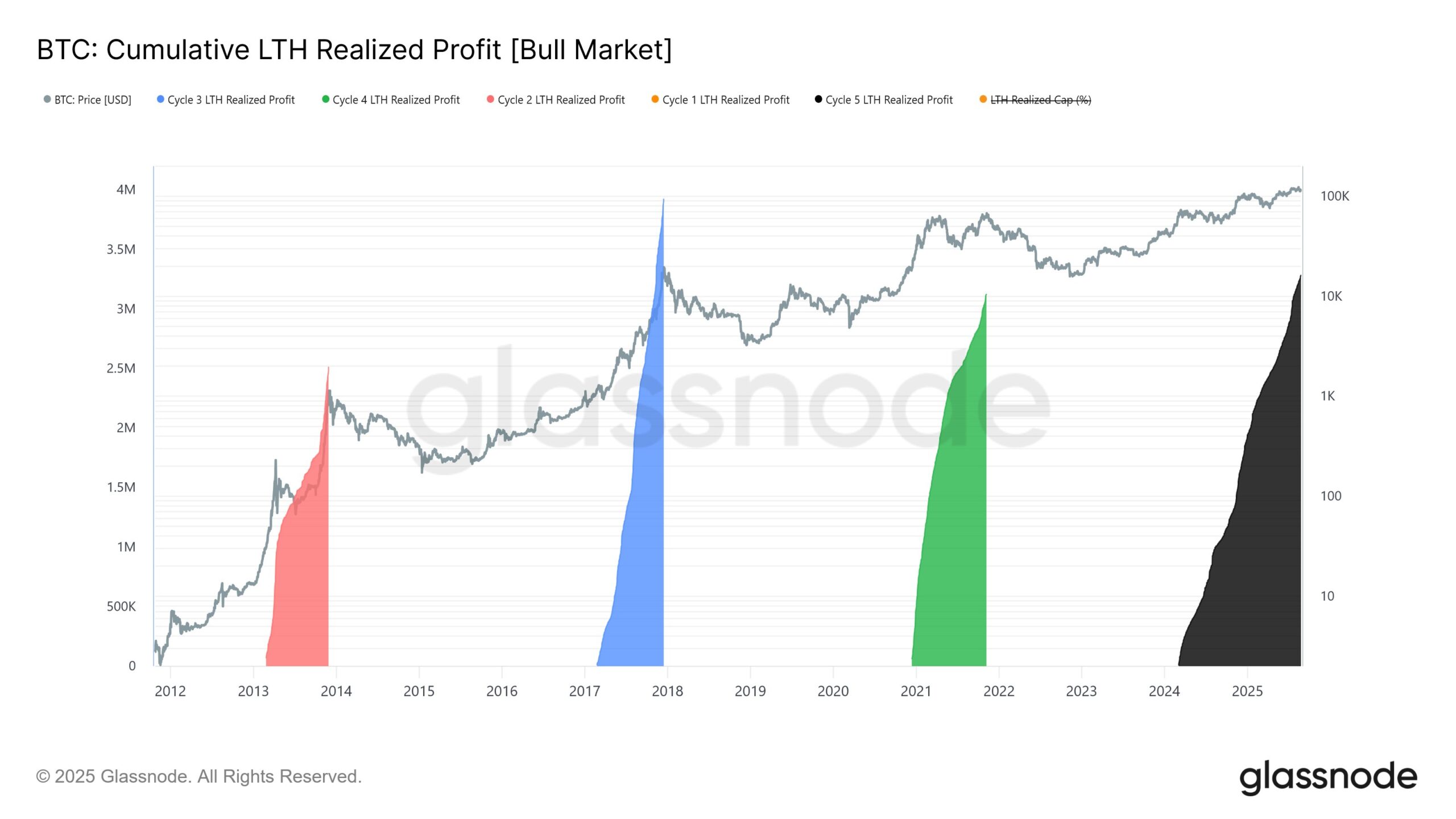

Furthermore, blockchain analytics firm Glassnode reported that long-term Bitcoin holders (LTHs) have realized 3.4 million BTC in cumulative profits since the start of the current cycle. It marks a historically high volume compared to previous bull runs of 2017 and 2021. Flows into Bitcoin ETFs have also turned negative, hinting at sell-off sentiment in the market.

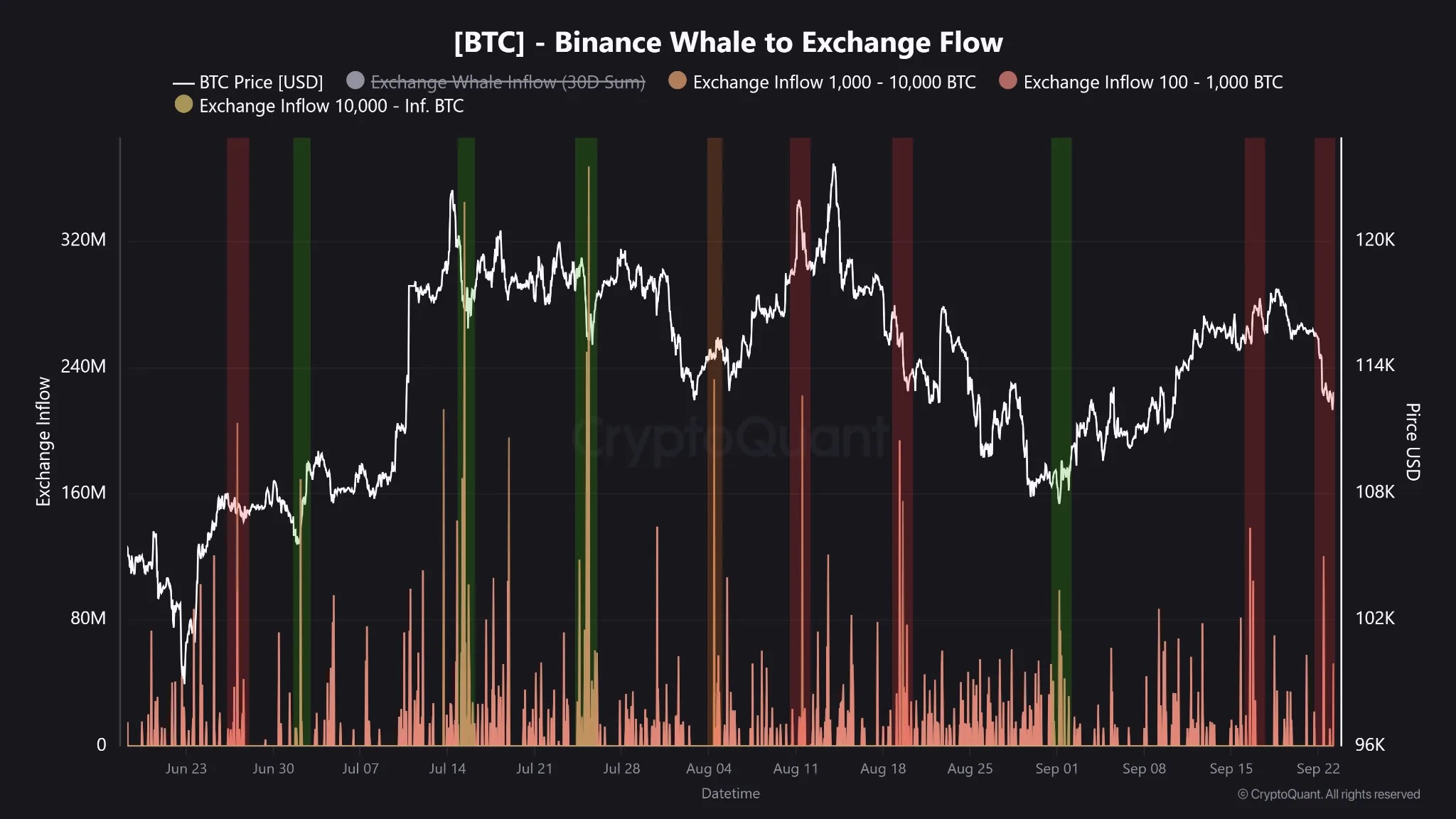

The third on-chain metric highlighted by CryptoQuant talks about significant whale activity on crypto exchange Binance this week. On September 22, Bitcoin inflows from whales to Binance reached $120 million during the market sell-off, followed by an additional $52 million on September 23 around 05:00 UTC, signaling continued large-scale movements likely intended for trading.

All these indicators suggest that the crypto market recovery in the near term seems difficult. Furthermore, Bitcoin and altcoins are currently trading at a crucial junction, which could either be a make-or-break event for the market.

Bitcoin and Altcoins At Crucial Junction

Bitcoin price is currently flirting at $112,500 levels, after strong selling pressure earlier this week. Popular crypto analyst CryptoBullet noted that BTC is currently trading at a crucial support zone between $109,500 and $111,500.

He added that if this level holds, the analyst predicts a potential recovery toward the bullish target of $118,000. However, if the support fails, Bitcoin could test a lower bottoming range between $101,000 and $103,000. Despite this, analysts expect a BTC rally to $150K by Q4 2024.

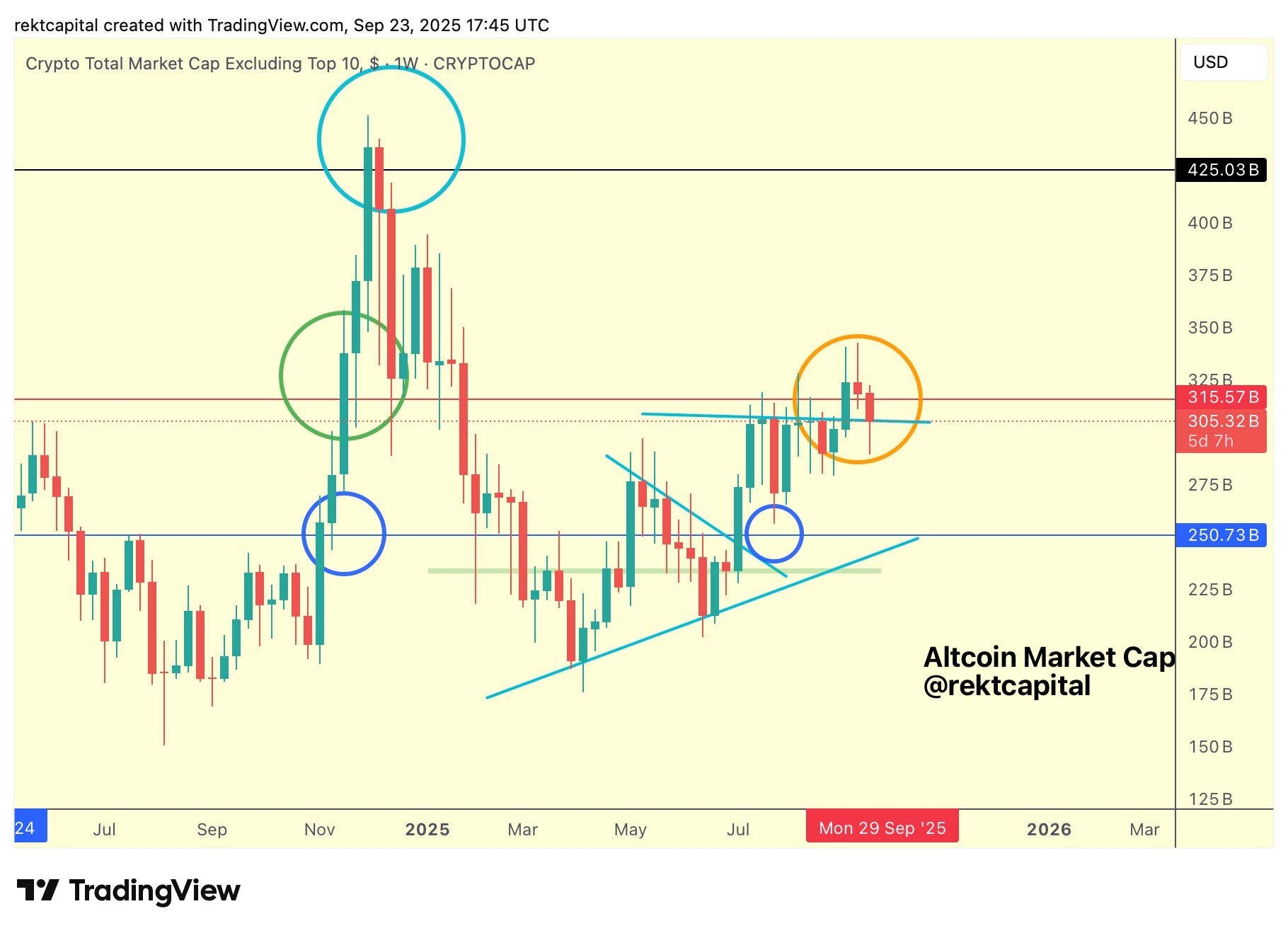

Crypto analyst Rekt Capital reports that the altcoin market cap (excluding top ten) is undergoing a volatile retest of a key trendline, marked in light blue. The retest briefly dipped below the trendline but remains intact for now. The analyst noted that maintaining this level is crucial before the market cap can reclaim the $315 billion mark, highlighted in red.

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For the Week Ahead: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs