Will the U.S. Government Shutdown Finally End This Month As Key Crypto Policies Face Delays

Highlights

- U.S. government shutdown disrupts key sectors like healthcare, crypto, and federal operations.

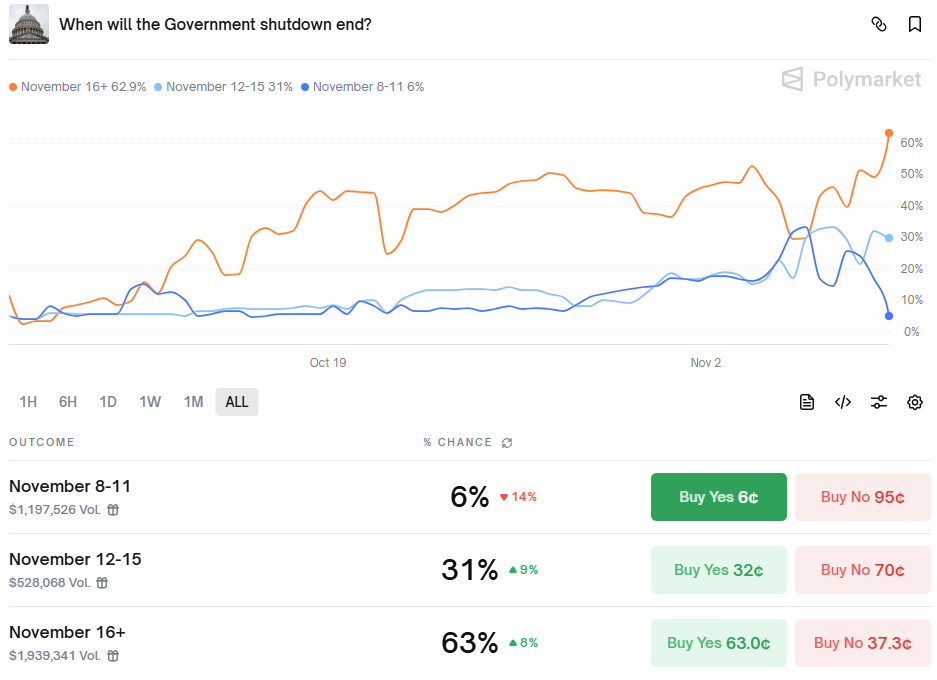

- Polymarket predicts shutdown could last beyond mid-November, deepening economic impact.

- Shutdown delays crucial crypto ETF decisions, stalling market growth and investor confidence.

The U.S. government shutdown has now become the longest in the country’s history, continuing for over a month. A budget dispute triggered the shutdown, halting federal operations and disrupting sectors like healthcare and the crypto sector.

The lack of agreement between Republicans and Democrats on a funding bill to reopen the government. As the Senate gears up to take a vote, health care is still the name of the game. Democrats want to reinstate tax credits for health insurance, and Republicans say the government must reopen first.

Polymarket traders think the shutdown could drag well into mid-November, with a 63% chance it’ll go longer than Nov. 16. As the impasse drags on and becomes more entrenched, worry is increasing about its lasting effect on both the economy and financial markets.

Analysts fear that the protracted uncertainty could worsen the financial pressure. Economists calculate the economy is losing between $10 billion and $30 billion a week.

Crypto Markets React as Shutdown Deepens Economic Strain

The financial markets are already feeling the heat. The investors, seeking to reduce risk, are taking their money out of the hands of riskier investments. This cautious sentiment is spreading across various sectors, and analysts fear that further damage would occur if the shutdown persists.

The crypto industry is bleeding as well, facing significant crypto treasury losses amid the ongoing shutdown impact. Key agencies, including the SEC and CFTC, are being run with fewer staff and unable to make necessary decisions. This delay is proving to be especially problematic for crypto investors, who are anxious for approval on exchange-traded funds (ETFs) among other regulatory concerns.

That break on progress in regulation is parasitizing growth and development in the world of crypto. Decisions on the crypto ETFs that have the most potential to influence market prices will be delayed.

Key Crypto Policies Face Delays As Federal Workers and Services Hit Hard

The U.S. government shutdown is also weighing on federal workers. About 1.4 million federal employees are impacted, and about half of them aren’t receiving pay checks. It is wreaking financial havoc and slowing federal services nationwide.

Those services are now getting backlogged, as a few try their best to address urgent cases. Airports lack staff, and federal agencies have halted critical work. The distractions have further made it that much more difficult for the government to operate effectively amid this ongoing crisis.

The U.S. government shutdown is also disrupting global markets. Geopolitical pressures, including earlier tariff threats by President Trump, have added even more volatility. These outside influences only serve to complicate an already volatile scenario.

Analyst Tyler points out an ironic situation. Even as Washington freezes, the talk about digital assets and crypto policy continues. This is one of the few sectors advancing, despite regulatory setbacks.

Political chaos be damned, the conversation about digital assets marches on. With regulatory decisions on pause, and the crypto market dip, analysts note that the crypto sector is one of the few places where business activity remains active. But the time it is taking regulators to approve them has gun activists worried for the future of an industry.

Economists warn that if the U.S. government shutdown impact could permanently weaken the economy. Consumer spending, already weakened by high inflation and job insecurity, may further shrink. The shutdown could also deal blows well into the crucial holiday season.

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

Claim Card

Claim Card