XRP Lawsuit No Longer to Blame for Flat Price Action, Lawyer Says

Highlights

- Crypto lawyer Bill Morgan says XRP’s stagnant price can no longer be blamed on the SEC lawsuit.

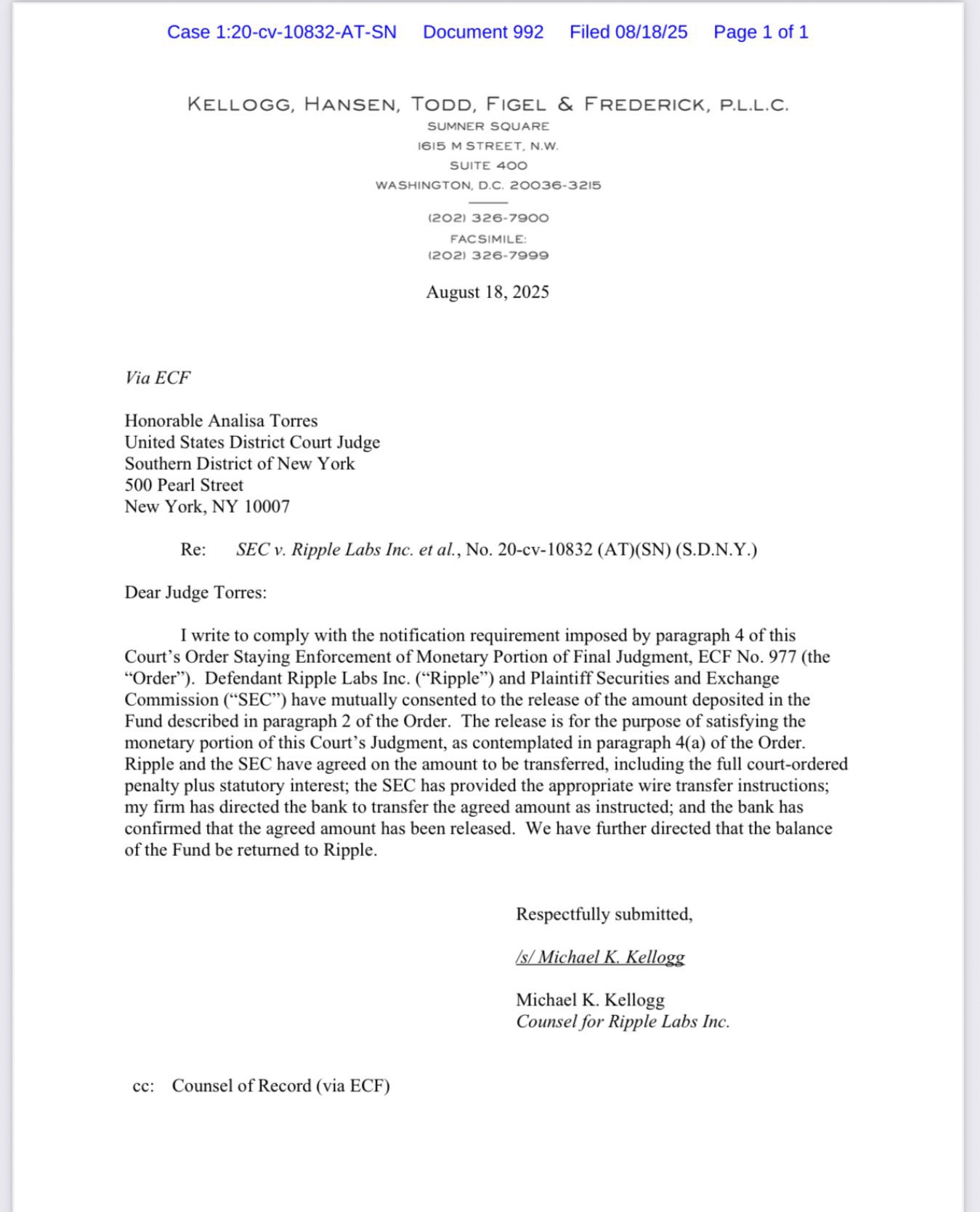

- Ripple’s $125M settlement payment has officially closed the multi-year legal battle.

- Despite regulatory clarity, XRP remains under $3 and has failed to capitalize on recent bullish catalysts.

A crypto lawyer has shared that the XRP price stagnation can no longer be excused amid regulatory clarity. This comes after a CEO confirmed the settlement payment of the lawsuit.

Crypto Lawyer Says XRP Price Stagnation No Longer Tied to Lawsuit

Prominent lawyer Bill Morgan stated that the XRP Lawsuit has “run its course” as a justification for the token’s lack of adoption or weak price action.

Yes the lawsuit excuse has run its course for any further lack of XRP adoption or flat price action. https://t.co/Gl2U8Z7Ui9

— bill morgan (@Belisarius2020) September 22, 2025

His comments came shortly after crypto commentator and CEO Jake Claver confirmed that Ripple’s $125 million penalty was paid to the U.S. Treasury last month, putting an end to the multi-year case.

The conclusion stems from Ripple’s May 2025 settlement with the SEC. According to the agreement, the business had to pay the fine and consent to limitations on specific institutional sales.

Notably, the settlement preserved key rulings that distinguished between programmatic retail sales and institutional transactions. The formal conclusion of a five-year dispute was reached in early August when all appeals were dismissed.

The token has not produced significant price increases even after reaching long-awaited legal closure. Unable to take advantage of favourable events like the launch of the first U.S. spot XRP ETF, the altcoin is still trading below $3.

Momentum has waned following the rally in late 2024 and a brief surge earlier this year. Some community members are appalled that the increase that many had hoped for has not materialized since regulatory uncertainty was removed.

Ecosystem Expands Since Lawsuit End

Since the XRP Lawsuit ended, the ecosystem has continued to grow in ways that could shape long-term value. Flare Network recently announced a stablecoin backed by XRP through its Liquity V2 platform. This is intended to improve DeFi use cases and increase on-chain liquidity.

Furthermore, in Japan, gaming and blockchain firm Gumi established an XRP treasury worth 2.5 billion yen (about $17 million). The move aligns with SBI Holdings’ broader push into blockchain finance. This reflects growing corporate interest in the token as a treasury asset.

Ripple itself has also outlined ambitious expansion plans. The company confirmed it will roll out its U.S. dollar–backed stablecoin, RLUSD, in African markets. They intend to work with fintech partners, including Chipper Cash, VALR, and Yellow Card. The project will initially inject $700 million into cross-border payment channels.

With the token’s regulatory clarity achieved, industry voices stress that the token’s performance will now depend on adoption and innovation. This can be seen in the ETF products set to launch as the SEC releases more crypto-friendly policies. Stablecoin projects and Ripple’s continuing alliances offer expansion opportunities.

Ripple developers released the roadmap for the new phase of institutional DeFi on the XRP Ledger today, and one of the focuses is stablecoins. The crypto firm plans to help introduce more stablecoins on the network, which will help boost XRP’s utility.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs