XRP Price Rallies as Spot ETFs Record Massive $164M in Fresh Inflows

Highlights

- XRP price rebounds with an 8% rally.

- This comes after after spot XRP ETFs recorded $164 million in single-day inflows, the second-largest since launch.

- Analyst Chad Steingraber predicts XRP ETFs may replicate Bitcoin’s billion-dollar inflow days.

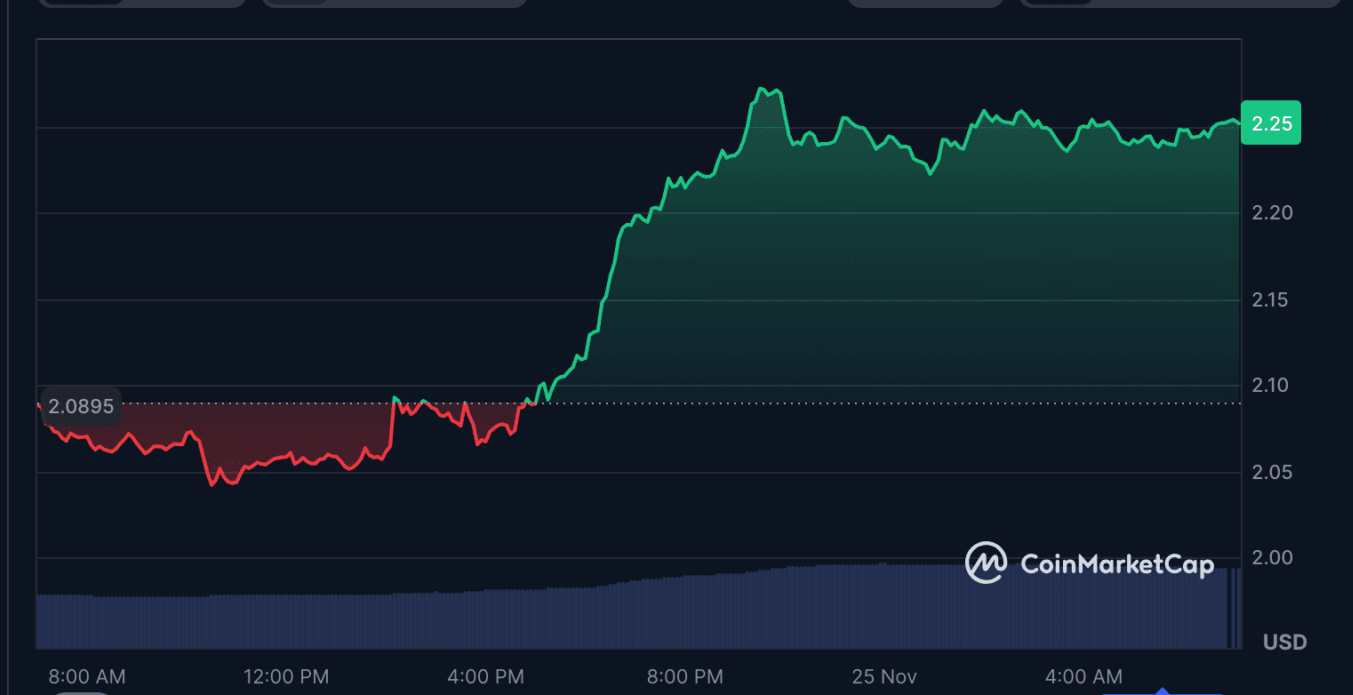

The XRP price recorded an increase after its recent downturn. This comes as the newly launched spot ETFs saw inflows of up to $164 million yesterday. This is the second largest single day influx the funds have recorded since it began trading.

ETF Issuers Attract $164 Million of Fresh Capital as XRP Price Recovers

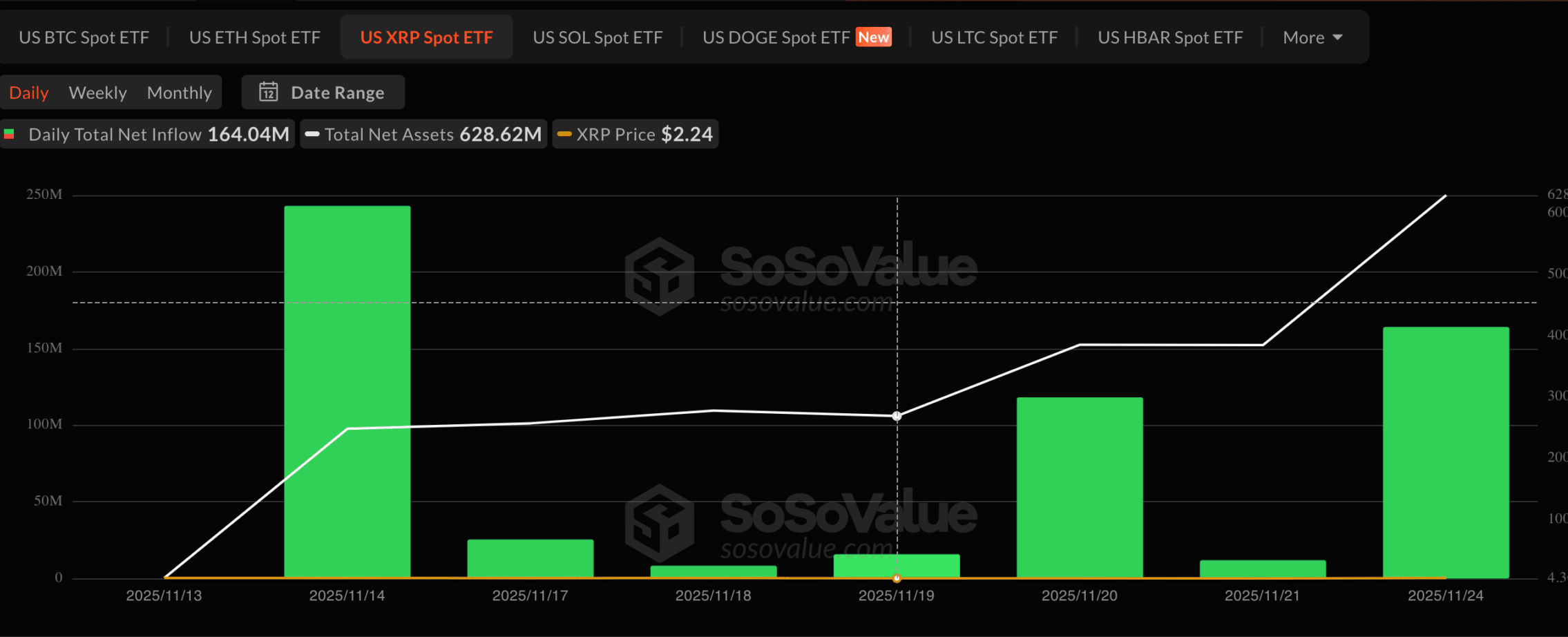

According to SoSoValue data, spot XRP ETFs pulled in $164 million in net inflows on November 24. This marks one of the biggest single-day totals since launch.

Grayscale’s GXRP led all issuers with $67.36 million after launching yesterday. Franklin Templeton’s XRPZ followed closely with $62.59 million.

This increase is the seventh day in a row that it has seen inflows. It is also the second-largest inflow day since Canary’s launch.

Franklin launched its XRP ETF (XRPZ) just yesterday and is already seeing great investments. Canary is ranked 231st globally with over $84 million in ETF assets but is still gaining strong interest. Its XRPC fund has now reached $306 million in total investments since it started on November 21.

These investments has boosted the XRP price. According to CoinMarketCap, the token’s value has gone up by more than 8%.

Analyst: XRP ETFs Could Mirror Bitcoin’s $1B Inflow Days

Crypto analyst Chad Steingraber said this is only the beginning of the momentum for XRP ETFs. He compared it with how Bitcoin ETFs performed when they were starting. According to Steingraber, several months after launch, BTC funds had multiple days on which inflows reached $1 billion.

Let’s see it.

The Bitcoin ETF’s did over $1Billion inflows at least five times, months after launch. Let’s just go with a flat $1B. Let’s also assume the same scenario of 5 months after launch, XRP as of today $2.25. At this point, we have 12+ Funds. Go with 12.

1 Day

12… https://t.co/wIrKv6cqBQ pic.twitter.com/WsqQ3ENDql— Chad Steingraber (@ChadSteingraber) November 25, 2025

If XRP ETF products follow the same pattern, with 12 active funds, a cumulative $1 billion day would require just over $83 million per fund, he estimated.

His projections suggest that if there’s a five-day run of billion-dollar inflows, more than 2.2 billion XRP could be absorbed from the market in less than seven days. According to Steingraber, this could boost the XRP price.

Meanwhile, several more XRP ETFs are due to be launched in the coming days. 21Shares received automatic approval from the SEC via an 8-A filing. Its XRP ETF will start trading on the Cboe BZX Exchange in the next few days.

Also, CoinShares updated its S-1 filing to disclose its intended ticker and key details ahead of its Nasdaq debut. The fund has already appeared on the DTCC platform which means it’s ready for launch.

Steingraber says if the current rate of inflows persists, the available circulating supply of XRP could be taken up in under a year. In his view, participation from large asset managers like BlackRock could reduce that time frame to less than six months.

“The only variable that changes the equation is price,” he said. “The XRP price must move significantly higher to balance demand.”

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Coinbase Adds XRP, ADA, LTC, DOGE as Collateral for Crypto-Backed Loans

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand