Just-In: XRP Sees Strong Institutional Interest as ETF Approval Countdown Begins

Highlights

- XRP recorded another week of strong inflows of $61.6 million.

- It indicates institutional interest in Ripple coin stayed afloat.

- XRP price jumped 10% in the last 24 hours, but trading near key support level.

XRP funds recorded another week of strong inflows of $61.6 million. This indicates institutional interest in the Ripple coin remains intact ahead of anticipated approval by the U.S. Securities and Exchange Commission (SEC) this week. The price rebounded over 10% in the last 24 hours.

XRP Saw Massive $61.6 Million in Inflows

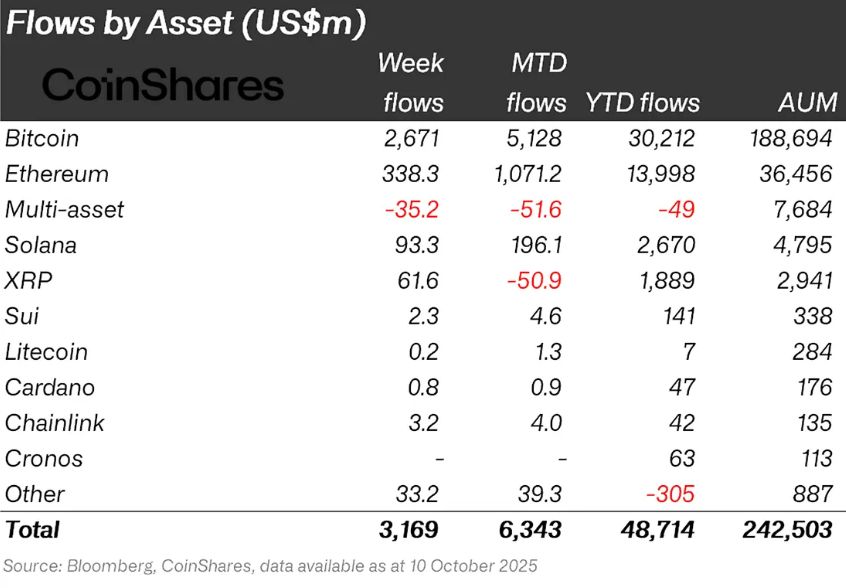

Inflows into XRP continued for the 18th consecutive week, as per CoinShares data on October 13. Ripple coin recorded $61.6 million in inflows despite massive selloffs by investors last week, indicating institutional investors remain bullish on the crypto asset.

While the U.S. government shutdown and crypto market crash caused XRP to fall below $2.50 and inflows slowed, sentiment remained bullish. Inflows into Ripple coin were $219 million in the previous week.

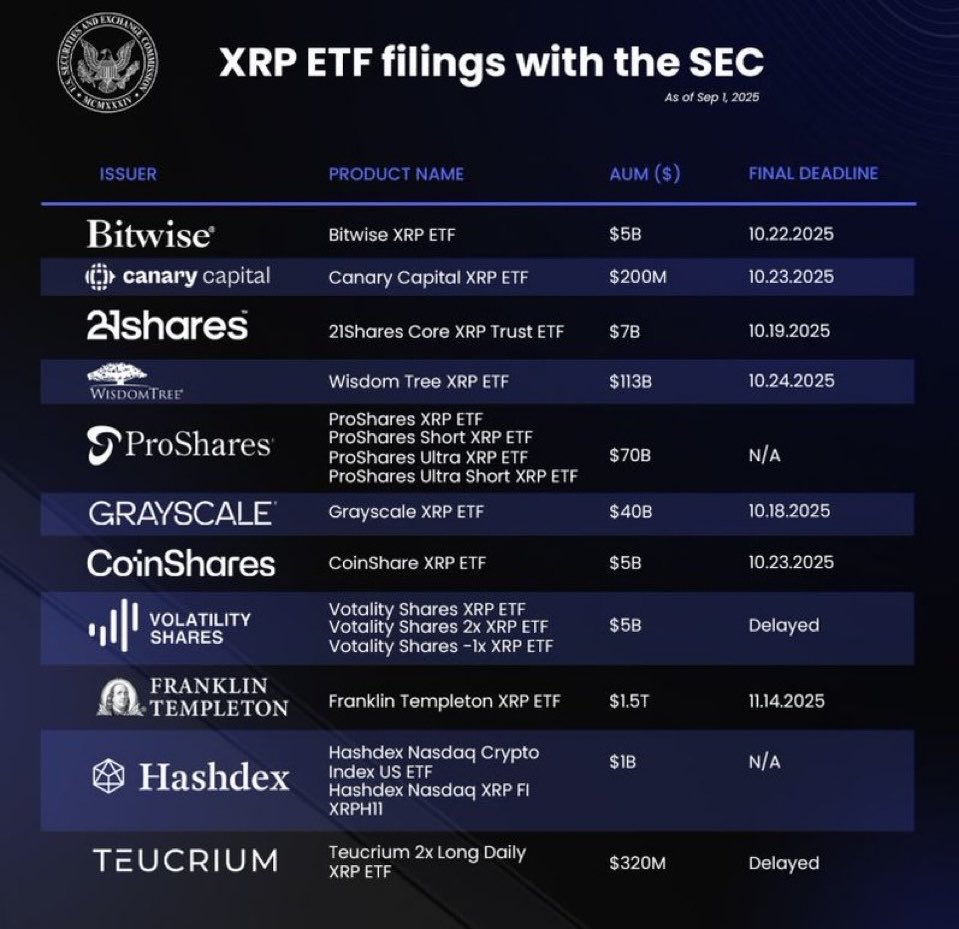

Wall Street firms are expecting massive inflows into XRP ETFs, higher than the demand witnessed by the Rex-Osprey XRP ETF (XRPR). Canary Capital’s Steve McCurve estimated $3 to $5 billion in first-year inflows, which could double the market cap to take the price toward the $5 mark.

Notably, six spot XRP ETF decisions are due between October 18 and 25, with the SEC’s final deadline for a decision on Grayscale’s ETF due this week. Decisions on 21Shares, Bitwise, WisdomeTree, CoinShares, and Canary Capital applications are due next week.

ETF expert Nate Geraci said spot crypto ETF floodgates to open as soon as the U.S. government shutdown ends. He added that it’s ironic that growing fiscal debt and usual political theater are delaying it, which crypto aims to resolve.

Ripple Coin Price Rebound 10%

XRP price jumped 10% in the past 24 hours, with the price currently trading at $2.62. The 24-hour low and high are $2.37 and $2.64, respectively. An increase in trading volume by 40% in the last 24 hours supported a rebound in prices.

CoinGlass data showed massive buying in the derivatives market. At the time of writing, the total XRP futures open interest jumped 8% to $4.40 billion in the last 24 hours. XRP futures OI on CME and Binance climbed more than 8% and 2%, respectively. This signals bullish sentiment among derivatives traders.

The key support level to watch is $2.58, the 200-day moving average. Also, the resistance level is at $2.74 and $2.80, respectively.

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- Dalio’s Warning on World Order Sparks Fresh Bullish Outlook for Crypto Market

- 8 Best Multisig Crypto Wallets in 2026 – Top List Reviewed

- Michael Saylor Says Strategy Can Cover Debt Even If Bitcoin Crashes to $8,000

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs